Long

Taking It A Step Farther: Valuing Valueless Assets

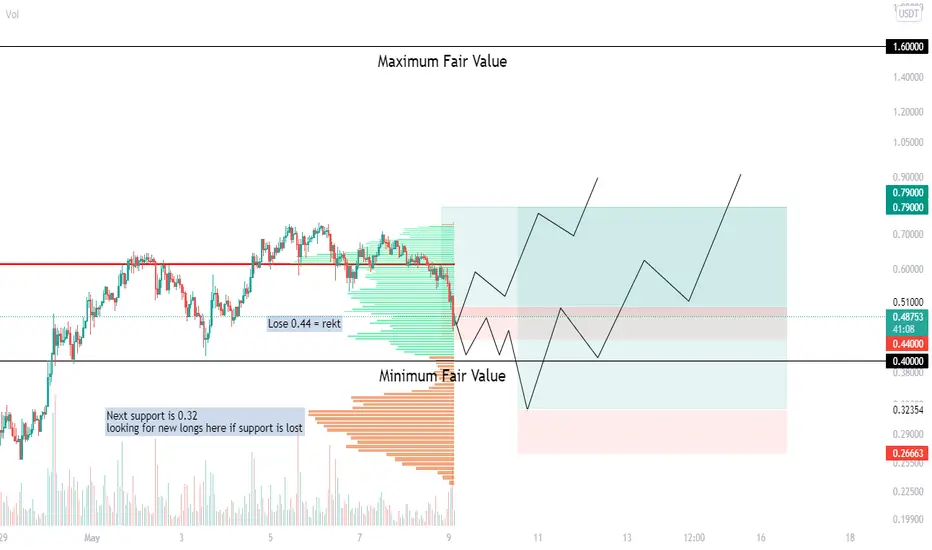

I have created a fair value model for a worthless asset based on it's trading volume alone. Since volume represents the fluctuating demand for this ultimately vaporware asset, it shows us the minimum and maximum fair values of the asset.

Based on this model, it is good to place bids and buy big below Minimum Fair Value, and then sell as price reaches / moves above Maximum Fair Value. It's possible for the market to drasically overshoot the Maximum Fair Value, but it's best to keep realistic targets.

24hr Volume / Circulating Supply

Minimum Fair Value (lowest 24hr volume):

$100,000,000 volume / 250,000,000 tokens =

$0.4

Maximum Fair Value (highest 24hr volume):

$400,000,000 volume / 250,000,000 tokens =

$1.6

Despite this model, within a few years this asset will be worth ZERO! ALWAYS ALWAYS ALWAYS use a stop loss when trading worthless assets!!!!!

Based on this model, it is good to place bids and buy big below Minimum Fair Value, and then sell as price reaches / moves above Maximum Fair Value. It's possible for the market to drasically overshoot the Maximum Fair Value, but it's best to keep realistic targets.

24hr Volume / Circulating Supply

Minimum Fair Value (lowest 24hr volume):

$100,000,000 volume / 250,000,000 tokens =

$0.4

Maximum Fair Value (highest 24hr volume):

$400,000,000 volume / 250,000,000 tokens =

$1.6

Despite this model, within a few years this asset will be worth ZERO! ALWAYS ALWAYS ALWAYS use a stop loss when trading worthless assets!!!!!

Note

Last try!Note

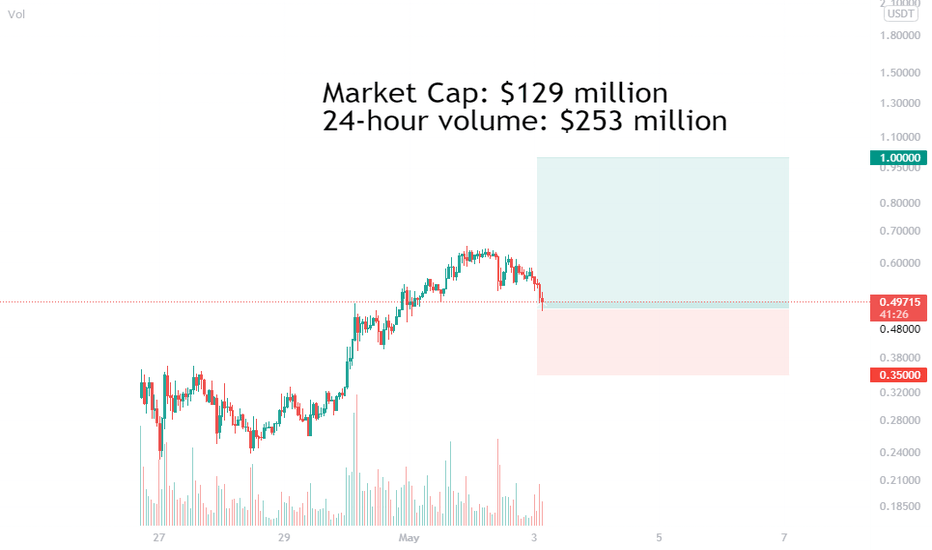

Price bounced from our entry and then SLAMMED into the minimum fair value. It looks like it could make a bottom here and then shoot upwards. As a bonus, retail stop losses seem to have been taken.Note

Another thing to think of:Note

market momentum is truly slowly and then all at once, so having a big take profit can make sense for these kind of assetsNote

That's why stop losses are good to keep that momentum from cutting you to bits, and far reaching take profits can be good so that you can really ride the waves if things play out nicely.Note

See how we stopped up for a loss at $0.44, and now the price is even lower but we are making money because we got into a better trade at the new support. Just right!Note

I am moving to a 5% trailing stop loss to see if I can sqeeze a little more out of this trade while still protecting my profits. GGNote

I got stopped out overnight at a great profit. The trade has been rolled over into a new idea and this one is closed with over 2 R:R of profit!Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.