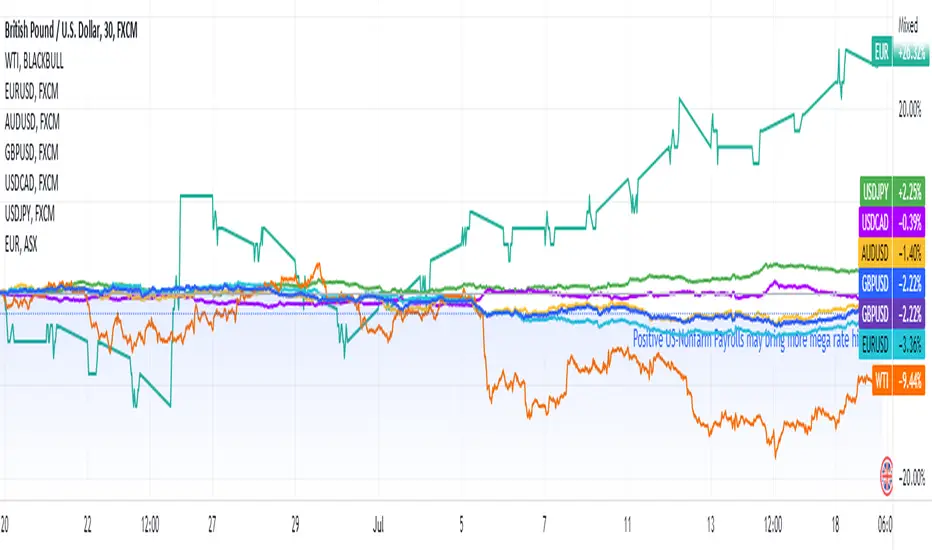

EUR/USD 🔼

GBP/USD 🔼

AUD/USD 🔼

USD/CAD 🔽

XAU 🔼

WTI 🔼

Previous comments from Federal Reserve officials have shifted market bets from a 100 bps rate hike to 75, pushing the US dollar to retreat against its peers, with the British Pound gaining 99 pips to 1.1954 towards the greenback as the leading currency pair. Later today, the UK Unemployment Rate and Average Earnings will be announced, and investors expect the latest readings to have little to no change from last month.

Forecasts for the Eurozone Consumer Price Index also stayed the same at 8.6%, still high enough to prompt a possible 25 bps interest rate increase from the European Central Bank on Thursday. Meanwhile, EUR/USD rose to 1.0141 with a week-high of 1.0193, as Bitcoin rallied over 7% to $22,300.

Fresh meeting minutes for July revealed the Reserve Bank of Australia's perspective for the 50 bps rate hike, the document addressed increased savings, a tight labor market, and overall resilience as key components for its economy to combat inflation. AUD/USD closed with minor gains at 0.6811, USD/CAD slumped to 1.2902 and rebounded to 1.2978.

Gold futures retreated from a high of $1,721.0 to $1,710.2, now trading at $1,704.8 an ounce. Though the annual maintenance is still underway, Gazprom has warned Europe that the Nord Stream 1 gas supply may not resume on time. As a result, oil prices climbed and met resistance at $99 level, finally closing at $99.42 a barrel.

More information on Mitrade website.

GBP/USD 🔼

AUD/USD 🔼

USD/CAD 🔽

XAU 🔼

WTI 🔼

Previous comments from Federal Reserve officials have shifted market bets from a 100 bps rate hike to 75, pushing the US dollar to retreat against its peers, with the British Pound gaining 99 pips to 1.1954 towards the greenback as the leading currency pair. Later today, the UK Unemployment Rate and Average Earnings will be announced, and investors expect the latest readings to have little to no change from last month.

Forecasts for the Eurozone Consumer Price Index also stayed the same at 8.6%, still high enough to prompt a possible 25 bps interest rate increase from the European Central Bank on Thursday. Meanwhile, EUR/USD rose to 1.0141 with a week-high of 1.0193, as Bitcoin rallied over 7% to $22,300.

Fresh meeting minutes for July revealed the Reserve Bank of Australia's perspective for the 50 bps rate hike, the document addressed increased savings, a tight labor market, and overall resilience as key components for its economy to combat inflation. AUD/USD closed with minor gains at 0.6811, USD/CAD slumped to 1.2902 and rebounded to 1.2978.

Gold futures retreated from a high of $1,721.0 to $1,710.2, now trading at $1,704.8 an ounce. Though the annual maintenance is still underway, Gazprom has warned Europe that the Nord Stream 1 gas supply may not resume on time. As a result, oil prices climbed and met resistance at $99 level, finally closing at $99.42 a barrel.

More information on Mitrade website.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.