Hello traders!

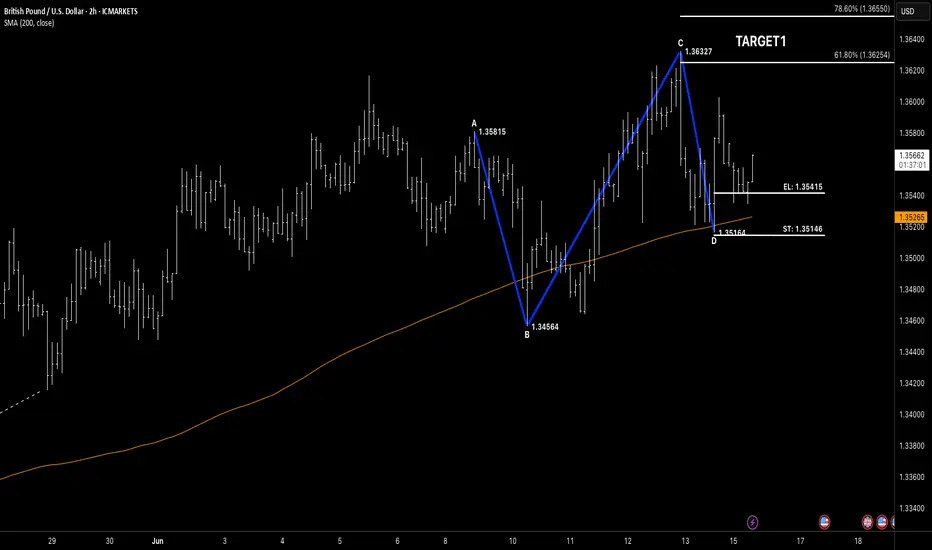

We’re tracking a clean bullish AB=CD symmetry pattern on the 2H chart of GBPUSD. After printing a mirror leg into the 1.3516 zone, price reacted off the 200 SMA and has reclaimed the short-term structure, triggering our setup.

🔹 Pattern: Bullish Symmetry (AB = CD)

🔹 Completion Zone: 1.35164

🔹 Entry Level: 1.35415

🔹 Stop: 1.35146 (tight invalidation)

🔹 Target 1: 1.36254

🔹 Target 2: 1.37407

🔹 Extended: 1.38017

If price holds above 1.354 and continues to build above the 200 SMA, we expect momentum to carry toward the 61.8% retracement and higher. This is a textbook structural reversal setup with clear symmetry, tight risk, and multi-level targets.

⚠️ As always, manage your risk. Invalidation below 1.3515 cancels the symmetry thesis.

Let’s monitor how this plays out — follow for live updates and more clean chart structures.

We’re tracking a clean bullish AB=CD symmetry pattern on the 2H chart of GBPUSD. After printing a mirror leg into the 1.3516 zone, price reacted off the 200 SMA and has reclaimed the short-term structure, triggering our setup.

🔹 Pattern: Bullish Symmetry (AB = CD)

🔹 Completion Zone: 1.35164

🔹 Entry Level: 1.35415

🔹 Stop: 1.35146 (tight invalidation)

🔹 Target 1: 1.36254

🔹 Target 2: 1.37407

🔹 Extended: 1.38017

If price holds above 1.354 and continues to build above the 200 SMA, we expect momentum to carry toward the 61.8% retracement and higher. This is a textbook structural reversal setup with clear symmetry, tight risk, and multi-level targets.

⚠️ As always, manage your risk. Invalidation below 1.3515 cancels the symmetry thesis.

Let’s monitor how this plays out — follow for live updates and more clean chart structures.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.