Greetings Traders!

Current Market Analysis:

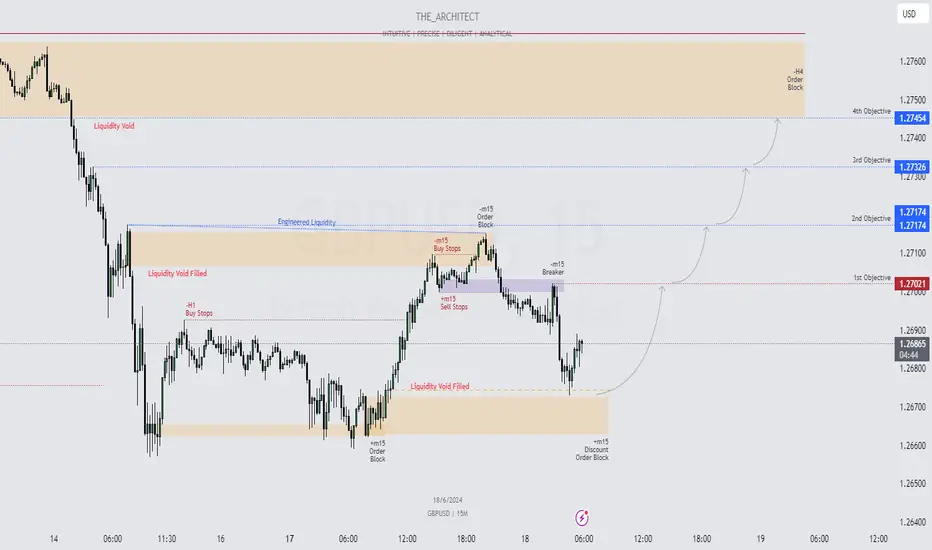

At present, I am observing bullish institutional order flow stepping into GBPUSD. The key evidence for this bullish momentum is the support provided by the bullish order block, an institutional support zone. Additionally, the price has filled the liquidity void preceding the order block, further reinforcing its strength.

Key Observations:

Trading Strategy:

Conclusion:

By understanding the current bullish institutional order flow and leveraging key support and resistance levels, we can effectively anticipate and execute bullish trades on GBPUSD. The confluence of the bullish order block, filled liquidity void, and strategic target levels supports a bullish outlook and guides our trading strategy towards taking advantage of buying opportunities in the market.

