GBPUSD: Profit taking or a downward move?

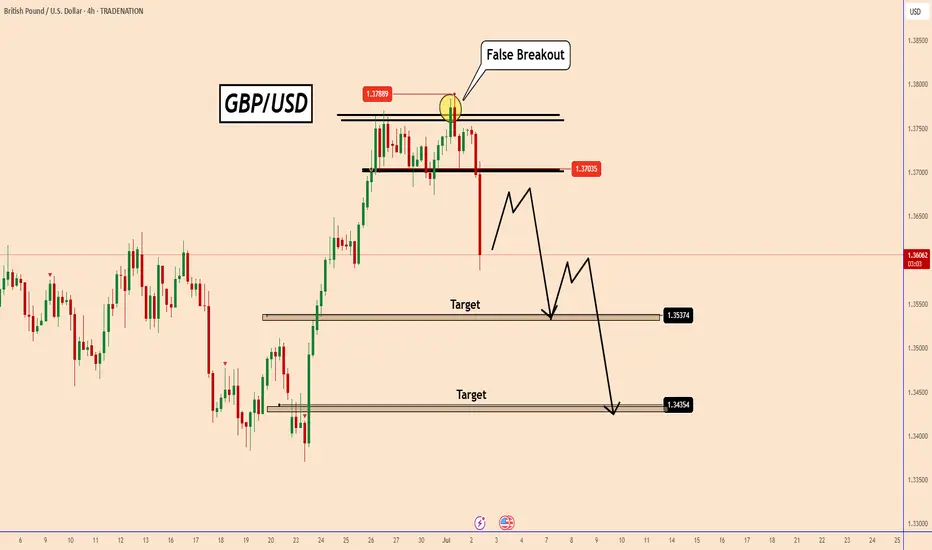

Yesterday, GBPUSD reached a new high of 1.3788, last seen in February 2022.

From the chart it can be clearly seen that GBPUSD only created a false breakout to the upside.

Market participants expected USD to weaken, but it changed direction again and locked in many long positions.

Despite the ADP data today being a real dud from expectations of 95k to -33k, we can see that GBPUSD did not stop the decline.

I think this could be related to the FED and if they think that maybe this is the time to change Interest Rates at the July meeting. It could also be a liquidity release and it could rise again, but we cannot prove this yet with the current pattern.

Technical Analysis:

As long as the price stays below 1.3680 or below this small structure, the price could fall further.

Don't forget that tomorrow we also have NFP data and the US market will be preparing for a long weekend. The 4-hour candle is strong and bearish, so let's see.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Yesterday, GBPUSD reached a new high of 1.3788, last seen in February 2022.

From the chart it can be clearly seen that GBPUSD only created a false breakout to the upside.

Market participants expected USD to weaken, but it changed direction again and locked in many long positions.

Despite the ADP data today being a real dud from expectations of 95k to -33k, we can see that GBPUSD did not stop the decline.

I think this could be related to the FED and if they think that maybe this is the time to change Interest Rates at the July meeting. It could also be a liquidity release and it could rise again, but we cannot prove this yet with the current pattern.

Technical Analysis:

As long as the price stays below 1.3680 or below this small structure, the price could fall further.

Don't forget that tomorrow we also have NFP data and the US market will be preparing for a long weekend. The 4-hour candle is strong and bearish, so let's see.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trade active

Note

GBPUSD: (UPDATE)

From our analysis that I posted yesterday after the price fell to 1.3562, we can see that the correction started as expected and reached 1.3675, which also corresponds to 50% of the move from the July 1st high of 1.3788 to 1.3675.

Today the price awaited the NFP data at 1.3675 and after the news we can see that everything is developing as expected. 80 pips down so far as the NFP data came in above expectations 145K vs. the expected 110K.

GBPUSD should fall further from this area as long as it is respecting our analysis.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

✅MY Free Signals

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

t.me/TradingPuzzles

✅Personal Telegram

t.me/KlejdiCuni

✅YouTube

youtube.com/@TradingPuzzles

✅MY Recommended Broker is TRADE NATION

🔸bit.ly/49VySJF

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.