GBPAUD – DTF Technical & Fundamental Analysis

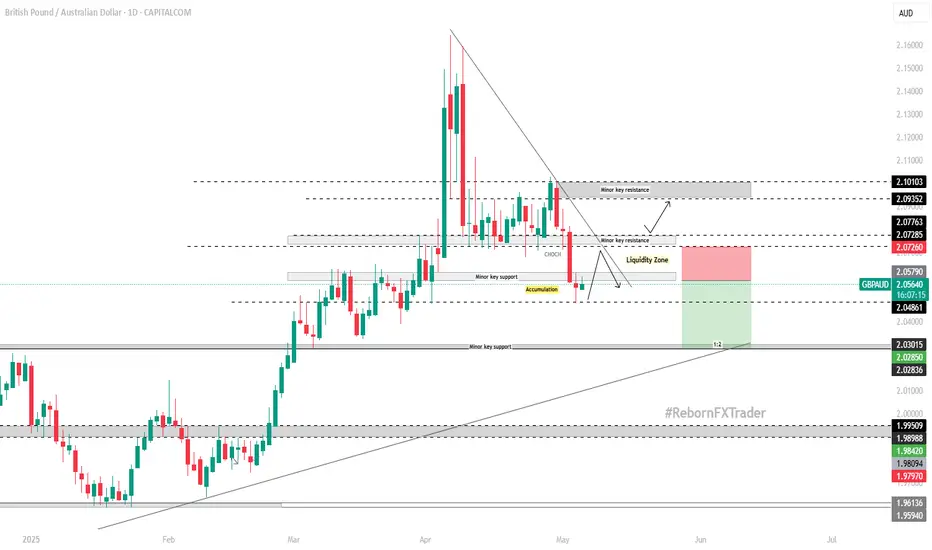

On the daily timeframe, the price was previously within a range following an uptrend. A major support level at 2.07500 has been breached in recent sessions, signaling a potential Change of Character (CHoCH) and possibly indicating a shift in market momentum. Additionally, the price has broken below a minor support level at 2.05800, with an accumulation phase developing.

Our strategy moving forward is to monitor price action as it seeks liquidity above the identified liquidity zone. We will wait for clear confirmation of liquidity formation. Should the price return to test and break the support level again, the area of interest lies around 2.05790 (a potential breakout point). Risk management should be placed below 2.07260 should liquidity form as expected. The longer-term target is a potential move toward the next minor resistance zone at 0.90650.

Fundamental Analysis:

The British Pound (GBP) has depreciated against the Australian Dollar (AUD) in early May 2025, reaching a one-month low around 2.0525. This decline can be attributed to several key factors:

Australian Dollar Strength: The AUD has gained strength, primarily driven by the Australian Labor Party's recent election victory, securing a second term in office. This political stability, coupled with a rally in the AUD/USD exchange rate to five-month highs near 0.65, has instilled greater investor confidence in the Australian currency.

GBP/AUD Exchange Rate Trends: The GBP/AUD pair has been in a downtrend, with the current price at approximately 1.98078 as of May 6, 2025. Market forecasts suggest a potential further decline of around 3.5% in the short term, although a modest recovery is anticipated over the longer term, potentially extending into the next year.

📌 Disclaimer:

This is not financial advice. As always, wait for proper confirmation before executing trades. Manage your risk wisely and trade what you see, not what you feel.

On the daily timeframe, the price was previously within a range following an uptrend. A major support level at 2.07500 has been breached in recent sessions, signaling a potential Change of Character (CHoCH) and possibly indicating a shift in market momentum. Additionally, the price has broken below a minor support level at 2.05800, with an accumulation phase developing.

Our strategy moving forward is to monitor price action as it seeks liquidity above the identified liquidity zone. We will wait for clear confirmation of liquidity formation. Should the price return to test and break the support level again, the area of interest lies around 2.05790 (a potential breakout point). Risk management should be placed below 2.07260 should liquidity form as expected. The longer-term target is a potential move toward the next minor resistance zone at 0.90650.

Fundamental Analysis:

The British Pound (GBP) has depreciated against the Australian Dollar (AUD) in early May 2025, reaching a one-month low around 2.0525. This decline can be attributed to several key factors:

Australian Dollar Strength: The AUD has gained strength, primarily driven by the Australian Labor Party's recent election victory, securing a second term in office. This political stability, coupled with a rally in the AUD/USD exchange rate to five-month highs near 0.65, has instilled greater investor confidence in the Australian currency.

GBP/AUD Exchange Rate Trends: The GBP/AUD pair has been in a downtrend, with the current price at approximately 1.98078 as of May 6, 2025. Market forecasts suggest a potential further decline of around 3.5% in the short term, although a modest recovery is anticipated over the longer term, potentially extending into the next year.

📌 Disclaimer:

This is not financial advice. As always, wait for proper confirmation before executing trades. Manage your risk wisely and trade what you see, not what you feel.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.