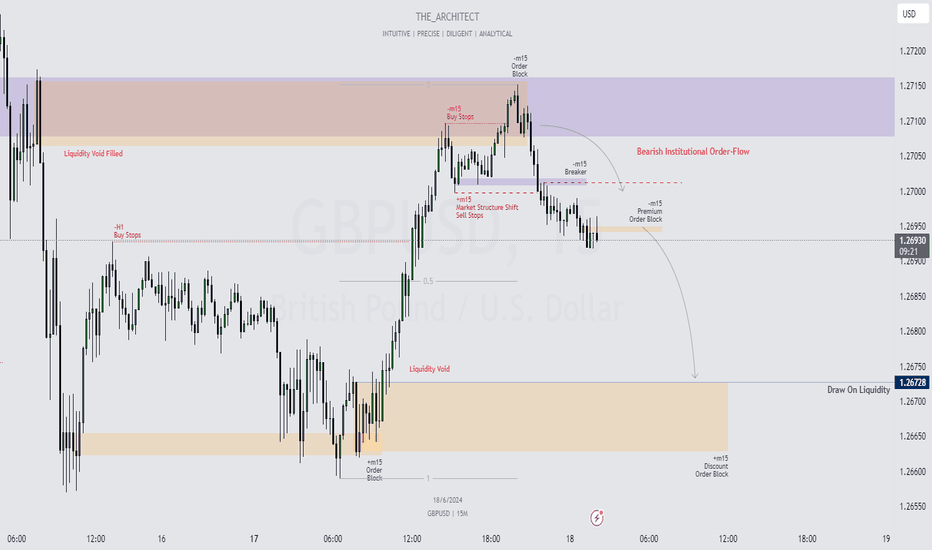

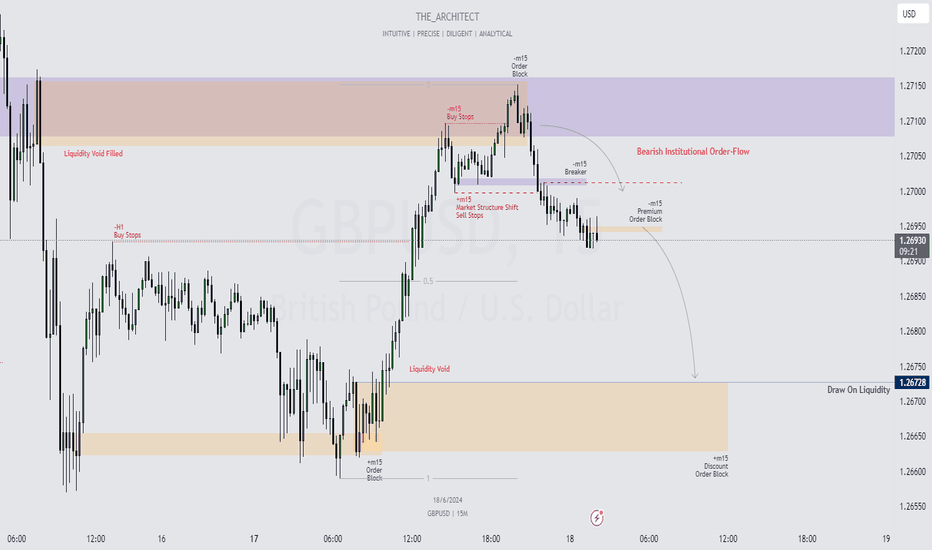

For this morning's sell-side analysis of GBPUSD, please see:

Happy Trading,

The_Architect

Current Market Analysis:

At present, I am observing bullish institutional order flow stepping into GBPUSD. The key evidence for this bullish momentum is the support provided by the bullish order block, an institutional support zone. Additionally, the price has filled the liquidity void preceding the order block, further reinforcing its strength.

Key Observations:

- Bullish Institutional Support: The bullish order block is acting as a robust support level, indicating the presence of institutional buying interest. The filled liquidity void before this order block adds to its validity and strength.

- Retest Opportunity: We may see a retest into the M15 bullish order block, where I have placed a pending order. This potential retest within the current discount price range offers a favorable environment for buying opportunities.

- Target Levels:

- Relatively Equal Highs: These present engineering liquidity, making them a prime target for bullish price action.

- H4 Bearish Order Block: The main objective is for the price to reach this level, which is a strong draw due to the liquidity void presented before it.

Trading Strategy:

- Focus on Discount Prices: As we are currently in discount prices, it is an opportune moment to look for buying opportunities. The goal is to enter at discounted levels and aim to book profits at premium prices.

- Bullish Targets: The primary targets are the relatively equal highs and ultimately the H4 bearish order block. These targets align with the draw on liquidity and offer significant profit potential.

Conclusion:

By understanding the current bullish institutional order flow and leveraging key support and resistance levels, we can effectively anticipate and execute bullish trades on GBPUSD. The confluence of the bullish order block, filled liquidity void, and strategic target levels supports a bullish outlook and guides our trading strategy towards taking advantage of buying opportunities in the market.

For this morning's sell-side analysis of GBPUSD, please see:

Happy Trading,

The_Architect

Trade active

Trade active

Greetings Traders!I am seeing a continuation of price towards the last objective as per the analysis. We are currently being supported by a H4 mitigation block which is aligned with a h1 bullish order block. This confluence is aligning with the idea of seeing price continue towards the upside.

If price takes the h1 sell stops I will continue to look for a confirmation entry to push price to the upside.

Refer:

Happy Trading,

The_Architect

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.