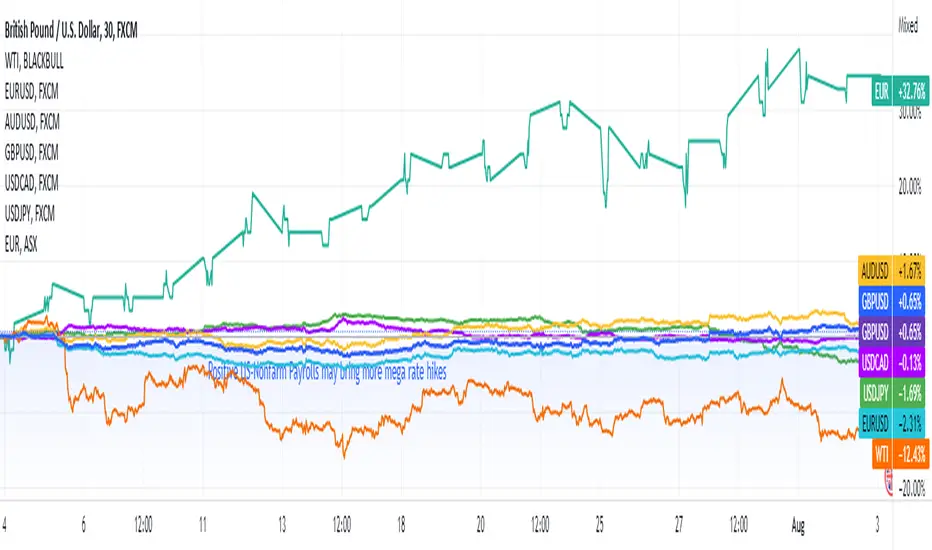

EUR/USD 🔽

GBP/USD 🔽

AUD/USD 🔽

USD/JPY 🔼

USD/CAD 🔼

XAU 🔼

WTI ▶️

Investors flocked to safe-haven assets due to building tensions between the US and China, the greenback and gold had their prices recovered, when US stocks and indices took a hit. Gold futures closed at $1,789.7 an ounce, then slid from $1,804.8 to $1772.5.

A stronger dollar rebounded against other major currencies, and EUR/USD declined to 1.0164, currently trading flat. USD/JPY rose sharply to 133.16, almost gaining 150 pips. The loonie had a choppy trading session, USD/CAD eventually gained 31 pips to 1.2875.

Meanwhile, several Federal Reserve officials have implied further rate hikes to control soaring inflation. The comments have overshadowed an imminent interest rate increase from the Bank of England on Thursday, GBP/USD was weakened to 1.2172.

Despite raising rates on Tuesday, Governor Lowe of the Reserve Bank of Australia claimed “normalizing monetary conditions… is not on a pre-set path”, the relatively dovish comment led the AUD/USD pair to fall below the 0.700 level to 0.6919, losing over 100 pips in the process.

Market estimates have the US Crude Oil Inventories decreasing by 629,000 barrels, and WTI oil futures reached a high of $96.26 a barrel before closing at $94.42 with little change.

More information on Mitrade website.

GBP/USD 🔽

AUD/USD 🔽

USD/JPY 🔼

USD/CAD 🔼

XAU 🔼

WTI ▶️

Investors flocked to safe-haven assets due to building tensions between the US and China, the greenback and gold had their prices recovered, when US stocks and indices took a hit. Gold futures closed at $1,789.7 an ounce, then slid from $1,804.8 to $1772.5.

A stronger dollar rebounded against other major currencies, and EUR/USD declined to 1.0164, currently trading flat. USD/JPY rose sharply to 133.16, almost gaining 150 pips. The loonie had a choppy trading session, USD/CAD eventually gained 31 pips to 1.2875.

Meanwhile, several Federal Reserve officials have implied further rate hikes to control soaring inflation. The comments have overshadowed an imminent interest rate increase from the Bank of England on Thursday, GBP/USD was weakened to 1.2172.

Despite raising rates on Tuesday, Governor Lowe of the Reserve Bank of Australia claimed “normalizing monetary conditions… is not on a pre-set path”, the relatively dovish comment led the AUD/USD pair to fall below the 0.700 level to 0.6919, losing over 100 pips in the process.

Market estimates have the US Crude Oil Inventories decreasing by 629,000 barrels, and WTI oil futures reached a high of $96.26 a barrel before closing at $94.42 with little change.

More information on Mitrade website.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.