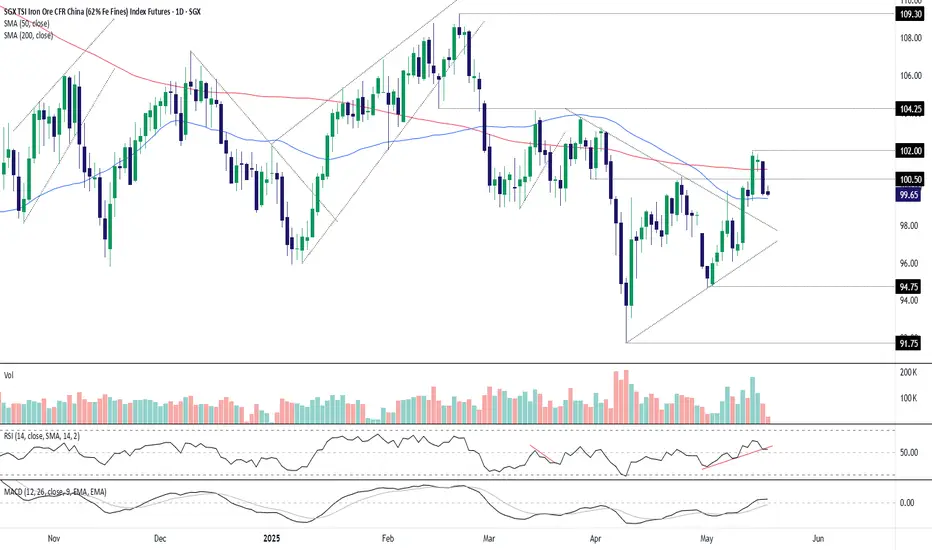

SGX Iron Ore: Evening Star Reversal Skews Risks Lower

Having completed a bearish reversal pattern and with bullish momentum starting to fade, traders should stay alert to the risk of renewed downside in SGX iron ore futures.

A three-candle evening star has knocked the price back below $100 per tonne, putting the spotlight on the 50-day moving average for those eyeing potential bearish setups. A clean break below could invite fresh shorts, allowing for a stop to be placed above for protection.

Former downtrend resistance from March 27 may now act as support, offering a potential target around $98 today. Beyond, $96 and $94.75 are levels of interest for those seeking greater risk-reward.

While momentum indicators had swung bullish over the past week, that’s now starting to reverse. RSI (14) has broken its short-term uptrend, and MACD looks toppy. With modest volumes accompanying the reversal, patience is warranted.

Good luck!

DS

A three-candle evening star has knocked the price back below $100 per tonne, putting the spotlight on the 50-day moving average for those eyeing potential bearish setups. A clean break below could invite fresh shorts, allowing for a stop to be placed above for protection.

Former downtrend resistance from March 27 may now act as support, offering a potential target around $98 today. Beyond, $96 and $94.75 are levels of interest for those seeking greater risk-reward.

While momentum indicators had swung bullish over the past week, that’s now starting to reverse. RSI (14) has broken its short-term uptrend, and MACD looks toppy. With modest volumes accompanying the reversal, patience is warranted.

Good luck!

DS

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.