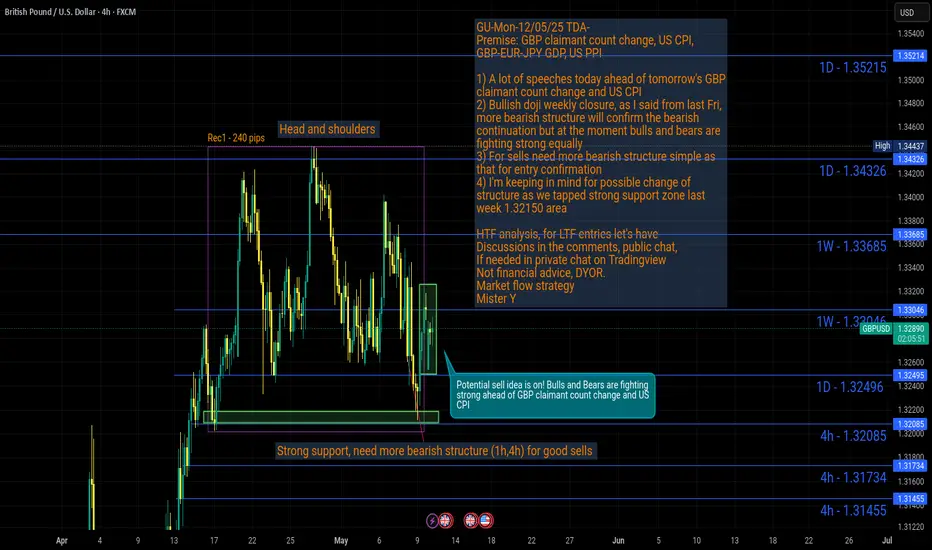

Analysis done directly on the chart

Ahead of GBP claimant count change and

US CPI I'll be cautious and lower my risks or

preserve the capital for more clarity after

the news events.

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

Ahead of GBP claimant count change and

US CPI I'll be cautious and lower my risks or

preserve the capital for more clarity after

the news events.

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

Trade active

Short sell:

Entry 1.32444

Reason catching strong bearish momentum after

flash news:

Breaking: China to lower tariffs on US goods to 10%

from 125% for 90 days (Source: financial juice)

sl 60 pips above 1h structure

tp possibly next DS 1.31020

but we have lots of 1h-4h supports along the way

as you can see on the chart

managing the trade if it starts to reject from support

and possibly reentry but at the moment looking good

Note

Update2: currently in BE position we tapped 4hS and broke through easily I don't believe price will come back soonForgot to mention 1% risk on this trade.

Trade closed manually

Post trade analysis opened on Mon:-Mistake: setting too wide tp ahead of US CPI

-Lesson learned: 3 types of tp set

1) Strong fundamental back up, wide tp (relying to push through levels)

2) Medium fundamental back up, tp to next major resistances (1h+)

3) No fundamental back up, tight tp and no holding

Always doing post trade analysis is really good and super

useful. By understanding if it was a technical problem, emotional

problem, fundamentally not understanding problem etc.

I advise you to do the same for each trade!

This was indeed a medium range tp ahead of CPI when price started to reject

the 4hS. Clever move if I secured at least 50%-80% and let the rest run to full tp.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.