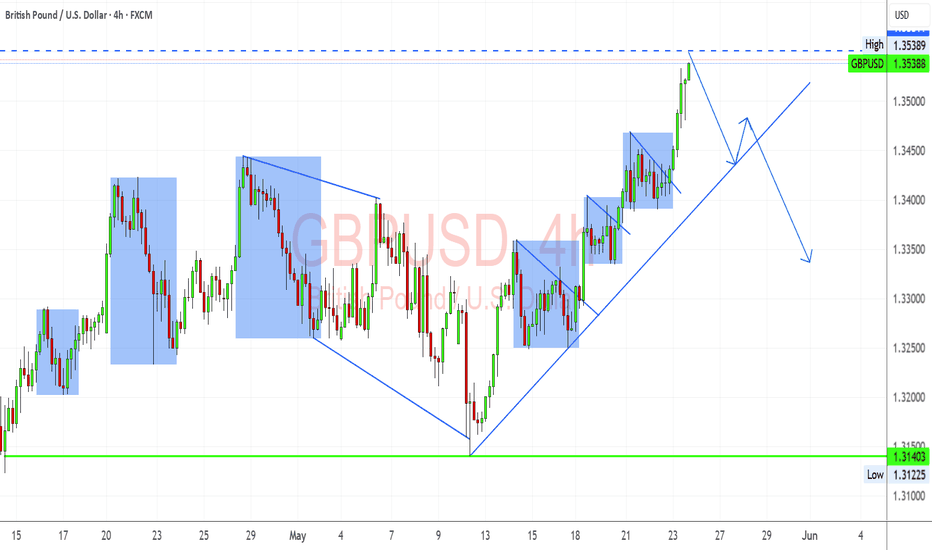

GBP/USD is trading into a key multi-week resistance zone between 1.3360 and 1.3413. The pair has failed to break this area multiple times, and current price action shows signs of compression and hesitation. With elevated UK inflation limiting BoE easing flexibility and renewed USD support following bond yield spikes, this setup offers a compelling bearish opportunity. Clean downside targets lie at 1.3177, 1.3016, and potentially 1.2890. The trade remains valid unless price breaks and holds above 1.3413.

🔍 Technical Analysis

Structure:

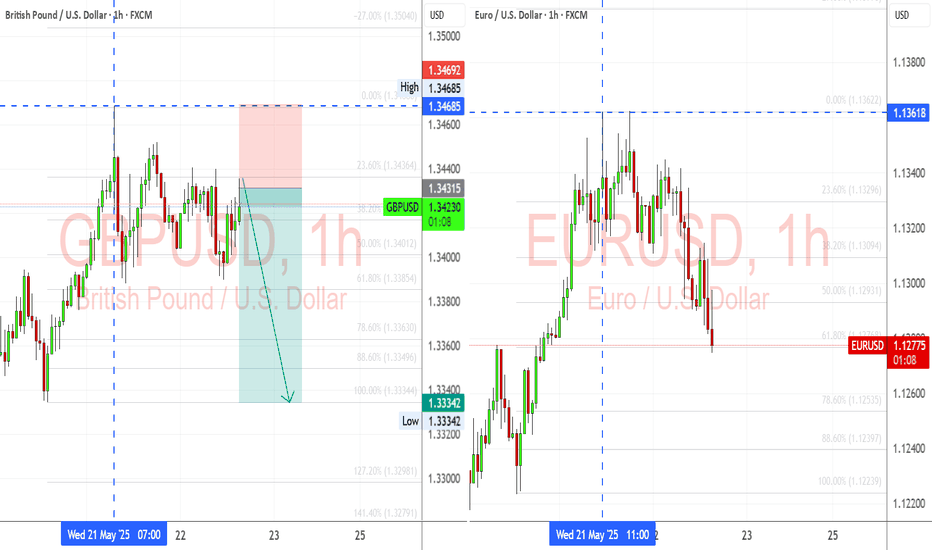

Price is testing a significant resistance zone (1.3360–1.3413) that’s held since early April.

Bearish trendline from May highs remains intact.

A descending structure is forming with lower highs and failed breakouts.

Support Levels to Watch:

1.3177 – Previous structure low

1.3016 – Strong horizontal support

1.2890 – March swing low and fib extension target

Confluence:

EUR/USD overlay shows rejection at similar highs, reinforcing risk-off dollar strength

Price failing to hold above fib retracement levels from prior swings

🌍 Fundamental Context

🇬🇧 British Pound (GBP):

UK inflation is climbing again (expected 3.0% CPI for April), delaying BoE's ability to cut further.

BoE’s Pill has pushed back on rapid easing, citing persistent service inflation.

