GBP/USD 4-Hour Technical & Fundamental Analysis

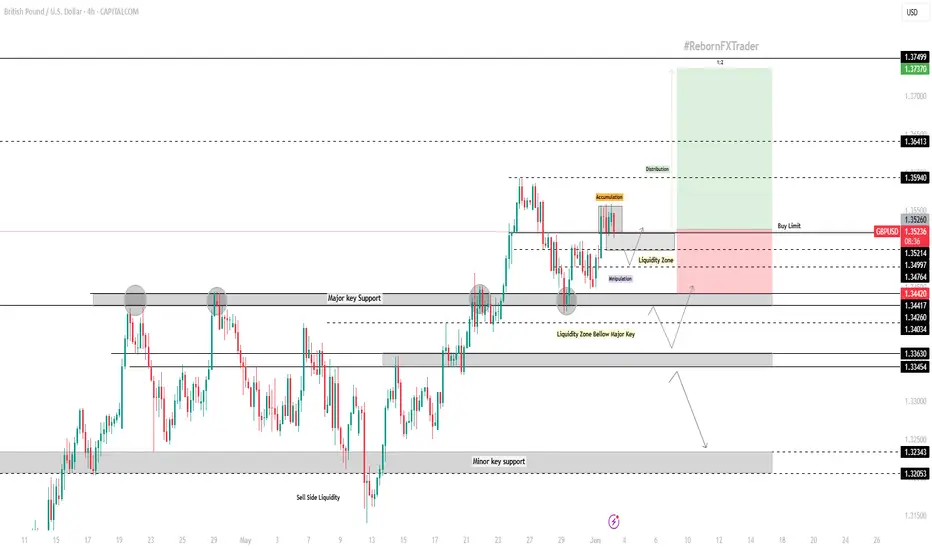

GBP/USD has pushed to a new multi-year high, breaking above key resistance as both technical and fundamental drivers favor the British Pound. The 4-hour chart reveals a strong bullish structure, with a sequence of Higher Lows and Higher Highs, signaling trend continuation amid smart money accumulation.

Price decisively broke above the major resistance at 1.34300, which now acts as structural support. Following the breakout, GBP/USD retested the level and consolidated above 1.3500, forming an accumulation zone. A liquidity hunt below minor intraday lows could provide a refined long opportunity, aligning with bullish momentum.

If price dips into the liquidity zone and reacts with bullish confirmation, the pair is likely to resume its upward trajectory, offering an attractive long setup with solid risk-reward potential.

📊 Trade Setup

📍 Area of Interest (AOI): 1.35260 (Buy Limit)

🛡 Stop-Loss: 1.34420 (Below support/liquidity pocket)

🎯 Take Profit: 1.37370 (Next major resistance / 1:2 RR)

This setup aligns with institutional bullish flow and offers a roadmap for catching the next impulsive leg to the upside.

📰 Fundamental Outlook

🇬🇧 GBP Strength vs 🇺🇸 USD Weakness

British Pound Strengthening:

UK Manufacturing: Contracted less than expected in May.

Housing Market: House prices rose 3.5% YoY, signaling strong domestic demand.

Bank of England Outlook: Markets expect rates to remain unchanged at the June 18 meeting after the recent 0.25% rate cut, showing a cautious but steady approach.

U.S. Dollar Under Pressure:

Manufacturing Slowdown: ISM Manufacturing Index dropped to 48.5, marking the 4th consecutive contraction — below the 50.0 threshold.

Trade Tensions: U.S. tariffs on steel and aluminum doubled to 50%, triggering renewed concerns.

Fiscal Concerns: Rising U.S. debt and unclear fiscal direction are weighing on USD.

Labor Market Weakness: Today’s JOLTS Job Openings report came in at 7.11M, down from 7.19M, suggesting cooling demand in the labor market.

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

GBP/USD has pushed to a new multi-year high, breaking above key resistance as both technical and fundamental drivers favor the British Pound. The 4-hour chart reveals a strong bullish structure, with a sequence of Higher Lows and Higher Highs, signaling trend continuation amid smart money accumulation.

Price decisively broke above the major resistance at 1.34300, which now acts as structural support. Following the breakout, GBP/USD retested the level and consolidated above 1.3500, forming an accumulation zone. A liquidity hunt below minor intraday lows could provide a refined long opportunity, aligning with bullish momentum.

If price dips into the liquidity zone and reacts with bullish confirmation, the pair is likely to resume its upward trajectory, offering an attractive long setup with solid risk-reward potential.

📊 Trade Setup

📍 Area of Interest (AOI): 1.35260 (Buy Limit)

🛡 Stop-Loss: 1.34420 (Below support/liquidity pocket)

🎯 Take Profit: 1.37370 (Next major resistance / 1:2 RR)

This setup aligns with institutional bullish flow and offers a roadmap for catching the next impulsive leg to the upside.

📰 Fundamental Outlook

🇬🇧 GBP Strength vs 🇺🇸 USD Weakness

British Pound Strengthening:

UK Manufacturing: Contracted less than expected in May.

Housing Market: House prices rose 3.5% YoY, signaling strong domestic demand.

Bank of England Outlook: Markets expect rates to remain unchanged at the June 18 meeting after the recent 0.25% rate cut, showing a cautious but steady approach.

U.S. Dollar Under Pressure:

Manufacturing Slowdown: ISM Manufacturing Index dropped to 48.5, marking the 4th consecutive contraction — below the 50.0 threshold.

Trade Tensions: U.S. tariffs on steel and aluminum doubled to 50%, triggering renewed concerns.

Fiscal Concerns: Rising U.S. debt and unclear fiscal direction are weighing on USD.

Labor Market Weakness: Today’s JOLTS Job Openings report came in at 7.11M, down from 7.19M, suggesting cooling demand in the labor market.

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.