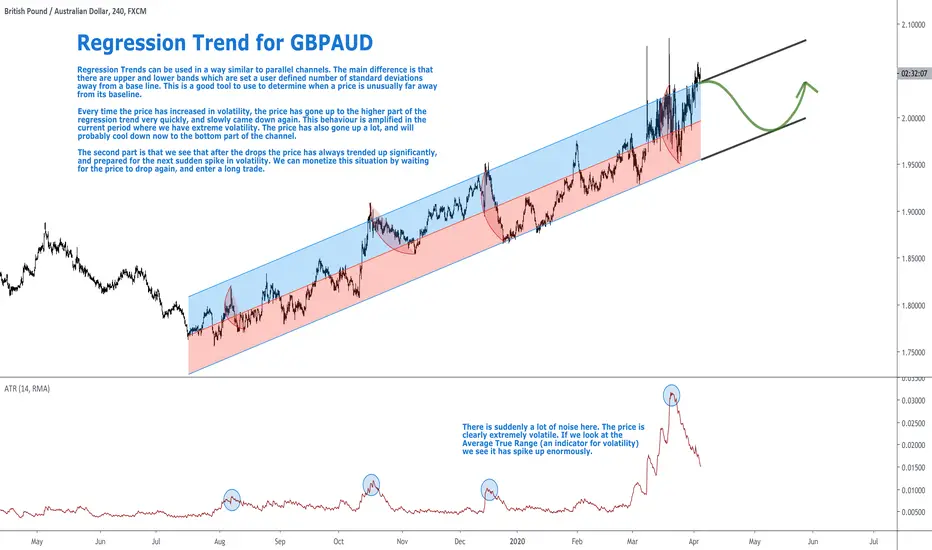

Regression Trends can be used in a way similar to parallel channels. The main difference is that there are upper and lower bands which are set a user defined number of standard deviations away from a base line. This is a good tool to use to determine when a price is unusually far away from its baseline.

Every time the price has increased in volatility, the price has gone up to the higher part of the regression trend very quickly, and slowly came down again. This behaviour is amplified in the current period where we have extreme volatility. The price has also gone up a lot, and will probably cool down now to the bottom part of the channel.

The second part is that we see that after the drops the price has always trended up significantly, and prepared for the next sudden spike in volatility. We can monetize this situation by waiting for the price to drop again, and enter a long trade.

There is suddenly a lot of noise at the current time as well. The price is clearly extremely volatile. If we look at the Average True Range (an indicator for volatility) we see it has spike up enormously. That's why I expect history to repeat it self, and we continue this channel in the way described on the chart.

Follow me for consistent high quality updates, with clear explanations and charts.

Please like this post to support me.

- Trading Guru

--------------------------------------------------------------

Disclaimer!

This post does not provide financial advice. It is for educational purposes only!

Every time the price has increased in volatility, the price has gone up to the higher part of the regression trend very quickly, and slowly came down again. This behaviour is amplified in the current period where we have extreme volatility. The price has also gone up a lot, and will probably cool down now to the bottom part of the channel.

The second part is that we see that after the drops the price has always trended up significantly, and prepared for the next sudden spike in volatility. We can monetize this situation by waiting for the price to drop again, and enter a long trade.

There is suddenly a lot of noise at the current time as well. The price is clearly extremely volatile. If we look at the Average True Range (an indicator for volatility) we see it has spike up enormously. That's why I expect history to repeat it self, and we continue this channel in the way described on the chart.

Follow me for consistent high quality updates, with clear explanations and charts.

Please like this post to support me.

- Trading Guru

--------------------------------------------------------------

Disclaimer!

This post does not provide financial advice. It is for educational purposes only!

Thảo luận về những biến động và nói cùng nhau về thị trường giao dịch ở cộng đồng Telegram này nhé!

t.me/Vietnam100eyes

(bắt đầu từ tháng 2 - 2023)

t.me/Vietnam100eyes

(bắt đầu từ tháng 2 - 2023)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Thảo luận về những biến động và nói cùng nhau về thị trường giao dịch ở cộng đồng Telegram này nhé!

t.me/Vietnam100eyes

(bắt đầu từ tháng 2 - 2023)

t.me/Vietnam100eyes

(bắt đầu từ tháng 2 - 2023)

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.