📌 Trade Plan #1 (Intraday Short Trade)

Trade Type: Intraday Short Position

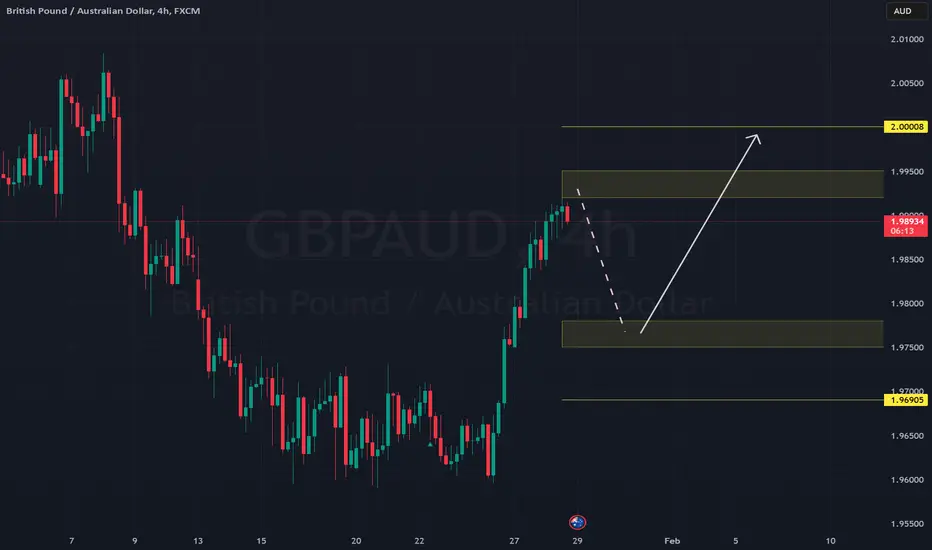

📉 Sell Limit at: 1.9920 - 1.9950 (Order Block + Liquidity Grab)

🛑 Stop Loss: 2.0010 (Above Structure + 60 pips)

🎯 Take Profit 1: 1.9800 (Liquidity Grab Zone)

🎯 Take Profit 2: 1.9750 (Major Demand Zone)

Risk-Reward (R:R): 1:4.5 (High Probability Trade)

🔥 Reasoning:

Liquidity above 1.9920 can induce Smart Money entries.

Order Flow still bearish on LTF, targeting liquidity at 1.9800.

Confluence: OB + FVG + Liquidity Pool + Bearish CHoCH

📌 Trade Plan #2 (Swing Trade Long Position)

Trade Type: Swing Buy Position

📈 Buy Limit at: 1.9750 - 1.9780 (Demand Zone + FVG)

🛑 Stop Loss: 1.9700 (Below Liquidity Grab)

🎯 Take Profit 1: 1.9900 (OB Retest)

🎯 Take Profit 2: 2.0000 (High R:R Target)

Risk-Reward (R:R): 1:5 (High Reward)

🔥 Reasoning:

Liquidity below 1.9750 hasn't been grabbed yet.

Major Demand Zone (Daily + 4H confluence).

Smart Money reversal expected after liquidity sweep.

Final Decision - What Would I Do?

As a professional institutional trader:

1️⃣ Wait for price to sweep above 1.9920 before shorting.

2️⃣ Enter Short at 1.9920 - 1.9950, target 1.9750.

3️⃣ If price reaches 1.9750, monitor for bullish signs before entering a long.

Key Risk Management Rule:

If price fails to reject at 1.9920, avoid shorts.

If price doesn't show reversal at 1.9750, no long entry.

Institutional Execution:

Use limit orders to avoid slippage.

Watch price reaction at key levels for confirmation.

This is an institutional-grade analysis ensuring precision and strict risk management. 🚀💰

Trade Type: Intraday Short Position

📉 Sell Limit at: 1.9920 - 1.9950 (Order Block + Liquidity Grab)

🛑 Stop Loss: 2.0010 (Above Structure + 60 pips)

🎯 Take Profit 1: 1.9800 (Liquidity Grab Zone)

🎯 Take Profit 2: 1.9750 (Major Demand Zone)

Risk-Reward (R:R): 1:4.5 (High Probability Trade)

🔥 Reasoning:

Liquidity above 1.9920 can induce Smart Money entries.

Order Flow still bearish on LTF, targeting liquidity at 1.9800.

Confluence: OB + FVG + Liquidity Pool + Bearish CHoCH

📌 Trade Plan #2 (Swing Trade Long Position)

Trade Type: Swing Buy Position

📈 Buy Limit at: 1.9750 - 1.9780 (Demand Zone + FVG)

🛑 Stop Loss: 1.9700 (Below Liquidity Grab)

🎯 Take Profit 1: 1.9900 (OB Retest)

🎯 Take Profit 2: 2.0000 (High R:R Target)

Risk-Reward (R:R): 1:5 (High Reward)

🔥 Reasoning:

Liquidity below 1.9750 hasn't been grabbed yet.

Major Demand Zone (Daily + 4H confluence).

Smart Money reversal expected after liquidity sweep.

Final Decision - What Would I Do?

As a professional institutional trader:

1️⃣ Wait for price to sweep above 1.9920 before shorting.

2️⃣ Enter Short at 1.9920 - 1.9950, target 1.9750.

3️⃣ If price reaches 1.9750, monitor for bullish signs before entering a long.

Key Risk Management Rule:

If price fails to reject at 1.9920, avoid shorts.

If price doesn't show reversal at 1.9750, no long entry.

Institutional Execution:

Use limit orders to avoid slippage.

Watch price reaction at key levels for confirmation.

This is an institutional-grade analysis ensuring precision and strict risk management. 🚀💰

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.