The British Pound (GBP) is experiencing a decline following the escalation of expectations for a mild recession in the UK economy amid growing geopolitical tensions. The UK labor market appears to be feeling the consequences of the economic slowdown, and it is expected that the Bank of England will keep interest rates unchanged at 5.25% for the second consecutive time. The Pound is pushing lower towards the 1.211 level as the UK economy is anticipated to enter a mild recession.

Last Tuesday, S&P Global reported that the manufacturing PMI was at 45.2, slightly above expectations of 45.0 and the previous reading of 44.3. However, a value below 50.0 indicates a contraction in manufacturing activity. According to PMI data, manufacturing activity in the UK has been contracting for over a year. This is the longest period of manufacturing decline in the country since 2008-2009, as businesses are reducing their inventories due to a slowdown in new orders. The services PMI dropped to 49.2 in October, below expectations of 49.5 and the September reading of 49.3. The services PMI, which measures activity among service providers, has been contracting for the third consecutive month.

The UK unemployment rate decreased to 4.2% in the quarter ending in August, contrary to forecasts and the previous figure of 4.3%. Meanwhile, the US dollar rebounded on Tuesday after finding support near 105.40. Investors rushed towards the US dollar after a positive PMI reading for October. This week, investors will be paying close attention to the third-quarter Gross Domestic Product (GDP) data set to be released on Thursday. Economists expect a growth rate doubling to 4.2% compared to the previous 2.1% on an annual basis. A high growth rate in the July-September period could increase the likelihood of further restrictive measures by the Federal Reserve (Fed) in the upcoming monetary policy meeting scheduled for November 1st.

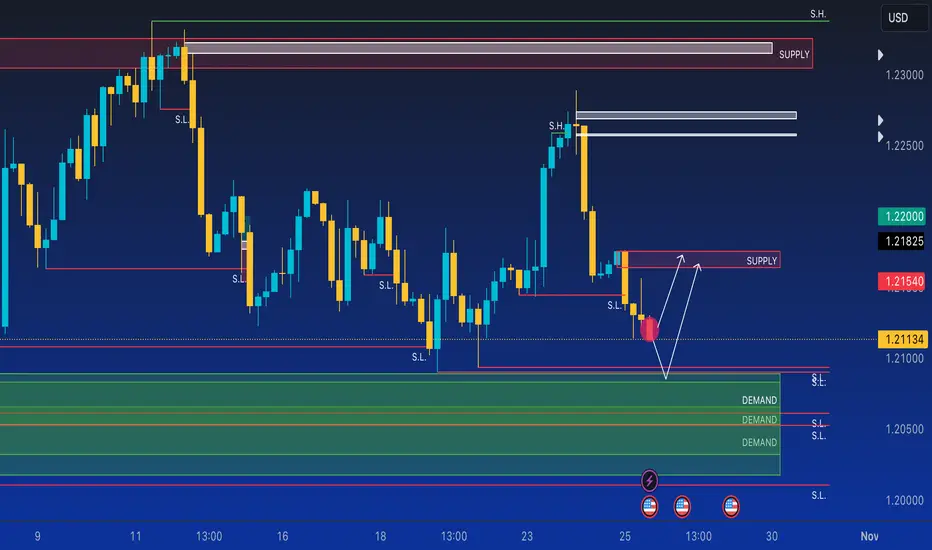

The British Pound faced strong selling pressure after a brief retracement towards the psychological resistance level of 1.2290. However, the price seems to be giving an initial bullish signal after breaking the swing low at the 1.2142 level. From this point, I expect either a bullish momentum in the Asian session and then look for an entry during the London session to ride this uptrend, or a further decline towards the 1.2088 zone where we have an H4 demand zone before the resumption. Let me know what you think. Leave a like and comment, greetings from Nicola, the CEO of Forex48 Trading Academy.

Last Tuesday, S&P Global reported that the manufacturing PMI was at 45.2, slightly above expectations of 45.0 and the previous reading of 44.3. However, a value below 50.0 indicates a contraction in manufacturing activity. According to PMI data, manufacturing activity in the UK has been contracting for over a year. This is the longest period of manufacturing decline in the country since 2008-2009, as businesses are reducing their inventories due to a slowdown in new orders. The services PMI dropped to 49.2 in October, below expectations of 49.5 and the September reading of 49.3. The services PMI, which measures activity among service providers, has been contracting for the third consecutive month.

The UK unemployment rate decreased to 4.2% in the quarter ending in August, contrary to forecasts and the previous figure of 4.3%. Meanwhile, the US dollar rebounded on Tuesday after finding support near 105.40. Investors rushed towards the US dollar after a positive PMI reading for October. This week, investors will be paying close attention to the third-quarter Gross Domestic Product (GDP) data set to be released on Thursday. Economists expect a growth rate doubling to 4.2% compared to the previous 2.1% on an annual basis. A high growth rate in the July-September period could increase the likelihood of further restrictive measures by the Federal Reserve (Fed) in the upcoming monetary policy meeting scheduled for November 1st.

The British Pound faced strong selling pressure after a brief retracement towards the psychological resistance level of 1.2290. However, the price seems to be giving an initial bullish signal after breaking the swing low at the 1.2142 level. From this point, I expect either a bullish momentum in the Asian session and then look for an entry during the London session to ride this uptrend, or a further decline towards the 1.2088 zone where we have an H4 demand zone before the resumption. Let me know what you think. Leave a like and comment, greetings from Nicola, the CEO of Forex48 Trading Academy.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.