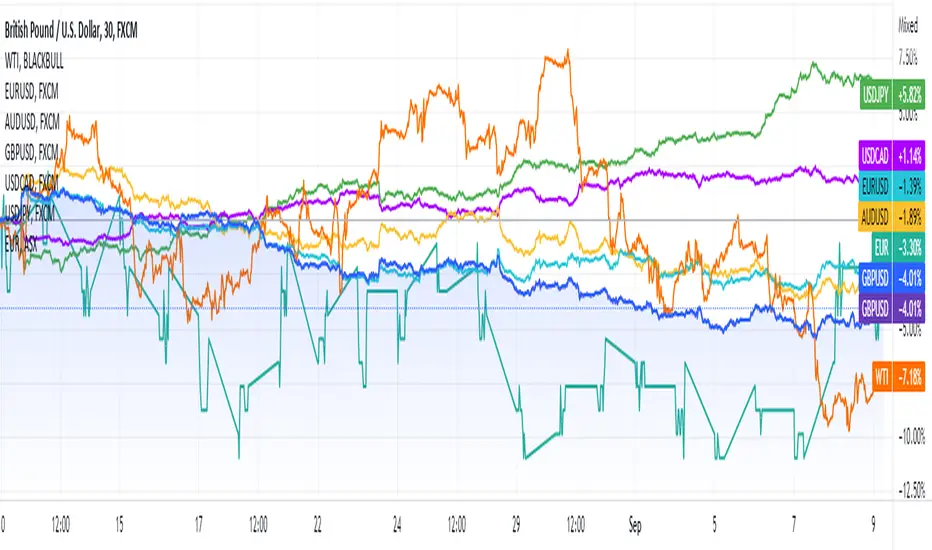

EUR/USD ▶️

GBP/USD 🔽

AUD/USD 🔽

USD/CAD 🔽

USD/JPY 🔼

XAU 🔽

WTI 🔼

The United Kingdom is in a somber mood upon their Queen’s passing, GBP/USD fell to 1.15 with minor fluctuations. Across the English Channel, the European Central Bank has followed the Bank of Canada with an aggressive 75 bps rate hike, to a total of 1.25%. Meantime, EUR/USD traded flat and closed at 0.9994, just managed to recover to 1.0052 today.

In the US, the Federal Reserve’s persistence to control inflation leads to a hawkish path of monetary tightening, overpowering the dovish Japanese yen, the USD/JPY pair was mostly stable and last traded at 144.09. On the other hand, USD/CAD closed lower at 1.3091, citing slightly higher oil prices.

Crude Oil Inventories increased by almost 9 million barrels, despite the market estimating a minor depletion. Nonetheless, WTI oil futures moved up slowly to $83.54 a barrel. Gold futures rebound from a low of $1,715 an ounce to $1,720.2, closing with minor losses.

Although Australia experienced lower inflation than other major countries, the Governor of the Reserve Bank of Australia did state it took the central bank by surprise, and AUD/USD dropped to 0.6751.

More information on Mitrade website.

GBP/USD 🔽

AUD/USD 🔽

USD/CAD 🔽

USD/JPY 🔼

XAU 🔽

WTI 🔼

The United Kingdom is in a somber mood upon their Queen’s passing, GBP/USD fell to 1.15 with minor fluctuations. Across the English Channel, the European Central Bank has followed the Bank of Canada with an aggressive 75 bps rate hike, to a total of 1.25%. Meantime, EUR/USD traded flat and closed at 0.9994, just managed to recover to 1.0052 today.

In the US, the Federal Reserve’s persistence to control inflation leads to a hawkish path of monetary tightening, overpowering the dovish Japanese yen, the USD/JPY pair was mostly stable and last traded at 144.09. On the other hand, USD/CAD closed lower at 1.3091, citing slightly higher oil prices.

Crude Oil Inventories increased by almost 9 million barrels, despite the market estimating a minor depletion. Nonetheless, WTI oil futures moved up slowly to $83.54 a barrel. Gold futures rebound from a low of $1,715 an ounce to $1,720.2, closing with minor losses.

Although Australia experienced lower inflation than other major countries, the Governor of the Reserve Bank of Australia did state it took the central bank by surprise, and AUD/USD dropped to 0.6751.

More information on Mitrade website.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.