UK-EU trade agreement provides medium-term support, but short-term upside appears priced in.

🇺🇸 U.S. Dollar (USD):

Despite Moody’s downgrade, U.S. yields are rising, supporting USD demand.

Trump’s tariff threats have injected global risk-off tones, lifting the dollar as a safe haven.

Fed remains cautious — no rate cuts expected soon.

🎯 Trade Setup

Bias: Bearish

Entry Zone: Near 1.3360–1.3413 resistance (wait for rejection candle confirmation)

Targets:

First: 1.3177

Second: 1.3016

Third: 1.2890

Invalidation: A daily close above 1.3413 would invalidate the bearish thesis

⚠️ Risk & Management Tips

Don’t short blindly into resistance — wait for strong wick or bearish engulfing candle.

Watch upcoming UK inflation data or Fed commentary for macro triggers.

Avoid over-leveraging: false breakouts near highs are common.

🧭 Conclusion

GBP/USD is coiling near a powerful resistance area. A confirmed rejection opens the door for a multi-leg downside move into 1.30 and below. As long as price holds beneath 1.3413, the risk-reward profile favors sellers. Patience and precision are key at this stage.

🔍 Technical Analysis

Structure:

Price is testing a significant resistance zone (1.3360–1.3413) that’s held since early April.

Bearish trendline from May highs remains intact.

A descending structure is forming with lower highs and failed breakouts.

Support Levels to Watch:

1.3177 – Previous structure low

1.3016 – Strong horizontal support

1.2890 – March swing low and fib extension target

Confluence:

EUR/USD overlay shows rejection at similar highs, reinforcing risk-off dollar strength

Price failing to hold above fib retracement levels from prior swings

🌍 Fundamental Context

🇬🇧 British Pound (GBP):

UK inflation is climbing again (expected 3.0% CPI for April), delaying BoE's ability to cut further.

BoE’s Pill has pushed back on rapid easing, citing persistent service inflation.

UK-EU trade agreement provides medium-term support, but short-term upside appears priced in.

🇺🇸 U.S. Dollar (USD):

Despite Moody’s downgrade, U.S. yields are rising, supporting USD demand.

Trump’s tariff threats have injected global risk-off tones, lifting the dollar as a safe haven.

Fed remains cautious — no rate cuts expected soon.

🎯 Trade Setup

Bias: Bearish

Entry Zone: Near 1.3360–1.3413 resistance (wait for rejection candle confirmation)

Targets:

First: 1.3177

Second: 1.3016

Third: 1.2890

Invalidation: A daily close above 1.3413 would invalidate the bearish thesis

⚠️ Risk & Management Tips

Don’t short blindly into resistance — wait for strong wick or bearish engulfing candle.

Watch upcoming UK inflation data or Fed commentary for macro triggers.

Avoid over-leveraging: false breakouts near highs are common.

🧭 Conclusion

GBP/USD is coiling near a powerful resistance area. A confirmed rejection opens the door for a multi-leg downside move into 1.30 and below. As long as price holds beneath 1.3413, the risk-reward profile favors sellers. Patience and precision are key at this stage.

Note

U.S. bond yields are rising despite the downgrade — this supports USD.GBP strength is overextended from earlier UK-EU deal optimism.

UK inflation is ticking up again → BoE may delay cuts, but it’s not hawkish enough to support big GBP upside.

Moody’s downgrade & anti-USD sentiment may be fully priced in short term.

Note

CPI bounce was clear, but the pair is near resistance (1.3360–1.3410).PMI disappointment could cause reversal.

If PMIs beat expectations, GBP will likely remain strong.

If they miss, GBP could fall back quickly, especially after the CPI rally.

📊 Forex Signals | Free Daily Alerts

✅ 85% Accuracy | 1–2 Signals/Day

💰 Profitable Trades Sent Daily – No Cost

📲 Join Us on Telegram

t.me/ultreos_forex

🎯 Upgrade to VIP:

ultreosforex.com/

✅ 85% Accuracy | 1–2 Signals/Day

💰 Profitable Trades Sent Daily – No Cost

📲 Join Us on Telegram

t.me/ultreos_forex

🎯 Upgrade to VIP:

ultreosforex.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

📊 Forex Signals | Free Daily Alerts

✅ 85% Accuracy | 1–2 Signals/Day

💰 Profitable Trades Sent Daily – No Cost

📲 Join Us on Telegram

t.me/ultreos_forex

🎯 Upgrade to VIP:

ultreosforex.com/

✅ 85% Accuracy | 1–2 Signals/Day

💰 Profitable Trades Sent Daily – No Cost

📲 Join Us on Telegram

t.me/ultreos_forex

🎯 Upgrade to VIP:

ultreosforex.com/

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.