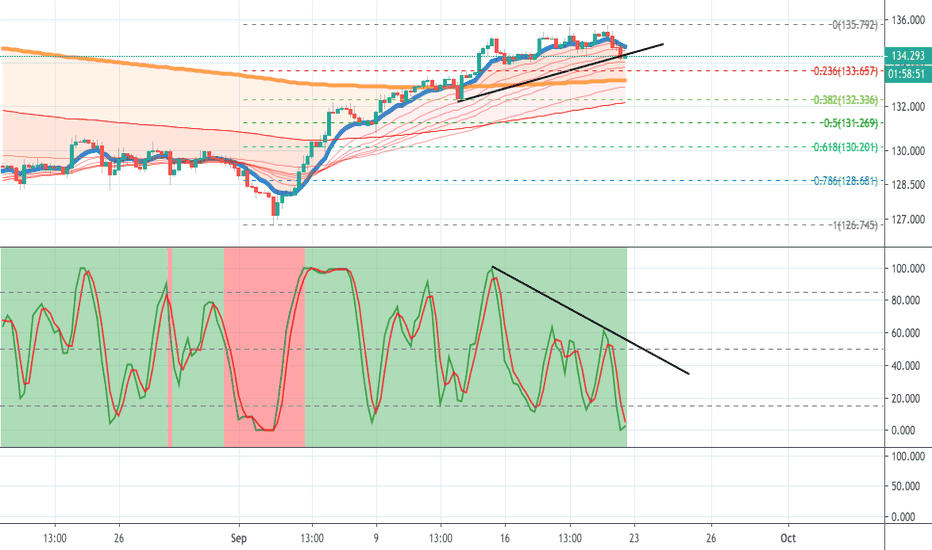

Timeframe (TF): 4 hr and Daily

Trend: Down on 4-hr TF with a correction for current 4-hr TF uptrend; correction to downtrend on Daily TF

-Some bullish divergence can be seen on the 4-Hr. Looking at the daily, stochastic is ready to move in the upwards direction, signaling some bullish movement may occur.

-Do not just open a trade based on my opinion about the divergence, unless your system suggests you do. If a trade is opened, a very tight SL is recommended.

-Fib levels may warrant some validity to this idea. On the Daily TF (overall downtrend), price got rejected at the 0.382 level, which may signal further decline in long-term. On the 4-Hr price is hovering around that 0.382 level which may give it a short-term bump to the upside.

-Keep in in GBP pairs, and especially this pair, may show some serious volatility with Brexit and the uncertainty in that subject. Keep in mind that we are getting into October and Brexit news, whether good or bad may start rolling in a lot. Also note that JPY is also is a safe haven so any global issues can cause people buying JPY (and in this case shorting GBP).

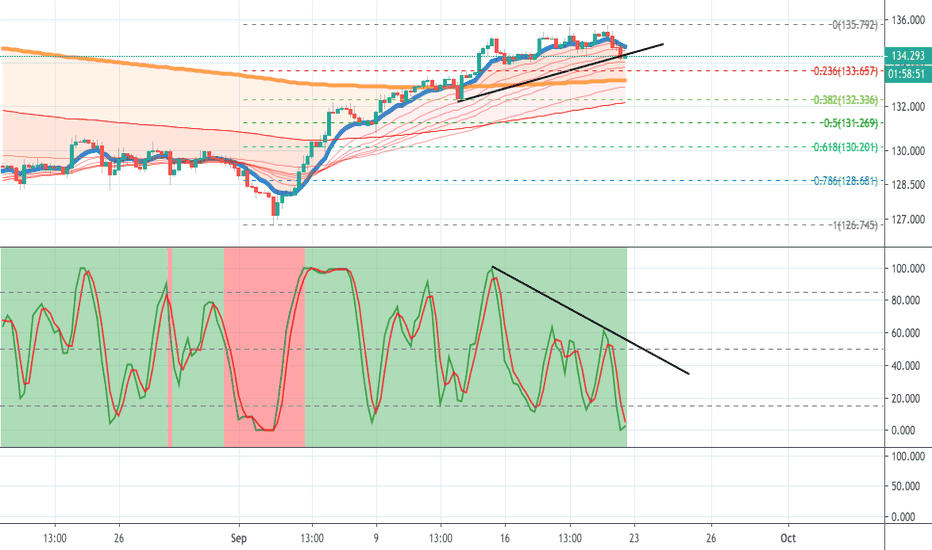

My previous view on GPB/JPY that turned out profitable (shorted ~134.60 down to 132.80), based on bearish divergence:

Trend: Down on 4-hr TF with a correction for current 4-hr TF uptrend; correction to downtrend on Daily TF

-Some bullish divergence can be seen on the 4-Hr. Looking at the daily, stochastic is ready to move in the upwards direction, signaling some bullish movement may occur.

-Do not just open a trade based on my opinion about the divergence, unless your system suggests you do. If a trade is opened, a very tight SL is recommended.

-Fib levels may warrant some validity to this idea. On the Daily TF (overall downtrend), price got rejected at the 0.382 level, which may signal further decline in long-term. On the 4-Hr price is hovering around that 0.382 level which may give it a short-term bump to the upside.

-Keep in in GBP pairs, and especially this pair, may show some serious volatility with Brexit and the uncertainty in that subject. Keep in mind that we are getting into October and Brexit news, whether good or bad may start rolling in a lot. Also note that JPY is also is a safe haven so any global issues can cause people buying JPY (and in this case shorting GBP).

My previous view on GPB/JPY that turned out profitable (shorted ~134.60 down to 132.80), based on bearish divergence:

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.