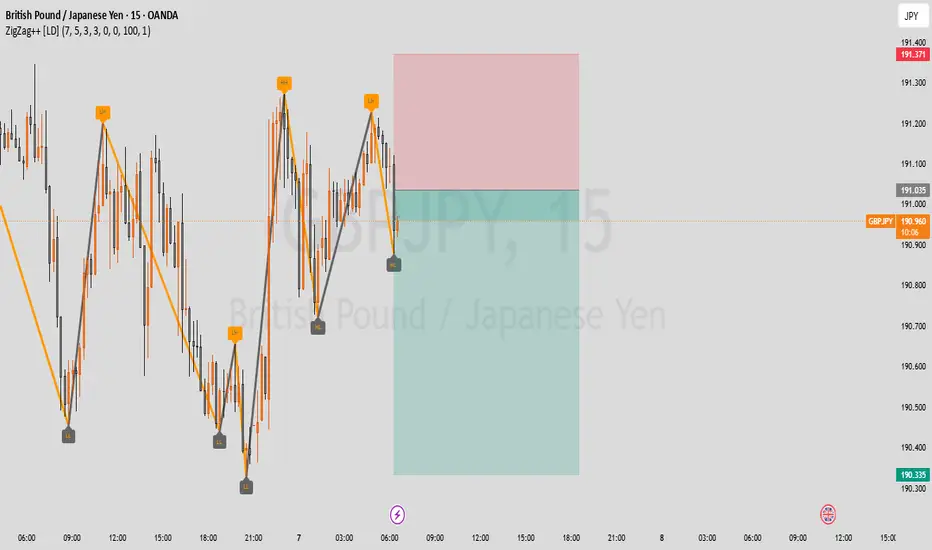

GBPJPY – Liquidity Setup and Short Opportunity

GBPJPY has a consistent behavior of creating liquidity before the London session ("pre-London"), only to retrace and sweep that liquidity during the actual London session before making its true directional move.

This pattern plays out frequently, and we take advantage of it on a daily basis. Typically, price forms inducement zones or liquidity traps just before the session opens — which then get taken out as part of the London open volatility.

Currently, GBPJPY has created such a setup, and based on this recurring behavior, I’m going short, anticipating a liquidity sweep before the pair resumes its broader directional move.

Key Factors:

Pre-London liquidity build-up observed

London session expected to sweep high/lows

Short setup in play based on this repeatable model

Traders familiar with session-based liquidity trading will recognize this as a high-probability setup.

GBPJPY has a consistent behavior of creating liquidity before the London session ("pre-London"), only to retrace and sweep that liquidity during the actual London session before making its true directional move.

This pattern plays out frequently, and we take advantage of it on a daily basis. Typically, price forms inducement zones or liquidity traps just before the session opens — which then get taken out as part of the London open volatility.

Currently, GBPJPY has created such a setup, and based on this recurring behavior, I’m going short, anticipating a liquidity sweep before the pair resumes its broader directional move.

Key Factors:

Pre-London liquidity build-up observed

London session expected to sweep high/lows

Short setup in play based on this repeatable model

Traders familiar with session-based liquidity trading will recognize this as a high-probability setup.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.