Market initially based around the PZ and in my plan yesterday I said it could be an opportunity to look for longs but instead in the group, called for a short as the DBZ held and also price was at a key Fib level during European session and it worked well for an 80 pip move down to the buy level. But yes, despite saying that price can revisit the wick of the long candle, I was not expecting a new low to be made.

If you see the movement of GBPUSD with indices, you can see how dollar strengthen as indices weaken yesterday. And so, DXY, which I said though it made an ugly bearish reversal candle, it sold off to a double support and yesterday, it totally rebounded, making new highs.

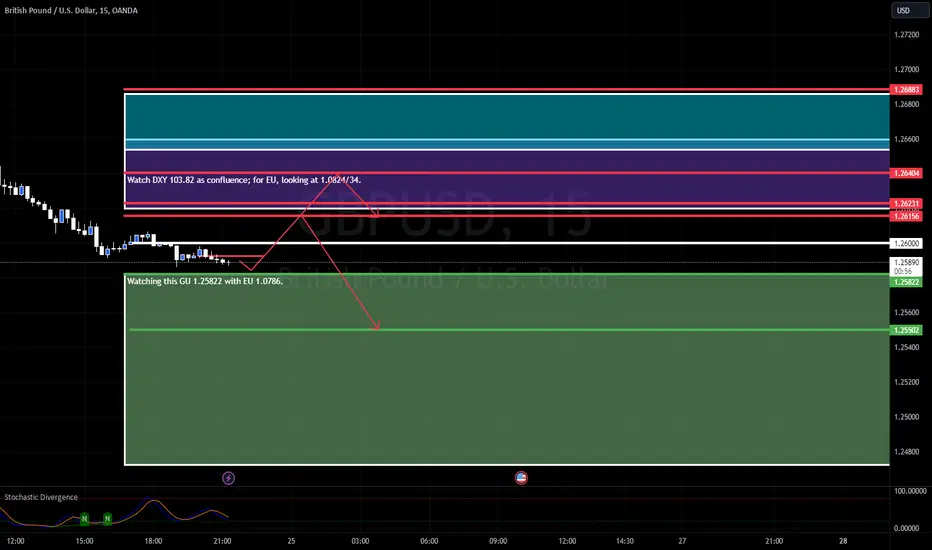

From the chart, we can see price is near the MBZ, while at the same time, DXY is nearing a key double resistance at 104.2 or so. Yesterday's price action is very bearish, and price are below the PZ, DBZ and WBZ so bias is to the downside. But if I may make an educated guess on how price will move, it would say that since DXY is near the double R, I am looking for that test and a pullback (not reversal, looking at 104.20 to 103.82 then another up move probably). Thus for GBPUSD, it should mean for it to test the MBZ at 1.2580 or maybe further also, then pull back to one of the zones - 1.2616 or even 1.2640 where we will look for shorts. Look together with DXY (104.2, 103.82) and EURUSD - 1.0778 is a strong support. Will also be using my setups as confirmation.

If you see the movement of GBPUSD with indices, you can see how dollar strengthen as indices weaken yesterday. And so, DXY, which I said though it made an ugly bearish reversal candle, it sold off to a double support and yesterday, it totally rebounded, making new highs.

From the chart, we can see price is near the MBZ, while at the same time, DXY is nearing a key double resistance at 104.2 or so. Yesterday's price action is very bearish, and price are below the PZ, DBZ and WBZ so bias is to the downside. But if I may make an educated guess on how price will move, it would say that since DXY is near the double R, I am looking for that test and a pullback (not reversal, looking at 104.20 to 103.82 then another up move probably). Thus for GBPUSD, it should mean for it to test the MBZ at 1.2580 or maybe further also, then pull back to one of the zones - 1.2616 or even 1.2640 where we will look for shorts. Look together with DXY (104.2, 103.82) and EURUSD - 1.0778 is a strong support. Will also be using my setups as confirmation.

Join me for free on Patreon (patreon.com/fademeifyoucan) to receive my daily FX and indices trading plan. DM me to join my new group to learn all my trading levels and to trade together.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Join me for free on Patreon (patreon.com/fademeifyoucan) to receive my daily FX and indices trading plan. DM me to join my new group to learn all my trading levels and to trade together.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.