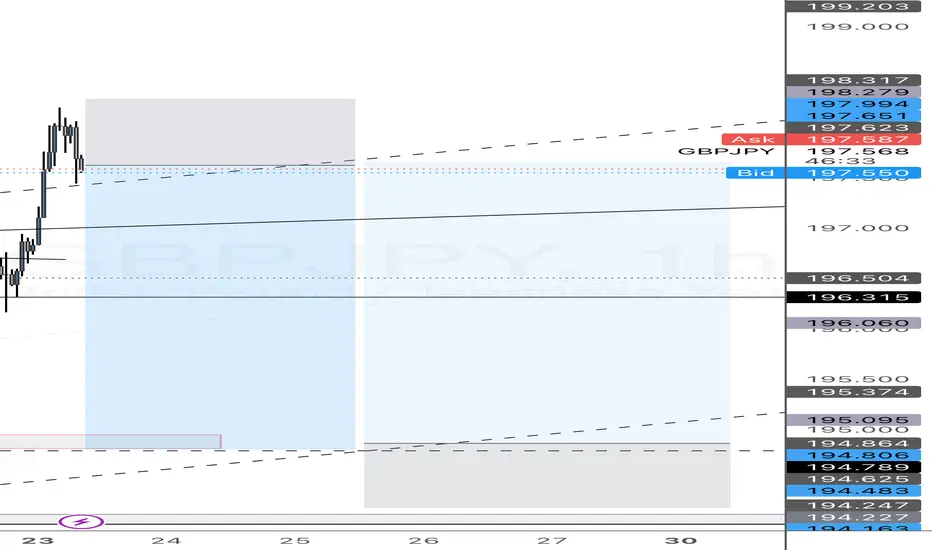

Currently in a short position from the top of the ascending channel (197.600s area), where price tapped into confluence:

• Rising wedge upper trendline

• Key Fibonacci zone (between -27% and 61.8%)

• Extended bullish move with clear signs of exhaustion

Trade Plan – Phase 1 (Sell):

I’m targeting the red box zone as marked on the chart, which aligns with prior structure support around 194.80–194.60, and also sits in a strong Fibonacci pocket (around the 61.8% retracement of the most recent impulse leg).

• Entry (Sell): ~197.600

• TP (Sell): 194.800

• SL: Above 197.750 (wick high)

⸻

Trade Plan – Phase 2 (Buy):

Once price taps into the red box, I’ll flip bias to long for a bullish continuation trade. This zone has acted as demand multiple times and aligns with:

• Lower trendline support

• Fib confluence zone

• Institutional-style stop hunt structure

Looking for a clean bullish signal (engulfing, pin bar, or strong volume reaction) before entering the buy. Expecting price to return to 196.3–197+ on the rebound.

• Buy Limit Zone: 194.800–194.600

• SL: Below 194.200

• TP: 196.300–197.000+

• Rising wedge upper trendline

• Key Fibonacci zone (between -27% and 61.8%)

• Extended bullish move with clear signs of exhaustion

Trade Plan – Phase 1 (Sell):

I’m targeting the red box zone as marked on the chart, which aligns with prior structure support around 194.80–194.60, and also sits in a strong Fibonacci pocket (around the 61.8% retracement of the most recent impulse leg).

• Entry (Sell): ~197.600

• TP (Sell): 194.800

• SL: Above 197.750 (wick high)

⸻

Trade Plan – Phase 2 (Buy):

Once price taps into the red box, I’ll flip bias to long for a bullish continuation trade. This zone has acted as demand multiple times and aligns with:

• Lower trendline support

• Fib confluence zone

• Institutional-style stop hunt structure

Looking for a clean bullish signal (engulfing, pin bar, or strong volume reaction) before entering the buy. Expecting price to return to 196.3–197+ on the rebound.

• Buy Limit Zone: 194.800–194.600

• SL: Below 194.200

• TP: 196.300–197.000+

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.