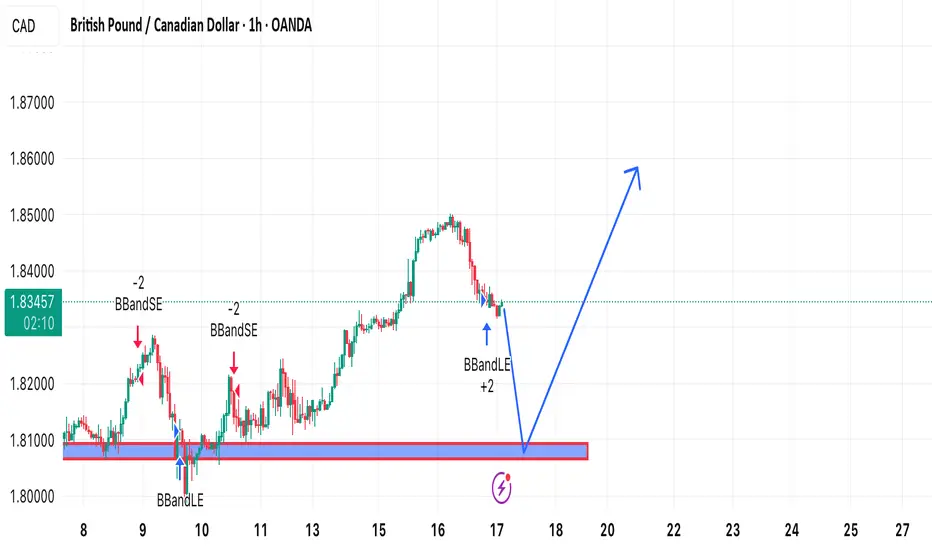

🧠 What We See Now:

• Strong impulse move up from the 1.8120–1.8178 demand zone (you marked that level like a pro).

• Price broke key lower highs around 1.8300, giving us bullish structure confirmation.

• Now we’re seeing a pullback after a clean rally—normal and expected.

• The most recent candle action is showing exhaustion from buyers (likely taking profits), which sets us up for a potential re-entry.

🔍 Is There a Buy Setup?

YES. But not right this second.

You’re in the “wait and strike” phase. Here’s what I’d be watching:

✅ BUY PLAN:

You want to buy the dip back into structure—not chase highs.

📌 Buy Entry Zone:

• Price to watch: 1.8250–1.8200

• Confluence:

• Previous consolidation before the breakout

• Discounted Fib zone (likely between 61.8%–78.6%)

• Imbalance fill on the 4H

• Demand zone revisit

🎯 Targets:

• TP1: 1.8385 (recent high)

• TP2: 1.8500+

• SL: Below 1.8120 to stay safe

⚠️ Should You Sell Here?

Nope. Here’s why:

• You’d be selling into a bullish market structure.

• Price already broke major highs—it’s no longer a downtrend.

• You’re better off waiting for a rejection at 1.8400–1.8450 if you want to scalp a short later, but now isn’t it.

🧠 Bonus Tip:

If you drop to the 1H or 30min and see price form a bullish engulfing or strong rejection wick in the 1.8250–1.8200 zone, that’s your confirmation trigger.

🔥 Final Words:

This is the part where emotions can fool traders into buying too early or selling too fast. But structure is on your side if you stay patient.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.