Several fundamental factors will have a strong influence on the stock market this week, including trade diplomacy, geopolitical tensions and the FED's monetary policy decision on Wednesday June 18.

1) The FED on June 18, the fundamental highlight of the week

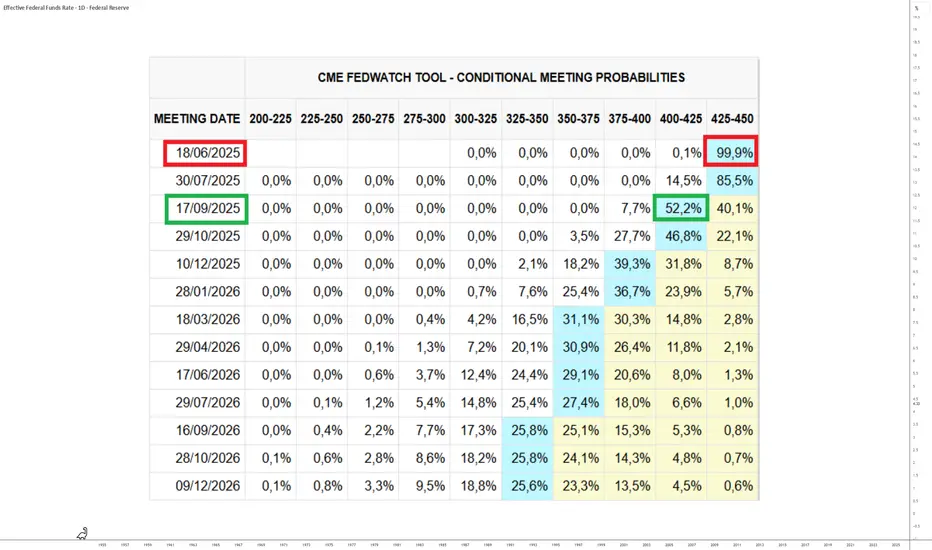

The stock market week will be dominated by one fundamental event: the US Federal Reserve's (FED) monetary policy decision scheduled for Wednesday June 18. This meeting promises to be crucial for the summer direction of the financial markets, against a backdrop of uncertainties linked to the trade war and an economic cycle nearing maturity. Although the consensus is for the US Fed Funds rate to remain unchanged, with a 99% probability according to the CME FedWatch Tool, investors' attention will be focused on the Fed's updated macroeconomic projections.

The expected evolution of inflation, employment and the Fed Funds rate will be at the heart of the debate, as will the tone of Jerôme Powell's press conference. The market, now expensive both technically and fundamentally, is demanding more accommodative signals to extend its rally.

2) The market wants confirmation of two rate cuts by the end of 2025

What investors now expect from the FED is not so much immediate action on rates as a clearer roadmap for the end of the year. Explicit confirmation of two rate cuts by December 2025 would represent the minimum required to support current equity market levels, particularly the S&P 500, which is trading close to its all-time highs.

However, the central bank remains under pressure, torn between calls for monetary easing and caution in the face of a possible rebound in inflation, particularly under the impact of customs tensions. If Jerome Powell reaffirms the Bank's wait-and-see stance, this could lead to market consolidation. Conversely, downwardly revised inflation forecasts and a Fed Funds curve pointing to further declines could be interpreted as a clear signal of a pivot.

We will also have to keep a close eye on the developments announced regarding the reduction of the Quantitative Tightening program.

Finally, beyond the fundamentals, the technical timing reinforces the importance of this meeting. The bond market is already providing clues, with a technical configuration that could herald an easing in yields if the Fed adopts a more conciliatory tone. In equities, the weekly technical analysis of the S&P 500 shows areas of overbought territory, reinforcing the need for monetary support to avoid a trend reversal. In this context, Wednesday's meeting is more than just a monetary policy decision: it is a strategic marker for the rest of 2025.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

1) The FED on June 18, the fundamental highlight of the week

The stock market week will be dominated by one fundamental event: the US Federal Reserve's (FED) monetary policy decision scheduled for Wednesday June 18. This meeting promises to be crucial for the summer direction of the financial markets, against a backdrop of uncertainties linked to the trade war and an economic cycle nearing maturity. Although the consensus is for the US Fed Funds rate to remain unchanged, with a 99% probability according to the CME FedWatch Tool, investors' attention will be focused on the Fed's updated macroeconomic projections.

The expected evolution of inflation, employment and the Fed Funds rate will be at the heart of the debate, as will the tone of Jerôme Powell's press conference. The market, now expensive both technically and fundamentally, is demanding more accommodative signals to extend its rally.

2) The market wants confirmation of two rate cuts by the end of 2025

What investors now expect from the FED is not so much immediate action on rates as a clearer roadmap for the end of the year. Explicit confirmation of two rate cuts by December 2025 would represent the minimum required to support current equity market levels, particularly the S&P 500, which is trading close to its all-time highs.

However, the central bank remains under pressure, torn between calls for monetary easing and caution in the face of a possible rebound in inflation, particularly under the impact of customs tensions. If Jerome Powell reaffirms the Bank's wait-and-see stance, this could lead to market consolidation. Conversely, downwardly revised inflation forecasts and a Fed Funds curve pointing to further declines could be interpreted as a clear signal of a pivot.

We will also have to keep a close eye on the developments announced regarding the reduction of the Quantitative Tightening program.

Finally, beyond the fundamentals, the technical timing reinforces the importance of this meeting. The bond market is already providing clues, with a technical configuration that could herald an easing in yields if the Fed adopts a more conciliatory tone. In equities, the weekly technical analysis of the S&P 500 shows areas of overbought territory, reinforcing the need for monetary support to avoid a trend reversal. In this context, Wednesday's meeting is more than just a monetary policy decision: it is a strategic marker for the rest of 2025.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

This content is written by Vincent Ganne for Swissquote.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only and does not constitute investment, legal or tax advice.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.