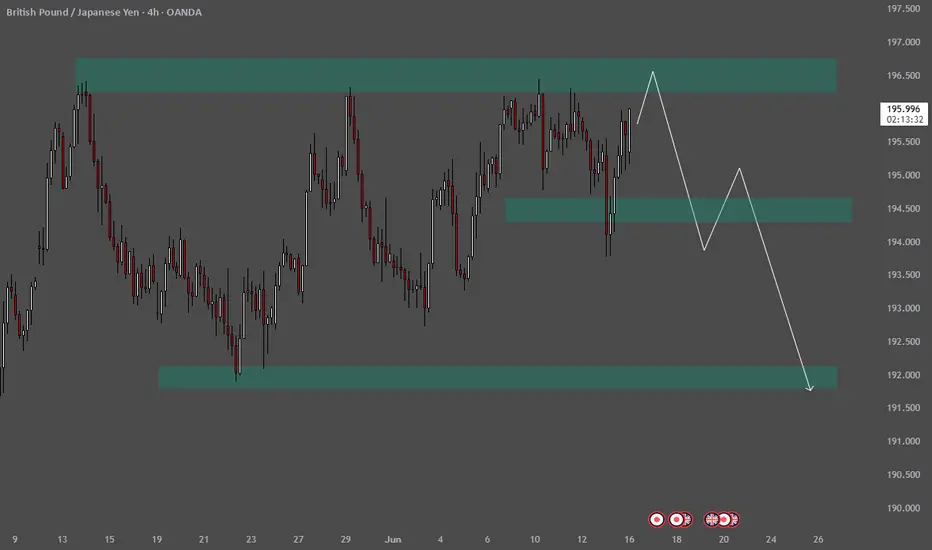

📊 GBPJPY 4H Technical Analysis Overview:

The chart displays a well-structured range-bound market with price moving between key supply and demand zones, suggesting potential for both continuation and reversal setups.

🔹 Key Zones:

Resistance Zone (Supply): 196.300 – 196.700

Price has previously reversed from this area multiple times, indicating strong selling pressure.

Mid-level Support/Resistance Zone: Around 194.300 – 194.800

This zone is acting as a decision point; price has shown reactions here both as support and resistance.

Major Demand Zone: 191.700 – 192.200

Strong historical buying pressure from this level, likely to act as a key support if price drops.

🔀 Price Projections:

Bullish Scenario:

A short-term push towards the resistance zone could occur, testing the 196.500 region before any major move.

Bearish Scenario (Primary Projection):

If price gets rejected from the resistance zone, we may see a bearish reversal breaking through the mid-support zone and eventually targeting the lower demand zone (around 192.000).

📌 Outlook:

Price is currently approaching a critical resistance area. Watch for signs of rejection or confirmation before entering short positions. A clean break below the 194.300 support zone would validate the bearish continuation setup.

The chart displays a well-structured range-bound market with price moving between key supply and demand zones, suggesting potential for both continuation and reversal setups.

🔹 Key Zones:

Resistance Zone (Supply): 196.300 – 196.700

Price has previously reversed from this area multiple times, indicating strong selling pressure.

Mid-level Support/Resistance Zone: Around 194.300 – 194.800

This zone is acting as a decision point; price has shown reactions here both as support and resistance.

Major Demand Zone: 191.700 – 192.200

Strong historical buying pressure from this level, likely to act as a key support if price drops.

🔀 Price Projections:

Bullish Scenario:

A short-term push towards the resistance zone could occur, testing the 196.500 region before any major move.

Bearish Scenario (Primary Projection):

If price gets rejected from the resistance zone, we may see a bearish reversal breaking through the mid-support zone and eventually targeting the lower demand zone (around 192.000).

📌 Outlook:

Price is currently approaching a critical resistance area. Watch for signs of rejection or confirmation before entering short positions. A clean break below the 194.300 support zone would validate the bearish continuation setup.

Trade active

Active Trade.💰 King Maker FX — Master the Gold Market with Precision.

Unlock real-time trends, pro strategies, and expert insights to turn every move into profit. 🚀✨ t.me/kmforexllc

Unlock real-time trends, pro strategies, and expert insights to turn every move into profit. 🚀✨ t.me/kmforexllc

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💰 King Maker FX — Master the Gold Market with Precision.

Unlock real-time trends, pro strategies, and expert insights to turn every move into profit. 🚀✨ t.me/kmforexllc

Unlock real-time trends, pro strategies, and expert insights to turn every move into profit. 🚀✨ t.me/kmforexllc

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.