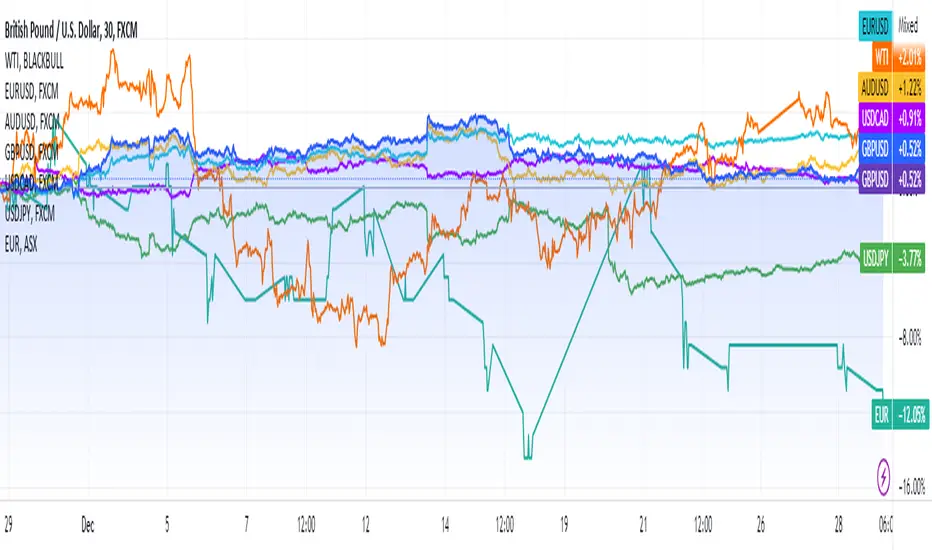

EUR/USD 🔽

GBP/USD 🔽

AUD/USD 🔼

USD/CAD 🔼

USD/JPY 🔼

XAU 🔽

WTI 🔽

Market sentiment remained subdued amidst high infection rates in China, as well as growing tensions between Serbia and Kosovo. The US 10-year Treasury bond yield then rose to a month-high of 3.885%, sending the stock market to close lower.

All three major indices dropped yesterday. There was a 365-point drop in the Dow Jones Industrial Average to 32,875, a 46-point drop in the S&P 500 to 3,783, and a 143-point slide in the Nasdaq 100 to 10,679.

Meanwhile, the greenback has strengthened against major currencies. USD/CAD added over 80 pips to 1.3608, and USD/JPY climbed to a week high of 134.49, before closing at 134.47. EUR/USD lost 30 pips to 1.0608, while GBP/USD and AUD/USD suffered minor losses at 1.2013 and 0.6736 respectively.

As a retaliation, Russia plans to impose an oil ban on those who follow the G7 price cap. However, lower demand expectations saw WTI oil futures trading lower at $78.96 a barrel. Spot gold retreated to $1,804.35 an ounce, as Bitcoin declined from $16,754.0 to $16,568.0.

GBP/USD 🔽

AUD/USD 🔼

USD/CAD 🔼

USD/JPY 🔼

XAU 🔽

WTI 🔽

Market sentiment remained subdued amidst high infection rates in China, as well as growing tensions between Serbia and Kosovo. The US 10-year Treasury bond yield then rose to a month-high of 3.885%, sending the stock market to close lower.

All three major indices dropped yesterday. There was a 365-point drop in the Dow Jones Industrial Average to 32,875, a 46-point drop in the S&P 500 to 3,783, and a 143-point slide in the Nasdaq 100 to 10,679.

Meanwhile, the greenback has strengthened against major currencies. USD/CAD added over 80 pips to 1.3608, and USD/JPY climbed to a week high of 134.49, before closing at 134.47. EUR/USD lost 30 pips to 1.0608, while GBP/USD and AUD/USD suffered minor losses at 1.2013 and 0.6736 respectively.

As a retaliation, Russia plans to impose an oil ban on those who follow the G7 price cap. However, lower demand expectations saw WTI oil futures trading lower at $78.96 a barrel. Spot gold retreated to $1,804.35 an ounce, as Bitcoin declined from $16,754.0 to $16,568.0.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.