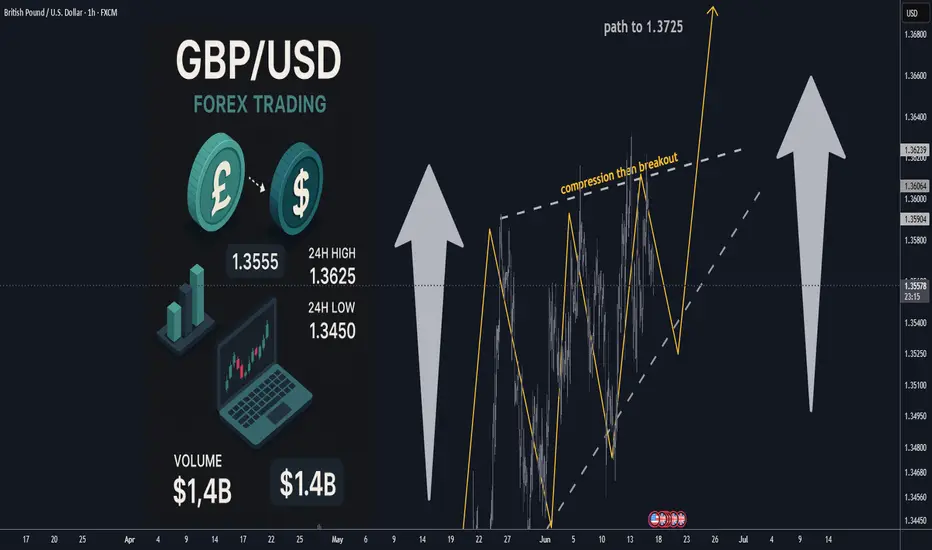

🏆 GBPUSD Market Update

📊 Technical Outlook

Short-term: BULLS active; resistance forming mid‑1.3600s, consolidation below 1.3600s

Mid-term: Neutral to slight bullish bias; bulls seek 1.3600–1.3700/1.3730 zone

Status: Narrow trading range (tight band) ahead of key UK CPI, Fed & BoE meetings

🔥 Latest Forex Updates

GBP/USD is consolidating in a narrow range around the mid‑1.3500s ahead of this week’s UK CPI and central bank meetings.

The pair holds defensive below 1.3600, with dovish BoE bets capping gains while the Fed is expected to stand pat.

GBP/USD sits near a 40‑month high (~1.3600), boosted by geopolitical risk tone, but lacking momentum to break much higher.

GBP/USD hit ~1.3600 after rebounding from 1.3515 amid renewed Middle East tensions and a weaker US dollar.

Live charts show a mild bullish tilt, awaiting central bank outcomes.

💡 Trade Recommendation

Buy GBPUSD at 1.3530 (recommended entry near 1.3530)

Take Profit at 1.3730 → +200 pips profit target

Stop Loss: 50 pips (around 1.3480)

This trade aligns with the current structure: shallow dip followed by rebound, positioning ahead of central bank catalysts. Momentum above resistance could propel GBP/USD toward 1.3730.

📌 Market Overview

Metric Details

Current Price ~1.3565–1.3600

24H Range 1.3515–1.3600

Central Event Risks UK CPI (Wed), US Retail Sales & Fed (Wed), BoE (Thu)

Geopolitical Middle East tension supports USD weakness, aiding GBP

📈 Forecast Highlights

Support Levels: ~1.3530 (100‑period SMA), ~1.3460, ~1.3425

Resistance Levels: 1.3600, 1.3630 static ceiling, followed by ~1.3700–1.3730 for bulls

🧭 Final Take

GBP/USD sits in a tight range, awaiting central bank clarity. The recommended long trade at 1.3530 aims to capitalize on upside momentum toward 1.3730, supported by technical confluence and a softer USD. Manage risk with a 50‑pip stop loss.

📊 Technical Outlook

Short-term: BULLS active; resistance forming mid‑1.3600s, consolidation below 1.3600s

Mid-term: Neutral to slight bullish bias; bulls seek 1.3600–1.3700/1.3730 zone

Status: Narrow trading range (tight band) ahead of key UK CPI, Fed & BoE meetings

🔥 Latest Forex Updates

GBP/USD is consolidating in a narrow range around the mid‑1.3500s ahead of this week’s UK CPI and central bank meetings.

The pair holds defensive below 1.3600, with dovish BoE bets capping gains while the Fed is expected to stand pat.

GBP/USD sits near a 40‑month high (~1.3600), boosted by geopolitical risk tone, but lacking momentum to break much higher.

GBP/USD hit ~1.3600 after rebounding from 1.3515 amid renewed Middle East tensions and a weaker US dollar.

Live charts show a mild bullish tilt, awaiting central bank outcomes.

💡 Trade Recommendation

Buy GBPUSD at 1.3530 (recommended entry near 1.3530)

Take Profit at 1.3730 → +200 pips profit target

Stop Loss: 50 pips (around 1.3480)

This trade aligns with the current structure: shallow dip followed by rebound, positioning ahead of central bank catalysts. Momentum above resistance could propel GBP/USD toward 1.3730.

📌 Market Overview

Metric Details

Current Price ~1.3565–1.3600

24H Range 1.3515–1.3600

Central Event Risks UK CPI (Wed), US Retail Sales & Fed (Wed), BoE (Thu)

Geopolitical Middle East tension supports USD weakness, aiding GBP

📈 Forecast Highlights

Support Levels: ~1.3530 (100‑period SMA), ~1.3460, ~1.3425

Resistance Levels: 1.3600, 1.3630 static ceiling, followed by ~1.3700–1.3730 for bulls

🧭 Final Take

GBP/USD sits in a tight range, awaiting central bank clarity. The recommended long trade at 1.3530 aims to capitalize on upside momentum toward 1.3730, supported by technical confluence and a softer USD. Manage risk with a 50‑pip stop loss.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.