GBP

FUNDAMENTAL OUTLOOK: WEAK BEARISH

BASELINE

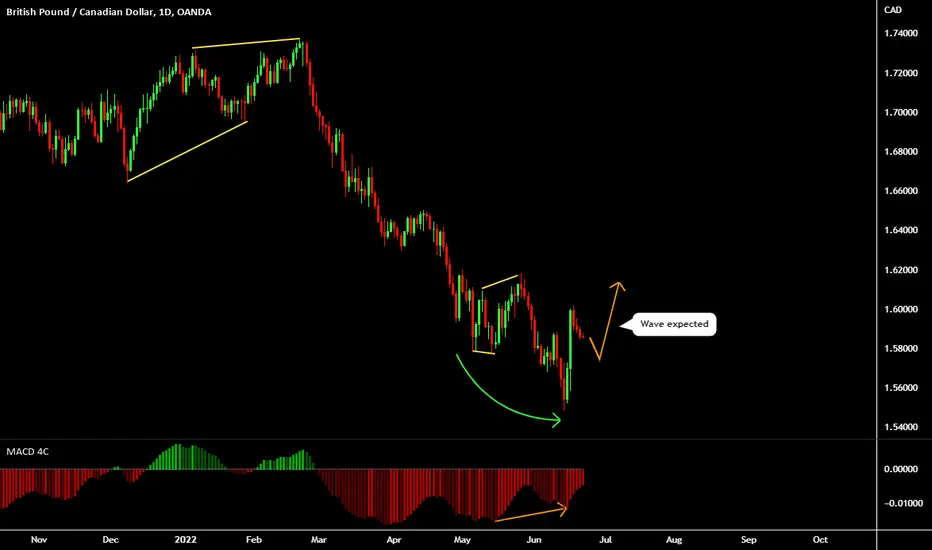

The overall bleak economic outlook for the UK, with exceptionally high Inflation and rapidly falling growth have been the biggest negative driver for Sterling. With rising price pressures and falling demand, the risks of stagflation has risen substantially, so much so that the BoE have forecasted a possible recession for the UK economy heading into 2023. At their June meeting the bank followed through with their more moderate approach by hiking 25bsp instead of growing calls of a potential 50bsp hike. The BoE is stuck between a rock and a hard place, right now they have to hike rates to try and fight inflation but by doing so they risk further damaging economic growth as a result. Even though the June statement was dovish, it wasn’t materially more dovish compared to their previous meeting. the price action was a clear warning sign that a lot of negatives has been priced in for Sterling in recent weeks so chasing lower in risky.

POSSIBLE BULLISH SURPRISES

Stagflation fears are very high for the UK, with probabilities of recession growing by the week. With so much bad news priced in, incoming news risk is asymmetrical, meaning positive surprises in growth data (like incoming flash PMIs) could trigger bullish reactions for Sterling. Furthermore, as the UK is facing one of its biggest cost of living squeezes in history, lower-than-expected inflation prints (coming up Wednesday) could counterintuitively be a positive driver for the currency (lower CPI means less stagflation risk). The economy needs help right now, which means any help from the fiscal side will be a positive. Any major fiscal support measures to help consumers (subsidies for energy or tax cuts) could trigger bullish reactions for the Pound. We have lots of BoE speak coming up this week, any overly hawkish comments signalling more aggressive policy than what markets are currently pricing in could trigger bullish GBP reactions.

POSSIBLE BEARISH SURPRISES

Monetary policy is a double-edged sword for the GBP. Odds that the BoE has limited hikes left has been a negative driver, but so too is risks that inflation forces them to hike even more and further damage GDP. Further stagflation risks from higher gas prices or CPI prints could trigger bearish reactions. Politics is also in focus, where any attempts to oust PM Johnson by changing no-confidence laws could trigger bearish reactions. GBP is usually sensitive to political uncertainty and anything that raises odds of a snap election should be negative. With UK threats of triggering Article 16 and EU threats to terminate the Brexit deal if they do Brexit is in focus again. For now, markets have rightly ignored this as posturing, but any actual escalation can see sharp GBP downside. We have lots of BoE speak coming up this week, any overly dovish comments signalling less aggressive policy than what markets are currently pricing in could trigger bearish GBP reactions.

