Fuelcell Energy (FCEL) reported a Q4 October 2021 loss of $0.07 per share on revenue of $13.9 million. The consensus estimate was a loss of $0.02 per share on revenue of $21.9 million. Revenue fell 18.0% compared to the same quarter a year ago. FCEL share price is right back where it started last Q3. I reckon if you're a long-term investor, this is a good price to start a small position or add it to your watchlist.

EPS = -$.07

52 week H = $29.44

52 week L = $4.83

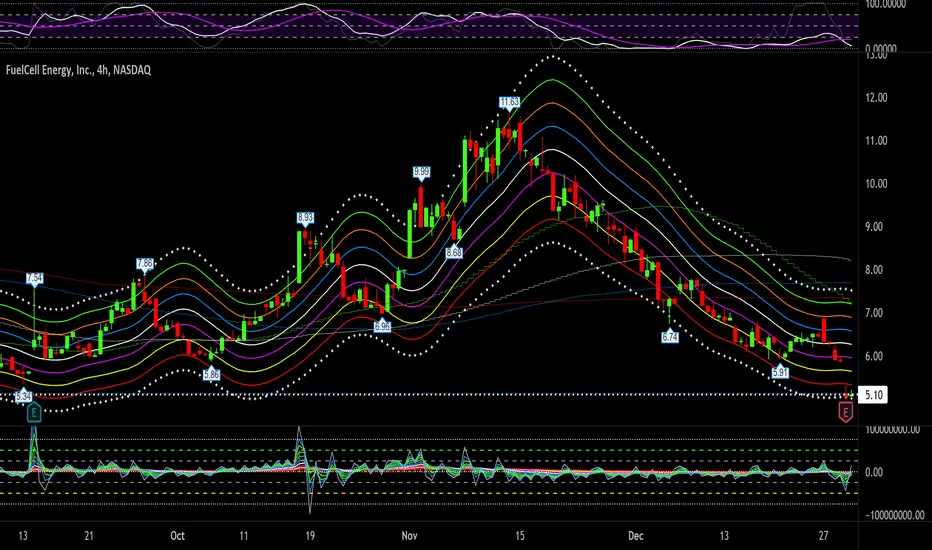

Price levels 4hr chart:

SMA200 = $7.33

SMA150 = $7.69

SMA100 =$8.22

SMA50 =$7.24

Trend channel 4hr chart:

breakout = $7.51

R3 = $7.20

R2 = $6.89

R1 = $6.57

pivot = $6.26

S1 = $5.95

S2 = $5.64

S3 = $5.32

breakdown = $5.01

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tradingview.com/u/growerik/

EPS = -$.07

52 week H = $29.44

52 week L = $4.83

Price levels 4hr chart:

SMA200 = $7.33

SMA150 = $7.69

SMA100 =$8.22

SMA50 =$7.24

Trend channel 4hr chart:

breakout = $7.51

R3 = $7.20

R2 = $6.89

R1 = $6.57

pivot = $6.26

S1 = $5.95

S2 = $5.64

S3 = $5.32

breakdown = $5.01

Do your own due diligence, your risk is 100% your responsibility. This is for educational and entertainment purposes only. You win some or you learn some. Consider being charitable with some of your profit to help humankind. Good luck and happy trading friends...

*3x lucky 7s of trading*

7pt Trading compass:

Price action, entry/exit

Volume average/direction

Trend, patterns, momentum

Newsworthy current events

Revenue

Earnings

Balance sheet

7 Common mistakes:

+5% portfolio trades, capital risk management

Beware of analyst's motives

Emotions & Opinions

FOMO : bad timing, the market is ruthless, be shrewd

Lack of planning & discipline

Forgetting restraint

Obdurate repetitive errors, no adaptation

7 Important tools:

Trading View app!, Brokerage UI

Accurate indicators & settings

Wide screen monitor/s

Trading log (pencil & graph paper)

Big, organized desk

Reading books, playing chess

Sorted watch-list

Checkout my indicators:

Fibonacci VIP - volume

Fibonacci MA7 - price

pi RSI - trend momentum

TTC - trend channel

AlertiT - notification

tradingview.com/u/growerik/

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trading indicators:

tradingview.com/u/Options360/

tradingview.com/u/Options360/

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.