📊 GBPUSD – WEEKLY FORECAST

Q3 | W32 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

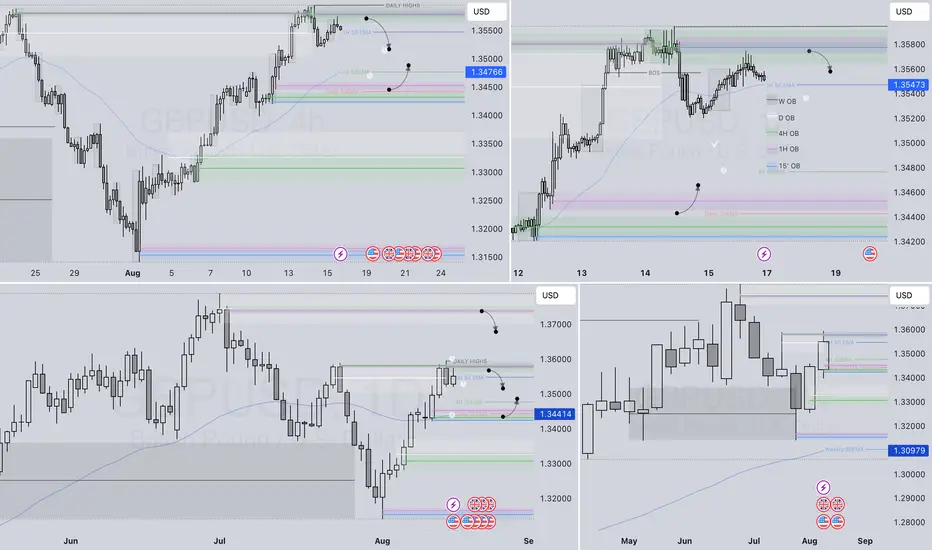

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

https://tradingview.sweetlogin.com/x/IogA6WdG/

GBPUSD

GBPUSD

Q3 | W32 | Y25

Weekly Forecast 🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

https://tradingview.sweetlogin.com/x/IogA6WdG/

Note

📈 GBPUSD – FRGNT Weekly OutlookWith price closing positively above both the weekly and daily 50 EMAs, my bias remains bullish. I

’ll primarily be looking for long positions, in line with the higher time frame trend.

🔑 Reminder: Buy from the lows, sell from the highs!

This doesn’t mean I’ll ignore short opportunities, but it does mean that my higher-probability setups are long trades, supported by higher time frame structure and trend alignment.

🔍 Week 34 – Forecast

As we enter Week 34 of Q3, I anticipate the weekly candle to open and retrace downward into our key buy-side points of interest.

During which, I’ll be watching closely for 15-minute breaks of structure to confirm a possible intra-day short — but with tight risk management, knowing that these setups are counter-trend on the higher time frame and the riskier trade.

Ultimately, I expect price to form a higher low before continuing its upward move.

🟢 Long Bias Confluence

My preferred long entries are around the daily 50 EMA, which aligns beautifully with HTF and LTF points of interest — adding strong confluence for bullish trades.

As price trends down intraday, we’ll be trading against the current lower time frame structure, so we’ll wait for:

✅ A 15-minute break of structure

✅ A pullback into a valid area of interest

Before executing a long — aiming for high-probability entries only.

📌 Summary:

✅ Higher Time Frame Bias: Bullish (Long)

⚠️ Shorts possible intraday — only with structure + strict risk

🕵️ Watch for 15’ breaks of structure to guide entries

🛡️ Longs from daily 50 EMA = high confluence setup

💬 Wishing you all a successful and disciplined trading week ahead.

– FRGNT

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.