BIGGER PICTURE

The fundamental outlook for the GBP remains fairly bleak right now with the economic prospects and risk of stagflation keeping the currency pressured. Anything that exacerbates stagflation fears is expected to weigh on the Pound and anything that alleviates some of that pressure should be positive. Tactically the GBP has been stretched to the downside, so any new shorts do need to be weary of the risk of some mean reversion as we saw after this past week’s BoE meeting.

CAD

FUNDAMENTAL OUTLOOK: NEUTRAL

BASELINE

The CAD has enjoyed far more upside in the past few weeks than we anticipated. We’ve been cautious on the currency given Canada’s dependency on the US (>70% of exports) where the clear signs of a faster than expected slowdown and possible recession should deteriorate the growth outlook for Canada. Apart from that, the risks to the Canadian housing market can negatively impact consumer spending as interest rates rise higher at aggressive speed. Potentially damaging the wealth effect created by the rapid rise in house prices since covid. However, despite the risks to the economy and the outlook, markets still price in a very favourable growth environment for Canada, also supported by a big push higher in terms of trade due to the rise in commodity prices. Furthermore, despite clear warning signals, the BoC has chosen to ignore the negatives and has stayed surprisingly optimistic and hawkish. We’ve missed most of the move higher in the CAD as our bias has kept us cautious, but the risks are still present and with the currency close to 9-year highs (at the index level) we have very little appetite for chasing it higher from here and will be actively looking for opportunities to trade the CAD lower with the right type of bearish catalyst.

POSSIBLE BULLISH SURPRISES

As an oil exporter, oil prices are important for CAD. Catalyst that sees further upside Oil (deteriorating supply outlook, ease in demand fears) could trigger bullish CAD reactions. The correlation has been hit and miss in recent weeks though. As a risk sensitive currency, and catalyst that causes big bouts of risk on sentiment could trigger bullish reactions in the CAD. With more market participants noticing cracks in the housing markets, a very solid House Price Index print could ease some of those concerns and provide some upside. Even though a lot of tightening has been priced in for the BoC , a big enough surprise in CPI that triggers further hike expectations could provide some short-term support.

POSSIBLE BEARISH SURPRISES

As an oil exporter, oil prices are important for CAD. Any catalyst that triggers meaningful downside in oil (deteriorating demand outlook, ease in supply shortage, less supply constraints) could be a negative catalyst for the CAD as well. As a risk sensitive currency, and catalyst that causes big bouts of risk off sentiment could trigger bearish reactions in the CAD. Since a lot of policy tightening has been priced into STIR markets, any negative catalysts that triggers less hawkish BoC expectations (faster deceleration in growth or inflation ) could trigger outsized downside for the CAD. In recent communication, Governor Macklem started to mention some hiccups in housing. A big miss in the House Price index could trigger more speculation of a less hawkish bank and could trigger some downside for the CAD.

BIGGER PICTURE

The bigger picture outlook for the CAD remains neutral for now. Given the clear risks to the growth outlook due to the slowdown in the US, as well as rising risks to the consumer and the housing market, we remain cautious on the currency, even though it’s move much higher than we anticipated. With a lot of upside priced into the CAD and Canadian yields, our preferred way of trading the CAD would be to look for short-term negative catalysts to trade the CAD lower instead of chasing it higher.

FUNDAMENTAL OUTLOOK: WEAK BEARISH

BASELINE

The overall bleak economic outlook for the UK, with exceptionally high Inflation and rapidly falling growth have been the biggest negative driver for Sterling. With rising price pressures and falling demand, the risks of stagflation has risen substantially, so much so that the BoE have forecasted a possible recession for the UK economy heading into 2023. At their June meeting the bank followed through with their more moderate approach by hiking 25bsp instead of growing calls of a potential 50bsp hike. The BoE is stuck between a rock and a hard place, right now they have to hike rates to try and fight inflation but by doing so they risk further damaging economic growth as a result. Even though the June statement was dovish, it wasn’t materially more dovish compared to their previous meeting. the price action was a clear warning sign that a lot of negatives has been priced in for Sterling in recent weeks so chasing lower in risky.

POSSIBLE BULLISH SURPRISES

Stagflation fears are very high for the UK, with probabilities of recession growing by the week. With so much bad news priced in, incoming news risk is asymmetrical, meaning positive surprises in growth data (like incoming flash PMIs) could trigger bullish reactions for Sterling. Furthermore, as the UK is facing one of its biggest cost of living squeezes in history, lower-than-expected inflation prints (coming up Wednesday) could counterintuitively be a positive driver for the currency (lower CPI means less stagflation risk). The economy needs help right now, which means any help from the fiscal side will be a positive. Any major fiscal support measures to help consumers (subsidies for energy or tax cuts) could trigger bullish reactions for the Pound. We have lots of BoE speak coming up this week, any overly hawkish comments signalling more aggressive policy than what markets are currently pricing in could trigger bullish GBP reactions.

