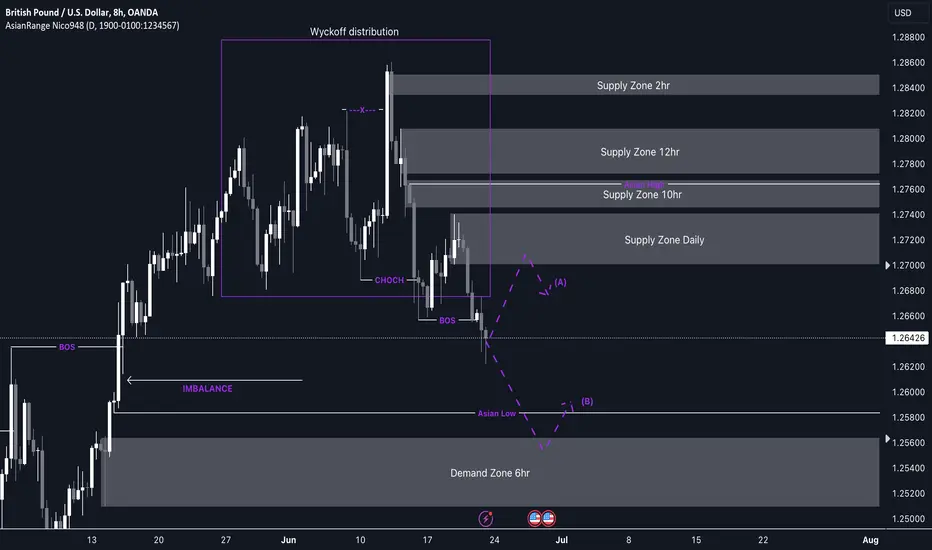

My analysis for GU is bearish, and I am currently waiting for a pullback into a daily supply zone to look for shorting opportunities. Once the price taps into my point of interest (POI), I will look for a lower time frame (LTF) Wyckoff schematic to take the price down.

With the dollar looking bullish, this analysis aligns well. Additionally, this is a pro-trend trade, as recent price action has shown lower lows and lower highs. If the price creates a new break of structure (BOS), we may see a new supply zone, which I will be monitoring closely.

Confluences for GU sells are as follow:

- Price broke structure to the downside on the higher time frame

- Daily supply level left unmitigated thats now become our POI.

- Lots of liquidity left to the downside as well as an imbalance

- DXY is also correlating and supporting this idea as the dollar is looking bullish right now.

- Lots of bearish pressure which means the correction is pending back up.

P.S. If the price continues to drop and enters the 6-hour demand zone, I will look for buying opportunities back up to a nearby supply zone. It's important to stay adaptable based on what the market presents.

With the dollar looking bullish, this analysis aligns well. Additionally, this is a pro-trend trade, as recent price action has shown lower lows and lower highs. If the price creates a new break of structure (BOS), we may see a new supply zone, which I will be monitoring closely.

Confluences for GU sells are as follow:

- Price broke structure to the downside on the higher time frame

- Daily supply level left unmitigated thats now become our POI.

- Lots of liquidity left to the downside as well as an imbalance

- DXY is also correlating and supporting this idea as the dollar is looking bullish right now.

- Lots of bearish pressure which means the correction is pending back up.

P.S. If the price continues to drop and enters the 6-hour demand zone, I will look for buying opportunities back up to a nearby supply zone. It's important to stay adaptable based on what the market presents.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.