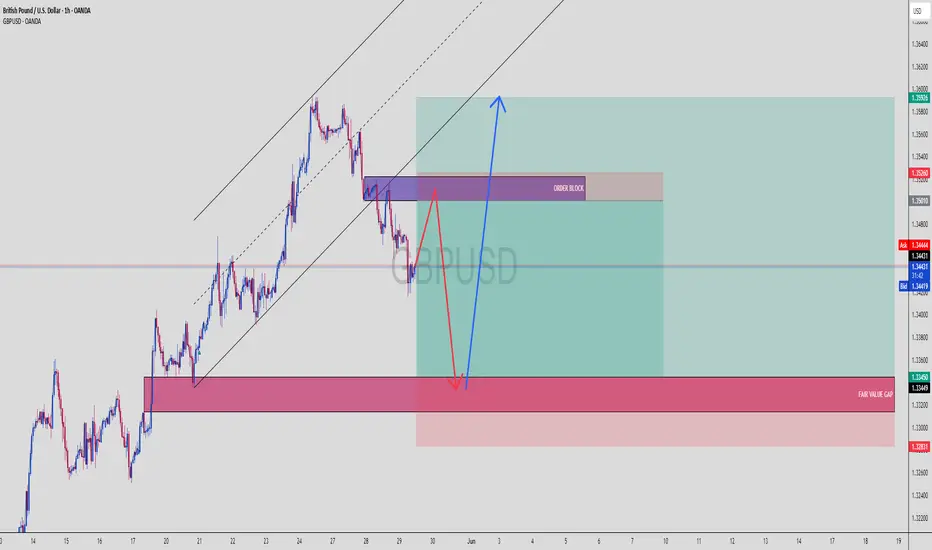

GBPUSD | Smart Money Liquidity Trap or Bullish Breakout?

Here’s a high-probability play based on Order Blocks, Fair Value Gaps, and channel structure—one of the cleanest SMC setups on cable this week.

📊 1. Market Overview

GBPUSD is currently pulling back after a sharp drop, retesting the premium zone Order Block on the H1 timeframe.

Structure remains bullish inside the ascending channel, but there’s major indecision here—will it break above the OB, or retrace deeper into the Fair Value Gap zone?

🧠 2. Dual Bias Logic

You’ve mapped out two valid SMC scenarios (marked in red & blue arrows):

🔻 Scenario 1: Bearish Trap + Deep Liquidity Grab

Price reacts from the Order Block (purple zone)

Rejects and breaks down into the Fair Value Gap (FVG) zone near 1.33300

Targets liquidity resting below prior structure

🔺 Scenario 2: Order Block Respect + Long Continuation

OB holds, price flips bullish

Pushes above 1.35260 for bullish continuation

Final target near channel top @ 1.35920–1.36000 zone

Both scenarios are textbook Smart Money setups — based on how price reacts at this OB, we’ll get the direction.

🧱 3. Key Zones

🔵 Order Block: 1.3445 – 1.3526

🔴 Fair Value Gap (FVG): 1.3330 – 1.3283

🟢 Target (Bullish): 1.3600

🔻 Target (Bearish): 1.3280

⚖️ 4. Risk-Reward Potential

Whether you go long from the FVG or short from the OB, both have:

✅ Clean entries

✅ Clear invalidation zones

✅ Strong RRR potential (1:3 to 1:4+)

📌 5. Watchlist Note

💡 If price taps into the OB and shows weak momentum, prepare for shorts targeting the FVG

💡 If it holds the OB cleanly with bullish engulfing or BOS (break of structure), ride the long back to channel highs

💬 Call to Action:

📈 Add GBPUSD to your SMC sniper list this week

💬 Comment “OB or FVG? 🤔” if you're waiting to catch the bounce

📌 Save this post for Smart Money reference setups

Here’s a high-probability play based on Order Blocks, Fair Value Gaps, and channel structure—one of the cleanest SMC setups on cable this week.

📊 1. Market Overview

GBPUSD is currently pulling back after a sharp drop, retesting the premium zone Order Block on the H1 timeframe.

Structure remains bullish inside the ascending channel, but there’s major indecision here—will it break above the OB, or retrace deeper into the Fair Value Gap zone?

🧠 2. Dual Bias Logic

You’ve mapped out two valid SMC scenarios (marked in red & blue arrows):

🔻 Scenario 1: Bearish Trap + Deep Liquidity Grab

Price reacts from the Order Block (purple zone)

Rejects and breaks down into the Fair Value Gap (FVG) zone near 1.33300

Targets liquidity resting below prior structure

🔺 Scenario 2: Order Block Respect + Long Continuation

OB holds, price flips bullish

Pushes above 1.35260 for bullish continuation

Final target near channel top @ 1.35920–1.36000 zone

Both scenarios are textbook Smart Money setups — based on how price reacts at this OB, we’ll get the direction.

🧱 3. Key Zones

🔵 Order Block: 1.3445 – 1.3526

🔴 Fair Value Gap (FVG): 1.3330 – 1.3283

🟢 Target (Bullish): 1.3600

🔻 Target (Bearish): 1.3280

⚖️ 4. Risk-Reward Potential

Whether you go long from the FVG or short from the OB, both have:

✅ Clean entries

✅ Clear invalidation zones

✅ Strong RRR potential (1:3 to 1:4+)

📌 5. Watchlist Note

💡 If price taps into the OB and shows weak momentum, prepare for shorts targeting the FVG

💡 If it holds the OB cleanly with bullish engulfing or BOS (break of structure), ride the long back to channel highs

💬 Call to Action:

📈 Add GBPUSD to your SMC sniper list this week

💬 Comment “OB or FVG? 🤔” if you're waiting to catch the bounce

📌 Save this post for Smart Money reference setups

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.