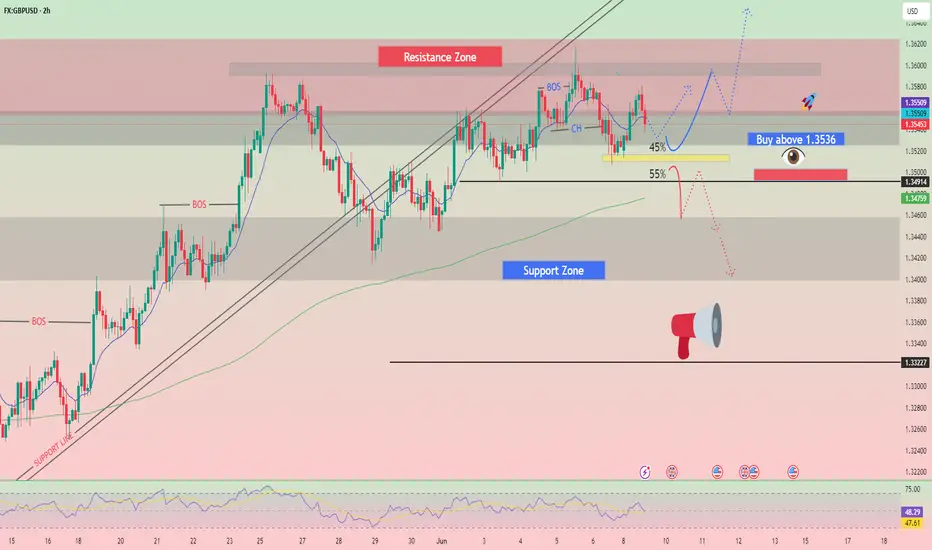

The price test at 1.3535 in the second half of the day occurred just as the RSI indicator was beginning to move downward from the zero line. This confirmed the correct entry point for selling the pound, resulting in a decline of more than 30 pips.

U.S economic indicators published on Friday sparked a wave of optimism across financial markets. Non-farm employment showed confident growth, surpassing economists' forecasts and reaching 139,000 new jobs, while market expectations hovered around 127,000. This factor immediately impacted currency rates. prompting the U.S. dollar to strengthen against major world currencies, particularly the British pound. The unemployment rate, remaining stable at 4.2%, also added to the positive sentiment. A low unemployment rate indicates the U.S. economy's healthy state and stable labor demand. This provides a favorable backdrop for continued economic growth and strengthens the dollar's position. The British pound's reaction to this news was expected - a decline against the U.S dollar. investors, assessing U.S. economic prospects as more favorable, redirected their capital, increasing demand for the dollar and decreasing demand for the pound sterling.

Today, there is no economic data from the UK, so it possible that after Friday's pullback, pound buyers may continue to act within the bullish market framework, betting on further growth in the GBP/USD pair. The absence of fresh economic data leaves room for speculation and allows traders to rely on already-established trends. However, existing risks should not be forgotten, Global economic uncertainty due to U.S. tariffs could exert pressure on the British currency at any moment.

U.S economic indicators published on Friday sparked a wave of optimism across financial markets. Non-farm employment showed confident growth, surpassing economists' forecasts and reaching 139,000 new jobs, while market expectations hovered around 127,000. This factor immediately impacted currency rates. prompting the U.S. dollar to strengthen against major world currencies, particularly the British pound. The unemployment rate, remaining stable at 4.2%, also added to the positive sentiment. A low unemployment rate indicates the U.S. economy's healthy state and stable labor demand. This provides a favorable backdrop for continued economic growth and strengthens the dollar's position. The British pound's reaction to this news was expected - a decline against the U.S dollar. investors, assessing U.S. economic prospects as more favorable, redirected their capital, increasing demand for the dollar and decreasing demand for the pound sterling.

Today, there is no economic data from the UK, so it possible that after Friday's pullback, pound buyers may continue to act within the bullish market framework, betting on further growth in the GBP/USD pair. The absence of fresh economic data leaves room for speculation and allows traders to rely on already-established trends. However, existing risks should not be forgotten, Global economic uncertainty due to U.S. tariffs could exert pressure on the British currency at any moment.

DAILY FREE SIGNAL. FREE SIGNAL (95% accuracy) TP AND SL PROVIDED

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

DAILY FREE SIGNAL. FREE SIGNAL (95% accuracy) TP AND SL PROVIDED

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

In This Channel, i Will Provide you a profitable Scalping And Swing Trade Follow My Signals

PUBLIC TELEGRAM CHANNEL

t.me/CEO_PREMIUM_ANALYSIS

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.