📊 Technical Analysis

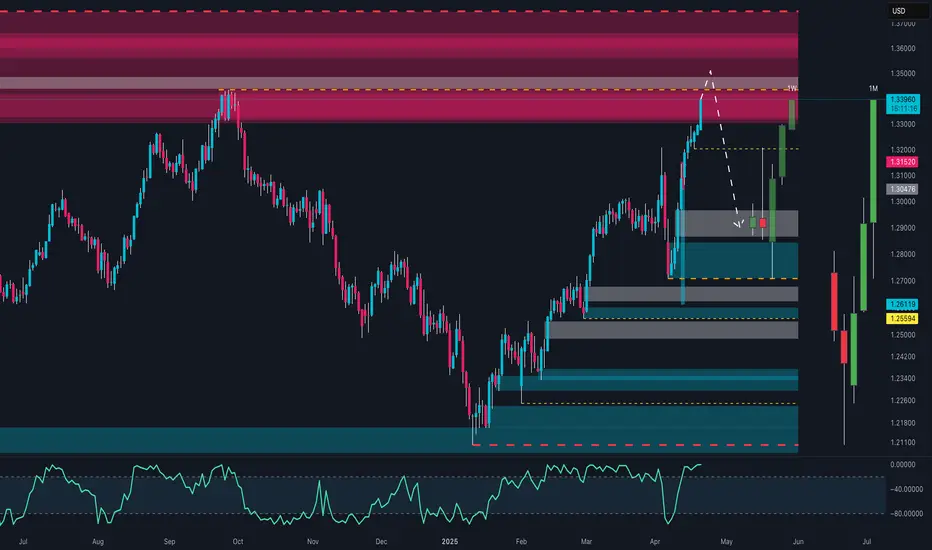

Price is currently trading in a strong weekly/monthly resistance zone around 1.3390–1.3400, marked by a dense multi-layer supply area. Historically, this level has caused sharp rejections.

From the lows, price completed a steep bullish leg, breaking through several structures. However:

Momentum seems overstretched.

RSI shows potential overbought signals.

There's a likely bearish target zone between 1.2950 and 1.2850, which is a key demand area.

📌 Trade Setup:

I’m watching for exhaustion signals or bearish confirmations on H1 to short from the current resistance, targeting the grey and turquoise zones below 1.30.

🧾 COT Report – GBP

Large Speculators (Asset Managers) still hold a net short position, although they've reduced exposure in recent months.

Leverage Funds remain slightly long, but without strong conviction.

💵 COT Report – USD

Leverage Funds have turned significantly net long on the dollar (strong green line upward since March).

This supports a bearish view on GBP/USD, as USD strength returns.

📉 Summary:

Price is at a key decision zone. A technical correction is possible. COT data supports this view:

GBP remains weak on the institutional side.

USD is regaining strength.

Price is currently trading in a strong weekly/monthly resistance zone around 1.3390–1.3400, marked by a dense multi-layer supply area. Historically, this level has caused sharp rejections.

From the lows, price completed a steep bullish leg, breaking through several structures. However:

Momentum seems overstretched.

RSI shows potential overbought signals.

There's a likely bearish target zone between 1.2950 and 1.2850, which is a key demand area.

📌 Trade Setup:

I’m watching for exhaustion signals or bearish confirmations on H1 to short from the current resistance, targeting the grey and turquoise zones below 1.30.

🧾 COT Report – GBP

Large Speculators (Asset Managers) still hold a net short position, although they've reduced exposure in recent months.

Leverage Funds remain slightly long, but without strong conviction.

💵 COT Report – USD

Leverage Funds have turned significantly net long on the dollar (strong green line upward since March).

This supports a bearish view on GBP/USD, as USD strength returns.

📉 Summary:

Price is at a key decision zone. A technical correction is possible. COT data supports this view:

GBP remains weak on the institutional side.

USD is regaining strength.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📈 Nicola | EdgeTradingJourney

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Documenting my path to $1M in prop capital through real trading, discipline, and analysis.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.