The British economy has taken a bold and proactive stance by acknowledging the reality of a looming recession earlier than most other major economies. While many nations continue to downplay or delay recognition of economic slowdown, the UK’s honest and strategic approach positions the pound for relative strength in the near term.

🇬🇧 Why This Matters for GBPUSD

Proactive Policy Making: By admitting economic challenges early and beginning to address them, the UK has earned credibility in global markets. This forward-thinking strategy often leads to greater investor confidence.

Currency Strength Through Stability: While other currencies are facing late-cycle policy adjustments and ongoing uncertainty, the GBP is likely to benefit from this perception of stability and transparency.

Comparative Resilience: Against a backdrop of monetary hesitation elsewhere, the pound could continue to outperform—especially as traders and institutions reward clarity and decisive leadership.

💡 What Traders Should Watch

If the UK’s measured steps toward economic recovery continue while others stall or scramble, GBPUSD may show strength, particularly in risk-off periods where relative macroeconomic discipline becomes a key asset. Still, always trade with a plan—use structure, confirmation, and adapt quickly if conditions shift.

Remember: being early is sometimes the most underrated form of being right.

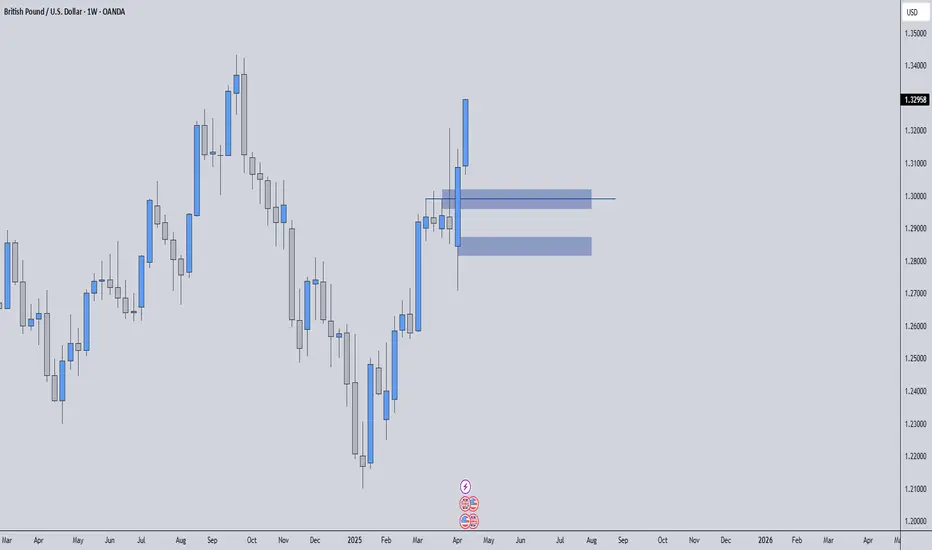

GBPUSD | Blue Boxes Mark Solid Support Zones

Following the recent strength in GBP due to the UK’s proactive economic stance, it's crucial to keep an eye on the blue boxes highlighted on the chart. These levels have acted as key support zones during recent price action, and they could continue to offer high-probability opportunities if retested.

🔵 Why These Zones Matter:

Price Memory: These areas have previously been defended by buyers, indicating strong institutional interest. If the market revisits them, it’s very likely we’ll see some kind of reaction.

Strategic Patience: Entering trades around support zones requires confirmation. Look for reversal patterns or LTF bullish signs before committing. These setups are where smart money often steps in.

Risk-Managed Entries: Waiting for price to come to you around these levels can offer great R:R trades while keeping your downside limited.

📌 The Bigger Picture:

Combine this technical structure with the UK’s relatively more realistic economic outlook, and you get a compelling setup. While other currencies may still be adjusting, GBP could remain strong—especially if these support zones continue to hold.

In uncertain macro times, solid support plus good fundamentals can make all the difference. Patience pays off, especially at these critical zones.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

🇬🇧 Why This Matters for GBPUSD

Proactive Policy Making: By admitting economic challenges early and beginning to address them, the UK has earned credibility in global markets. This forward-thinking strategy often leads to greater investor confidence.

Currency Strength Through Stability: While other currencies are facing late-cycle policy adjustments and ongoing uncertainty, the GBP is likely to benefit from this perception of stability and transparency.

Comparative Resilience: Against a backdrop of monetary hesitation elsewhere, the pound could continue to outperform—especially as traders and institutions reward clarity and decisive leadership.

💡 What Traders Should Watch

If the UK’s measured steps toward economic recovery continue while others stall or scramble, GBPUSD may show strength, particularly in risk-off periods where relative macroeconomic discipline becomes a key asset. Still, always trade with a plan—use structure, confirmation, and adapt quickly if conditions shift.

Remember: being early is sometimes the most underrated form of being right.

GBPUSD | Blue Boxes Mark Solid Support Zones

Following the recent strength in GBP due to the UK’s proactive economic stance, it's crucial to keep an eye on the blue boxes highlighted on the chart. These levels have acted as key support zones during recent price action, and they could continue to offer high-probability opportunities if retested.

🔵 Why These Zones Matter:

Price Memory: These areas have previously been defended by buyers, indicating strong institutional interest. If the market revisits them, it’s very likely we’ll see some kind of reaction.

Strategic Patience: Entering trades around support zones requires confirmation. Look for reversal patterns or LTF bullish signs before committing. These setups are where smart money often steps in.

Risk-Managed Entries: Waiting for price to come to you around these levels can offer great R:R trades while keeping your downside limited.

📌 The Bigger Picture:

Combine this technical structure with the UK’s relatively more realistic economic outlook, and you get a compelling setup. While other currencies may still be adjusting, GBP could remain strong—especially if these support zones continue to hold.

In uncertain macro times, solid support plus good fundamentals can make all the difference. Patience pays off, especially at these critical zones.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

- 🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

- 🐶 DOGEUSDT.P: Next Move

- 🎨 RENDERUSDT.P: Opportunity of the Month

- 💎 ETHUSDT.P: Where to Retrace

- 🟢 BNBUSDT.P: Potential Surge

- 📊 BTC Dominance: Reaction Zone

- 🌊 WAVESUSDT.P: Demand Zone Potential

- 🟣 UNIUSDT.P: Long-Term Trade

- 🔵 XRPUSDT.P: Entry Zones

- 🔗 LINKUSDT.P: Follow The River

- 📈 BTCUSDT.P: Two Key Demand Zones

- 🟩 POLUSDT: Bullish Momentum

- 🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

- 🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

- 🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

- 🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

- 🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

- 🤖 IQUSDT: Smart Plan

- ⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

- 💼 STMXUSDT: 2 Buying Areas

- 🐢 TURBOUSDT: Buy Zones and Buyer Presence

- 🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

- 🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

- 📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

- 🌟 FORTHUSDT: Sniper Entry +%26 Reaction

- 🐳 QKCUSDT: Sniper Entry +%57 Reaction

- 📊 BTC.D: Retest of Key Area Highly Likely

- 📊 XNOUSDT %80 Reaction with a Simple Blue Box!

- 📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

Professional Day Trader

Microstructure Practicioner

t.me/umuttrades

kick.com/umuttrades live everyday.

Microstructure Practicioner

t.me/umuttrades

kick.com/umuttrades live everyday.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Professional Day Trader

Microstructure Practicioner

t.me/umuttrades

kick.com/umuttrades live everyday.

Microstructure Practicioner

t.me/umuttrades

kick.com/umuttrades live everyday.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.