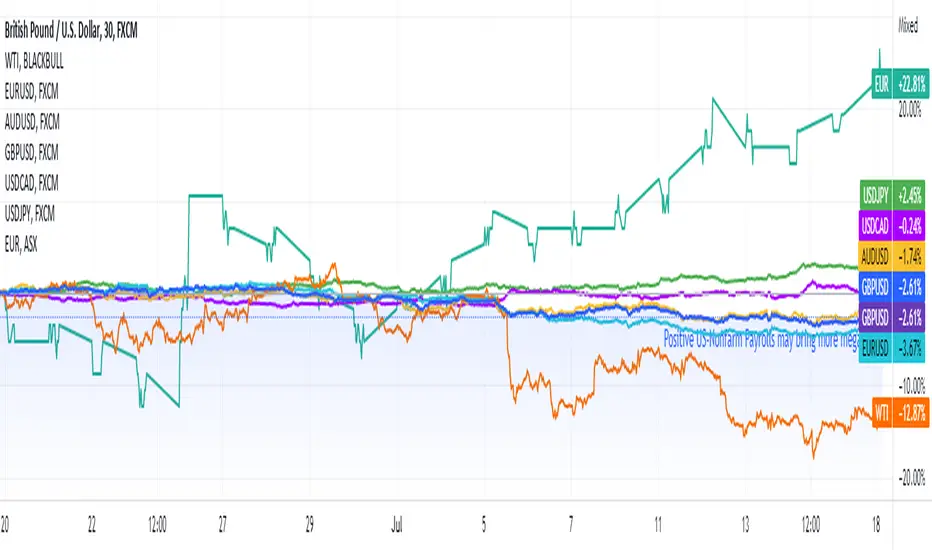

EUR/USD 🔼

GBP/USD 🔼

AUD/USD 🔼

USD/CAD 🔽

XAU 🔽

WTI 🔽

This week, investors expect a 25 basis point rate hike from the European Central Bank (ECB) on Thursday, which remains the most dovish despite being most affected by the Russian invasion of Ukraine. Uncertainties also surrounded the scheduled resumption of Nord Stream 1's gas supply from Russia, still EUR/USD managed to lose some pressure and climbed back to 1.0087, currently at 1.0114.

Other peers also reclaimed losses from the greenback last week, GBP/USD increased to 1.1852 and AUD/USD with a closing price of 0.6792. On Tuesday, the latest meeting minutes from the Reserve Bank of Australia outline the following monetary policies. The USD/CAD pair had lost over 90 pips to 1.303, with US Building Permits readings available tomorrow night.

Recession fears did not give gold futures a significant edge, the yellow metal slipped $5 to $1,703.6 an ounce. However, WTI crude oil futures declined to $94.57 a barrel, with a low of 91.84. President Biden's effort to convince Saudi Arabia to increase oil production substantially proved fruitless, though he claimed further steps are in motion to boost supply.

In the stock market, Citigroup's Q2 earnings exceed forecasts to gain 13.23%, leading the rally in the banking sector. Meanwhile, bitcoin just bounced back from 20,757 to 21,316.9.

More information on Mitrade website.

GBP/USD 🔼

AUD/USD 🔼

USD/CAD 🔽

XAU 🔽

WTI 🔽

This week, investors expect a 25 basis point rate hike from the European Central Bank (ECB) on Thursday, which remains the most dovish despite being most affected by the Russian invasion of Ukraine. Uncertainties also surrounded the scheduled resumption of Nord Stream 1's gas supply from Russia, still EUR/USD managed to lose some pressure and climbed back to 1.0087, currently at 1.0114.

Other peers also reclaimed losses from the greenback last week, GBP/USD increased to 1.1852 and AUD/USD with a closing price of 0.6792. On Tuesday, the latest meeting minutes from the Reserve Bank of Australia outline the following monetary policies. The USD/CAD pair had lost over 90 pips to 1.303, with US Building Permits readings available tomorrow night.

Recession fears did not give gold futures a significant edge, the yellow metal slipped $5 to $1,703.6 an ounce. However, WTI crude oil futures declined to $94.57 a barrel, with a low of 91.84. President Biden's effort to convince Saudi Arabia to increase oil production substantially proved fruitless, though he claimed further steps are in motion to boost supply.

In the stock market, Citigroup's Q2 earnings exceed forecasts to gain 13.23%, leading the rally in the banking sector. Meanwhile, bitcoin just bounced back from 20,757 to 21,316.9.

More information on Mitrade website.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.