GBPUSD 17/06 – The Calm Before the Storm: All Eyes on UK CPI & Central Banks

The GBPUSD pair is coiling in a tight range near the mid-1.3500s as traders brace for two high-impact events: UK CPI data on Wednesday and interest rate decisions from both the Fed and BoE this week. Price remains supported above the 200 EMA and is compressing within a symmetrical triangle – typically a precursor to a major breakout.

📊 Macro & Fundamental Outlook

🔹 Federal Reserve (FOMC): Expected to hold rates steady, but growing anticipation of a dovish tilt toward September is weighing slightly on the USD.

🔹 Bank of England (BoE): Markets are pricing in deeper rate cuts following recent UK GDP weakness, pressuring the GBP in the short term.

🔹 Geopolitical Risks: Rising Middle East tensions are fuelling demand for USD as a safe haven, reinforcing its strength ahead of data events.

📝 Bottom Line: The CPI release could be the first trigger to shift GBPUSD’s current consolidation. A hot inflation print might push GBP higher; a miss could fuel further downside.

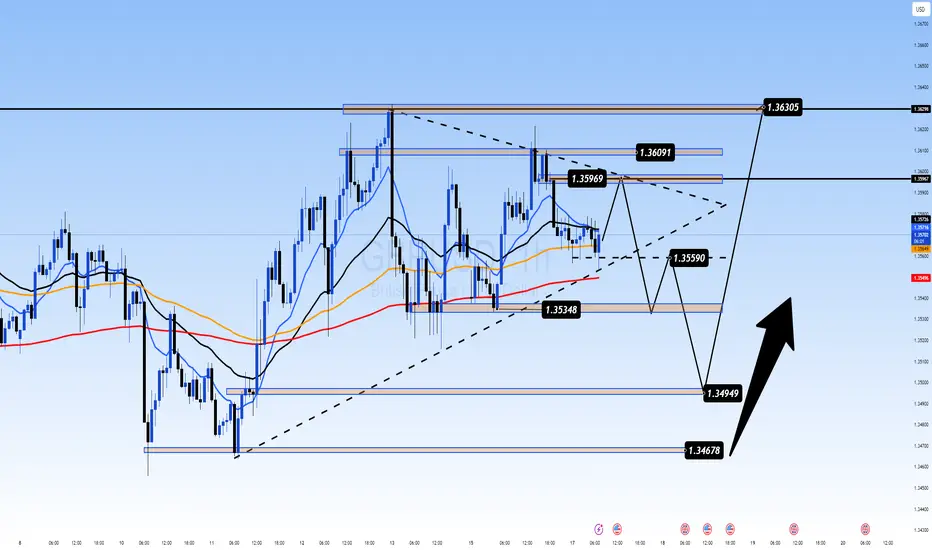

🔧 Technical Analysis (H1 Chart)

Price is ranging between 1.3535 (support) and 1.3609 (resistance)

EMAs 13/34 crossing below EMA 89 → signal of potential bearish continuation

Uptrend line from 1.3467 is still intact and acting as dynamic support

Break below 1.3559 may lead to a move toward 1.3495 and 1.3467

A confirmed breakout above 1.3609 opens the door to 1.3630+

🎯 Trade Scenarios

Scenario 1 – Buy from Trendline Support

Buy Zone: 1.3495 – 1.3467

Stop Loss: 1.3440

Targets: 1.3535 → 1.3559 → 1.3596 → 1.3630

🟢 Best setup if price prints a bullish engulfing or hammer candle on key support + UK CPI surprise.

Scenario 2 – Sell on Resistance Rejection

Sell Zone: 1.3609 – 1.3630

Stop Loss: 1.3660

Targets: 1.3590 → 1.3559 → 1.3535 → 1.3495

🔴 Only valid with strong rejection signals + softer UK data or hawkish Fed tone.

💡 Market Sentiment

Retail traders are trapped in a waiting zone – expecting a breakout

Institutions may push price into one direction pre-data to collect liquidity

Risk appetite is fragile, and traders are cautious ahead of back-to-back central bank announcements

📌 Final Thoughts

GBPUSD is preparing for volatility. Instead of chasing moves, let the market come to your key zones and react with discipline. The 1.3467–1.3495 support area could be crucial for the next directional move.

Stay patient. Wait for confirmation. Respect your risk.

The GBPUSD pair is coiling in a tight range near the mid-1.3500s as traders brace for two high-impact events: UK CPI data on Wednesday and interest rate decisions from both the Fed and BoE this week. Price remains supported above the 200 EMA and is compressing within a symmetrical triangle – typically a precursor to a major breakout.

📊 Macro & Fundamental Outlook

🔹 Federal Reserve (FOMC): Expected to hold rates steady, but growing anticipation of a dovish tilt toward September is weighing slightly on the USD.

🔹 Bank of England (BoE): Markets are pricing in deeper rate cuts following recent UK GDP weakness, pressuring the GBP in the short term.

🔹 Geopolitical Risks: Rising Middle East tensions are fuelling demand for USD as a safe haven, reinforcing its strength ahead of data events.

📝 Bottom Line: The CPI release could be the first trigger to shift GBPUSD’s current consolidation. A hot inflation print might push GBP higher; a miss could fuel further downside.

🔧 Technical Analysis (H1 Chart)

Price is ranging between 1.3535 (support) and 1.3609 (resistance)

EMAs 13/34 crossing below EMA 89 → signal of potential bearish continuation

Uptrend line from 1.3467 is still intact and acting as dynamic support

Break below 1.3559 may lead to a move toward 1.3495 and 1.3467

A confirmed breakout above 1.3609 opens the door to 1.3630+

🎯 Trade Scenarios

Scenario 1 – Buy from Trendline Support

Buy Zone: 1.3495 – 1.3467

Stop Loss: 1.3440

Targets: 1.3535 → 1.3559 → 1.3596 → 1.3630

🟢 Best setup if price prints a bullish engulfing or hammer candle on key support + UK CPI surprise.

Scenario 2 – Sell on Resistance Rejection

Sell Zone: 1.3609 – 1.3630

Stop Loss: 1.3660

Targets: 1.3590 → 1.3559 → 1.3535 → 1.3495

🔴 Only valid with strong rejection signals + softer UK data or hawkish Fed tone.

💡 Market Sentiment

Retail traders are trapped in a waiting zone – expecting a breakout

Institutions may push price into one direction pre-data to collect liquidity

Risk appetite is fragile, and traders are cautious ahead of back-to-back central bank announcements

📌 Final Thoughts

GBPUSD is preparing for volatility. Instead of chasing moves, let the market come to your key zones and react with discipline. The 1.3467–1.3495 support area could be crucial for the next directional move.

Stay patient. Wait for confirmation. Respect your risk.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.