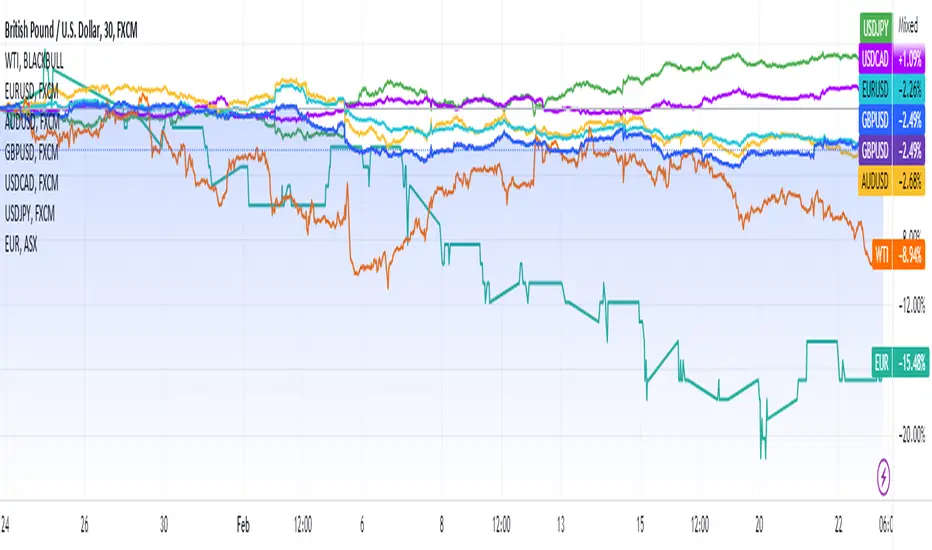

The Federal Reserve's meeting minutes reveal they continue to believe ongoing interest rate increases will be appropriate to combat inflation, with the target rate range set at 2%. This raised the risk-aversion mood in the market while strengthening the dollar. USD/CAD added 12 pips to 1.3549, but USD/JPY slid 9 pips to 134.90.

Germany's year-on-year inflation rate in February was 8.7% as Mitrade estimates. EUR/USD then fell 45 pips to 1.0601. GBP/USD dropped 71 pips to 1.2044, and AUD/USD decreased 49 pips to 0.6803.

Spot gold plunged almost $10 to $1,825.29 an ounce, and WTI oil futures declined $2.41 to $73.95 a barrel. Bitcoin and Ethereum closed lower at $24,150.0 and $1,641.40 respectively.

The Nasdaq 100 closed 5 points higher (+0.05%) at 12,066. On the other hand, the S&P 500 lost 6 points (-0.16%) to 3,991 and the Dow Jones Industrial Average dropped 84 points (-0.26%) to 33,045.

Germany's year-on-year inflation rate in February was 8.7% as Mitrade estimates. EUR/USD then fell 45 pips to 1.0601. GBP/USD dropped 71 pips to 1.2044, and AUD/USD decreased 49 pips to 0.6803.

Spot gold plunged almost $10 to $1,825.29 an ounce, and WTI oil futures declined $2.41 to $73.95 a barrel. Bitcoin and Ethereum closed lower at $24,150.0 and $1,641.40 respectively.

The Nasdaq 100 closed 5 points higher (+0.05%) at 12,066. On the other hand, the S&P 500 lost 6 points (-0.16%) to 3,991 and the Dow Jones Industrial Average dropped 84 points (-0.26%) to 33,045.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.