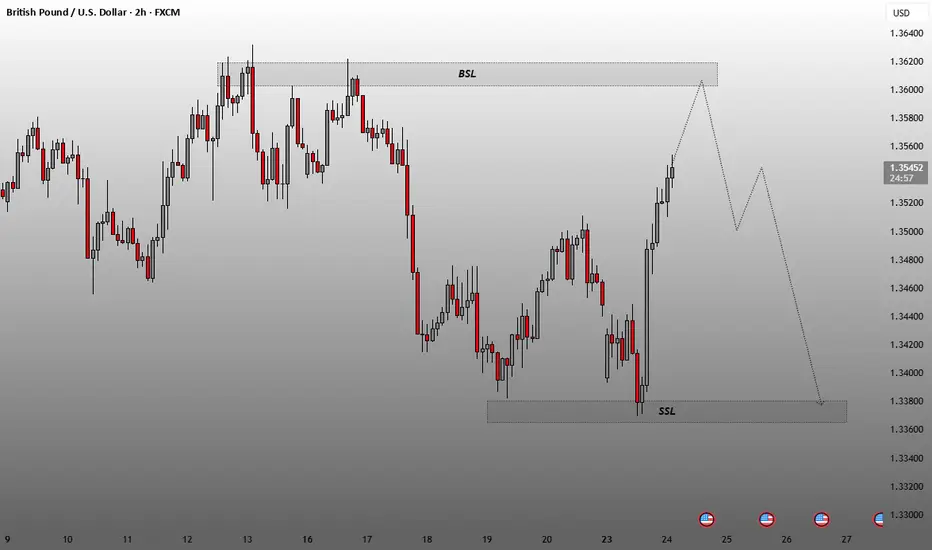

BSL (Buy-Side Liquidity):

The area above recent highs, where buy stops are likely resting.

Marked near the 1.36200–1.36400 zone.

The price is projected to sweep this area.

SSL (Sell-Side Liquidity):

The area below previous lows, where sell stops are likely resting.

Marked near the 1.33600–1.33800 zone.

Price previously swept this level before a sharp move upward.

Market Behavior Analysis:

Liquidity Sweep Pattern:

The price dipped below the SSL zone (stop-hunting weak longs).

A strong bullish move followed, aiming toward BSL.

The projected path suggests price may tap the BSL, then reverse.

Bearish Outlook Post-Liquidity Grab:

After hitting BSL (liquidity sweep), price is expected to reverse.

A potential bearish swing may take price back to SSL or lower.

Likely Strategy Indicated:

Short Setup After Liquidity Sweep:

Wait for confirmation (e.g., bearish engulfing or break of structure).

Entry near 1.36200 zone with target near SSL (1.33600 zone).

The area above recent highs, where buy stops are likely resting.

Marked near the 1.36200–1.36400 zone.

The price is projected to sweep this area.

SSL (Sell-Side Liquidity):

The area below previous lows, where sell stops are likely resting.

Marked near the 1.33600–1.33800 zone.

Price previously swept this level before a sharp move upward.

Market Behavior Analysis:

Liquidity Sweep Pattern:

The price dipped below the SSL zone (stop-hunting weak longs).

A strong bullish move followed, aiming toward BSL.

The projected path suggests price may tap the BSL, then reverse.

Bearish Outlook Post-Liquidity Grab:

After hitting BSL (liquidity sweep), price is expected to reverse.

A potential bearish swing may take price back to SSL or lower.

Likely Strategy Indicated:

Short Setup After Liquidity Sweep:

Wait for confirmation (e.g., bearish engulfing or break of structure).

Entry near 1.36200 zone with target near SSL (1.33600 zone).

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.