The Pound Sterling (GBP) is facing challenges in its attempt to surpass a critical resistance level at 1.2140, primarily due to the strength of the US Dollar. This strength has diminished investors' risk appetite, and as a result, the GBP/USD pair could potentially retreat to its lowest point in seven months. The reason for this setback lies in the UK economy, which is grappling with the repercussions of the Bank of England (BoE) raising interest rates in response to persistent consumer inflation.

Significant declines in business activities, labor demand, and retail sales have been observed, largely attributed to the pressure on household budgets caused by high inflation. Inflation risks persist due to robust wage growth, casting doubts among market participants about whether UK Prime Minister Rishi Sunak can fulfill his promise to reduce headline inflation to 5.4% by the year's end.

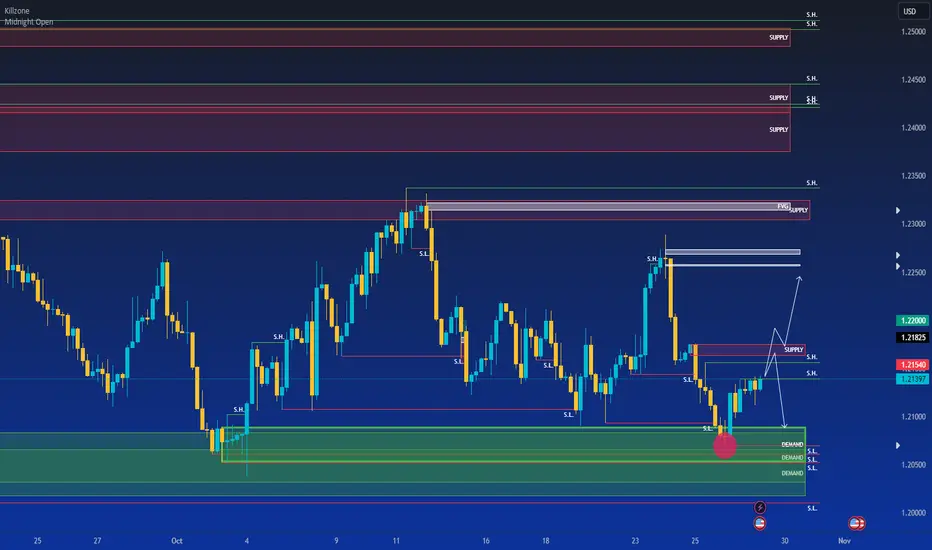

As the Pound Sterling makes a sharp recovery from 1.2070, it encounters substantial resistance near the 1.2140 level. The GBP/USD pair faces challenges in maintaining its upward trajectory, with market sentiment dampened by escalating geopolitical tensions. The short-term trend remains bearish, indicated by the gradual descent of both the 20-day and 50-day Exponential Moving Averages (EMAs). A breach of Thursday's low could potentially expose the psychological support level at the key figure of 1.2000.

Significant declines in business activities, labor demand, and retail sales have been observed, largely attributed to the pressure on household budgets caused by high inflation. Inflation risks persist due to robust wage growth, casting doubts among market participants about whether UK Prime Minister Rishi Sunak can fulfill his promise to reduce headline inflation to 5.4% by the year's end.

As the Pound Sterling makes a sharp recovery from 1.2070, it encounters substantial resistance near the 1.2140 level. The GBP/USD pair faces challenges in maintaining its upward trajectory, with market sentiment dampened by escalating geopolitical tensions. The short-term trend remains bearish, indicated by the gradual descent of both the 20-day and 50-day Exponential Moving Averages (EMAs). A breach of Thursday's low could potentially expose the psychological support level at the key figure of 1.2000.

Note

The provided text is a financial market analysis for the GBP/USD currency pair. Here's a breakdown of the key points:Price Movement: GBP/USD spent most of the day trading in a narrow range near 1.2100, but later in the American trading hours, it rose to around 1.2150. This indicates a slight increase in the value of the British Pound relative to the US Dollar during the trading day.

Factors Influencing GBP/USD:

Risk Sentiment: A positive shift in risk sentiment is mentioned, which seems to be impacting the US Dollar. When risk sentiment is positive, traders may be more inclined to invest in higher-yielding and riskier assets, which can lead to a weaker US Dollar.

Week-End Flows: Week-end flows, likely related to positioning and trading activities at the end of the trading week, are also mentioned as a factor affecting the currency pair.

Technical Levels: GBP/USD remained below certain key technical levels that could act as resistance, limiting its potential for further gains.

10-Year US Treasury Bond Yield: The 10-year US Treasury bond yield, an important indicator of the US economic outlook, experienced a significant decline of more than 2%. This decline may have made it challenging for the US Dollar to strengthen.

EUR/GBP Pair: The text mentions a sharp decline in the EUR/GBP pair after the European Central Bank's monetary policy announcements. This decline suggests that the British Pound (GBP) benefited from capital outflows from the Euro, supporting GBP/USD.

Market Indices:

The UK's FTSE 100 Index is reported to be trading slightly higher during the early European session.

US stock index futures are noted to be gaining between 0.4% and 1%, indicating an improvement in risk sentiment in the US stock market.

Impact of Data Releases: The text notes the absence of high-impact data releases and suggests that market sentiment will play a crucial role in driving GBP/USD's movements leading into the weekend.

USD's Response to GDP Data: Despite positive third-quarter Gross Domestic Product (GDP) growth data for the US, the US Dollar did not strengthen. This suggests that investors holding long positions in the US Dollar might be looking for opportunities to book their profits, potentially leading to a selloff of the USD if Wall Street shows bullish action.

In summary, the analysis highlights several factors affecting GBP/USD, including risk sentiment, technical levels, bond yields, and the performance of related currency pairs. It also suggests that market sentiment and potential USD selloffs may be important drivers for GBP/USD in the near term.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.