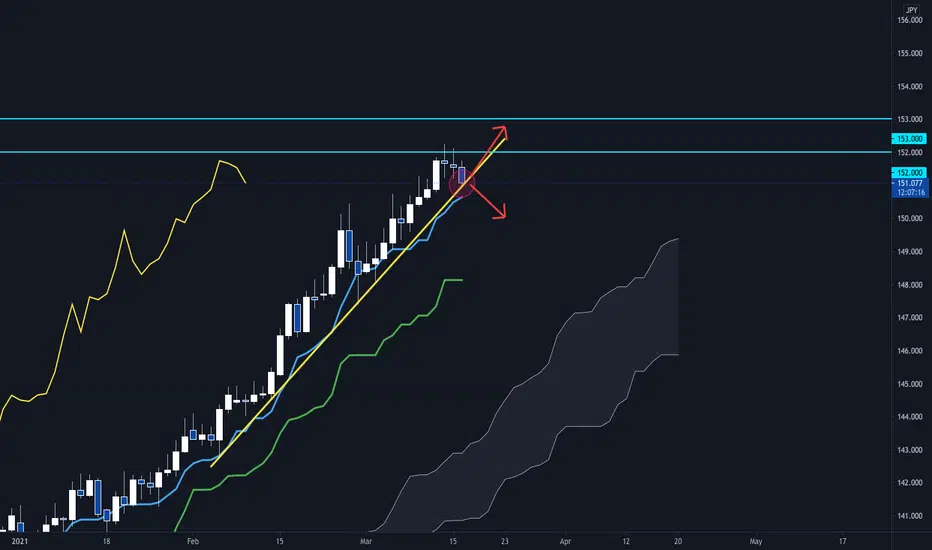

GBPJPY Daily chart shows the market is under retracement as below Ichimoku confirmations.

- Kumo (Senko span B) flat)

- Kijun sen flat

However the market is still in bullish momentum as below.

- Thick bullish Kumo

- Tenkan sen is still up

- Chiko span above the candles

Below is the next possible scenarios.

1. If market will be supported by the trend line, it could break the previous Doji high and reach up to 153.00.

2. If market breaks the support line and Tenkan sen, it could go down back to Kijun sen at 148.1 level.

- Kumo (Senko span B) flat)

- Kijun sen flat

However the market is still in bullish momentum as below.

- Thick bullish Kumo

- Tenkan sen is still up

- Chiko span above the candles

Below is the next possible scenarios.

1. If market will be supported by the trend line, it could break the previous Doji high and reach up to 153.00.

2. If market breaks the support line and Tenkan sen, it could go down back to Kijun sen at 148.1 level.

Note

Below is the video about the analysis.youtu.be/D84aSoBpuxk

Forex Kei

Official Website: forex-kei.com

Global Trading School: forex-kei.com/?page_id=2855

KTS Academy: keistradingstrategy.com

Official Website: forex-kei.com

Global Trading School: forex-kei.com/?page_id=2855

KTS Academy: keistradingstrategy.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Forex Kei

Official Website: forex-kei.com

Global Trading School: forex-kei.com/?page_id=2855

KTS Academy: keistradingstrategy.com

Official Website: forex-kei.com

Global Trading School: forex-kei.com/?page_id=2855

KTS Academy: keistradingstrategy.com

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.