GBPUSD Trend Update – Following the Channel

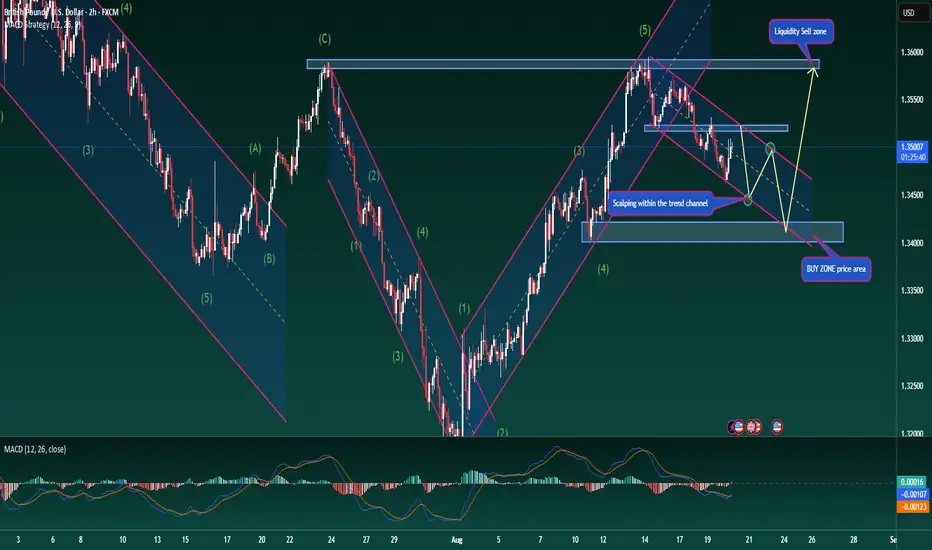

The GBPUSD pair is currently moving within a well-defined descending channel. Price behaviour in currency pairs often shows more sustainability, as their values are consistently balanced by fiscal and monetary policies. This makes the present structure an important reference for the coming sessions.

On the H1 timeframe, the 1.3400 level appears to be the next key area to watch. Price may either start a new bullish leg from here or at least stage a meaningful corrective bounce within the channel. This area could also serve as a potential long-term buying zone for GBPUSD.

Until then, traders can take advantage of intraday reactions when price retests the descending trendline near 1.3490 and 1.3445. These levels provide opportunities for short-term scalping setups, with profit targets of around 30–40 pips.

Meanwhile, the 1.3600 region stands as a solid resistance zone. If the long scenario plays out, this would be an important target for longs, or alternatively, a strong level to consider short positions for those looking at longer-term setups.

Overall, the channel is holding well and offering clear structure for trade planning. Traders can use this framework to align entries with market behaviour.

#GBPUSD #Forex #TechnicalAnalysis #PriceAction #Trendline #ChannelTrading #Scalping #SwingTrading

The GBPUSD pair is currently moving within a well-defined descending channel. Price behaviour in currency pairs often shows more sustainability, as their values are consistently balanced by fiscal and monetary policies. This makes the present structure an important reference for the coming sessions.

On the H1 timeframe, the 1.3400 level appears to be the next key area to watch. Price may either start a new bullish leg from here or at least stage a meaningful corrective bounce within the channel. This area could also serve as a potential long-term buying zone for GBPUSD.

Until then, traders can take advantage of intraday reactions when price retests the descending trendline near 1.3490 and 1.3445. These levels provide opportunities for short-term scalping setups, with profit targets of around 30–40 pips.

Meanwhile, the 1.3600 region stands as a solid resistance zone. If the long scenario plays out, this would be an important target for longs, or alternatively, a strong level to consider short positions for those looking at longer-term setups.

Overall, the channel is holding well and offering clear structure for trade planning. Traders can use this framework to align entries with market behaviour.

#GBPUSD #Forex #TechnicalAnalysis #PriceAction #Trendline #ChannelTrading #Scalping #SwingTrading

💠Accurate signals 🥉 a standardised trading system.

🍑Free training and daily sharing of market experience.

t.me/+jhvYYb3HympkMDI1

🍑Free training and daily sharing of market experience.

t.me/+jhvYYb3HympkMDI1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

💠Accurate signals 🥉 a standardised trading system.

🍑Free training and daily sharing of market experience.

t.me/+jhvYYb3HympkMDI1

🍑Free training and daily sharing of market experience.

t.me/+jhvYYb3HympkMDI1

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.