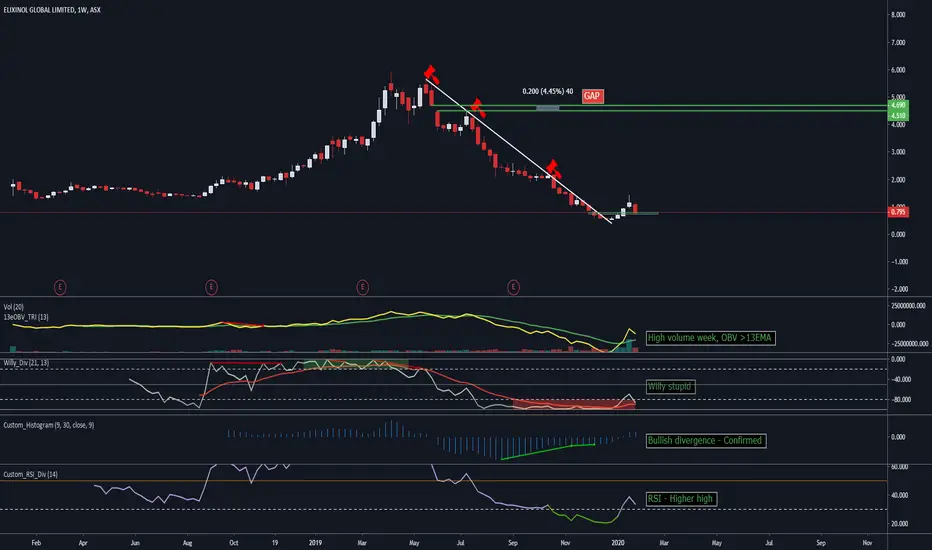

After forming a double top at the end of May last year, ASX:EXL has been bled down - dropping 90% (!!) from its all time highs. The bulls stepped in, providing some relief with 4 straight weeks of buying early this year. Can this be sustained?

Here's why I'm bullish:

Zooming into the 1D chart

My prediction is we range for the next month, filling in the VPVR void and providing opportunities to accumulate for astute traders. This range would give us a larger inverse H/S, providing the bullish spring needed to begin regaining some of that 90% drop from last year.

Hit the LIKE button if you find my analysis valuable and want to support me. Follow to make sure you don't miss any future trade ideas.

Here's why I'm bullish:

- Volume: High volume week, pushing the OBV above the 13EMA. "Volume precedes price", aka "Follow the money"

- Structure: Small inverse H/S on the daily, potentially forming a larger inverse H/S.

- Divergence: Confirmed histogram div, willy stupid, RSI making higher high.

- Weekly gap: >4% unaccounted for at the $4.5 price.

- Trend break.

Zooming into the 1D chart

My prediction is we range for the next month, filling in the VPVR void and providing opportunities to accumulate for astute traders. This range would give us a larger inverse H/S, providing the bullish spring needed to begin regaining some of that 90% drop from last year.

Hit the LIKE button if you find my analysis valuable and want to support me. Follow to make sure you don't miss any future trade ideas.

Trade closed: stop reached

Strong fear today in the weekly open amid worldwide Coronavirus concerns - tipping it to continue all week. Given all the uncertainty in the markets and fresh all time lows below us, I've cut the trade. Could potentially form a double bottom here with a SFP but I'm not willing to hold long enough to find out.Buy: 0.795

Sell: 0.500 (-36.7%)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.