The Bank of England (BoE) cut its key interest rate by 25 basis points (bps) last week, as expected, bringing the base rate down to 4%, its lowest level since 2023. However, the narrow 5-4 vote indicated greater resistance to rate cuts than expected by the markets, prompting traders to reduce their bets on aggressive easing by the BoE.

In addition, traders are also factoring in the likelihood that the US central bank will cut interest rates at least twice before the end of this year.

Meanwhile, expectations for a dovish Fed policy were confirmed by comments from Fed Governor Michelle Bowman on Saturday, who said that three interest rate cuts would likely be appropriate this year. Bowman added that the clear weakening of the labor market outweighs the risks of future inflation. This, in turn, should limit the decline of the GBP/USD pair.

The latest US consumer inflation data will be released on Tuesday, while preliminary UK second-quarter GDP data and the US producer price index (PPI) will be released on Thursday. These important data points should provide significant momentum to spot prices and help determine the next phase of the directional movement.

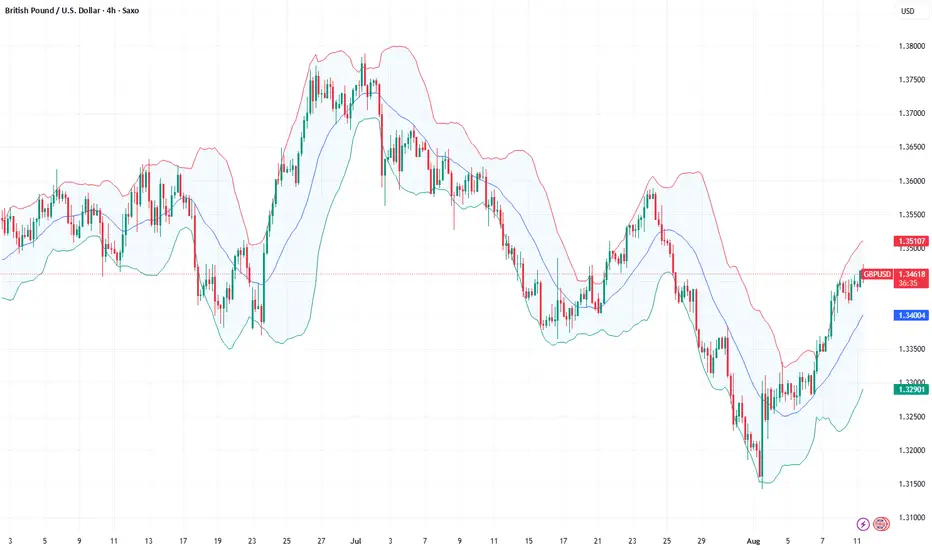

Trading recommendation: BUY 1.3490, SL 1.3410, TP 1.3570

In addition, traders are also factoring in the likelihood that the US central bank will cut interest rates at least twice before the end of this year.

Meanwhile, expectations for a dovish Fed policy were confirmed by comments from Fed Governor Michelle Bowman on Saturday, who said that three interest rate cuts would likely be appropriate this year. Bowman added that the clear weakening of the labor market outweighs the risks of future inflation. This, in turn, should limit the decline of the GBP/USD pair.

The latest US consumer inflation data will be released on Tuesday, while preliminary UK second-quarter GDP data and the US producer price index (PPI) will be released on Thursday. These important data points should provide significant momentum to spot prices and help determine the next phase of the directional movement.

Trading recommendation: BUY 1.3490, SL 1.3410, TP 1.3570

More analytical information and promotions on FreshForex website cutt.ly/LrP6j9qD

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

More analytical information and promotions on FreshForex website cutt.ly/LrP6j9qD

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.