POSSIBLE BEARISH SURPRISES

Monetary policy is a double-edged sword for the GBP. Odds that the BoE has limited hikes left has been a negative driver, but so too is risks that inflation forces them to hike even more and further damage GDP. Further stagflation risks from higher gas prices or CPI prints could trigger bearish reactions. Politics is also in focus, where any attempts to oust PM Johnson by changing no-confidence laws could trigger bearish reactions. GBP is usually sensitive to political uncertainty and anything that raises odds of a snap election should be negative. With UK threats of triggering Article 16 and EU threats to terminate the Brexit deal if they do Brexit is in focus again. For now, markets have rightly ignored this as posturing, but any actual escalation can see sharp GBP downside. We have lots of BoE speak coming up this week, any overly dovish comments signalling less aggressive policy than what markets are currently pricing in could trigger bearish GBP reactions.

BIGGER PICTURE

The fundamental outlook for the GBP remains fairly bleak right now with the economic prospects and risk of stagflation keeping the currency pressured. Anything that exacerbates stagflation fears is expected to weigh on the Pound and anything that alleviates some of that pressure should be positive. Tactically the GBP has been stretched to the downside, so any new shorts do need to be weary of the risk of some mean reversion as we saw after this past week’s BoE meeting.

CAD

FUNDAMENTAL OUTLOOK: NEUTRAL

BASELINE

The CAD has enjoyed far more upside in the past few weeks than we anticipated. We’ve been cautious on the currency given Canada’s dependency on the US (>70% of exports) where the clear signs of a faster than expected slowdown and possible recession should deteriorate the growth outlook for Canada. Apart from that, the risks to the Canadian housing market can negatively impact consumer spending as interest rates rise higher at aggressive speed. Potentially damaging the wealth effect created by the rapid rise in house prices since covid. However, despite the risks to the economy and the outlook, markets still price in a very favourable growth environment for Canada, also supported by a big push higher in terms of trade due to the rise in commodity prices. Furthermore, despite clear warning signals, the BoC has chosen to ignore the negatives and has stayed surprisingly optimistic and hawkish. We’ve missed most of the move higher in the CAD as our bias has kept us cautious, but the risks are still present and with the currency close to 9-year highs (at the index level) we have very little appetite for chasing it higher from here and will be actively looking for opportunities to trade the CAD lower with the right type of bearish catalyst.

POSSIBLE BULLISH SURPRISES

As an oil exporter, oil prices are important for CAD. Catalyst that sees further upside Oil (deteriorating supply outlook, ease in demand fears) could trigger bullish CAD reactions. The correlation has been hit and miss in recent weeks though. As a risk sensitive currency, and catalyst that causes big bouts of risk on sentiment could trigger bullish reactions in the CAD. With more market participants noticing cracks in the housing markets, a very solid House Price Index print could ease some of those concerns and provide some upside. Even though a lot of tightening has been priced in for the BoC , a big enough surprise in CPI that triggers further hike expectations could provide some short-term support.

POSSIBLE BEARISH SURPRISES

As an oil exporter, oil prices are important for CAD. Any catalyst that triggers meaningful downside in oil (deteriorating demand outlook, ease in supply shortage, less supply constraints) could be a negative catalyst for the CAD as well. As a risk sensitive currency, and catalyst that causes big bouts of risk off sentiment could trigger bearish reactions in the CAD. Since a lot of policy tightening has been priced into STIR markets, any negative catalysts that triggers less hawkish BoC expectations (faster deceleration in growth or inflation ) could trigger outsized downside for the CAD. In recent communication, Governor Macklem started to mention some hiccups in housing. A big miss in the House Price index could trigger more speculation of a less hawkish bank and could trigger some downside for the CAD.

BIGGER PICTURE

The bigger picture outlook for the CAD remains neutral for now. Given the clear risks to the growth outlook due to the slowdown in the US, as well as rising risks to the consumer and the housing market, we remain cautious on the currency, even though it’s move much higher than we anticipated. With a lot of upside priced into the CAD and Canadian yields, our preferred way of trading the CAD would be to look for short-term negative catalysts to trade the CAD lower instead of chasing it higher.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.