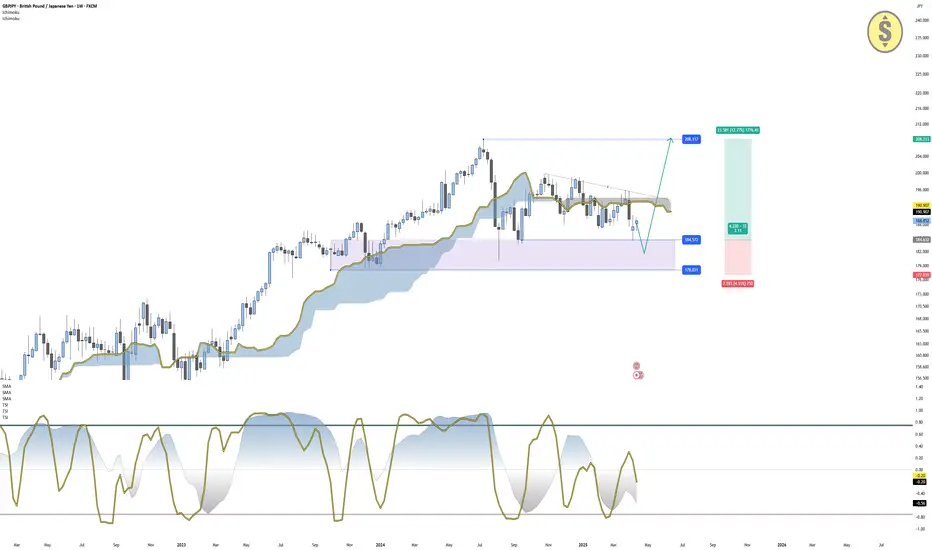

GBP/JPY is currently trading at 188.85, within a corrective move but still preserving its bullish structure, as long as price remains above the 178.00 support floor. The zone between 184.57 and 178.03 marks a strong weekly demand area, which aligns with previous consolidation and demand before impulsive moves.

The price is below the Ichimoku cloud (Span A: 190.90, Span B: 192.93), indicating short-term bearish momentum. However, this could simply be a retracement within a larger bullish trend, especially since the market has not yet broken structure to the downside.

Trend Strength Index (TSI) readings show a clear loss of momentum:

TSI(10): -0.62

TSI(20): -0.56

These values are near oversold levels, increasing the likelihood of a bullish reversal, especially within a key demand zone. Liquidity above recent local highs may serve as fuel for a breakout if bulls reclaim key levels near the cloud base.

If price confirms support at 184–178, the bullish setup targets a return to the previous swing high at 208.11. This would offer a highly favorable risk-to-reward ratio, with the invalidation clearly placed below 178.00.

Trade Setup Summary:

Long Entry Zone: 184.57 – 178.03

Stop Loss: Below 178.00

Target: 208.11 (previous high)

Structure Bias: Bullish above 178.00

The British pound remains relatively strong as the Bank of England signals caution before cutting rates, contrasting with Japan's ultra-loose monetary policy. While the yen remains fundamentally weak, there is always potential for temporary JPY strength due to risk-off flows. However, unless the BoJ surprises with policy shifts, GBP/JPY continues to favor upside on both structural and macroeconomic grounds.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

The price is below the Ichimoku cloud (Span A: 190.90, Span B: 192.93), indicating short-term bearish momentum. However, this could simply be a retracement within a larger bullish trend, especially since the market has not yet broken structure to the downside.

Trend Strength Index (TSI) readings show a clear loss of momentum:

TSI(10): -0.62

TSI(20): -0.56

These values are near oversold levels, increasing the likelihood of a bullish reversal, especially within a key demand zone. Liquidity above recent local highs may serve as fuel for a breakout if bulls reclaim key levels near the cloud base.

If price confirms support at 184–178, the bullish setup targets a return to the previous swing high at 208.11. This would offer a highly favorable risk-to-reward ratio, with the invalidation clearly placed below 178.00.

Trade Setup Summary:

Long Entry Zone: 184.57 – 178.03

Stop Loss: Below 178.00

Target: 208.11 (previous high)

Structure Bias: Bullish above 178.00

The British pound remains relatively strong as the Bank of England signals caution before cutting rates, contrasting with Japan's ultra-loose monetary policy. While the yen remains fundamentally weak, there is always potential for temporary JPY strength due to risk-off flows. However, unless the BoJ surprises with policy shifts, GBP/JPY continues to favor upside on both structural and macroeconomic grounds.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Trade forex, indices, stocks and metals with up to US$100.000 in company's funding.

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Complete a challenge to access funding or go for instant deposit.

Trading involves substantial risk. Not financial advice

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.