Only 1 way to get anywhere...

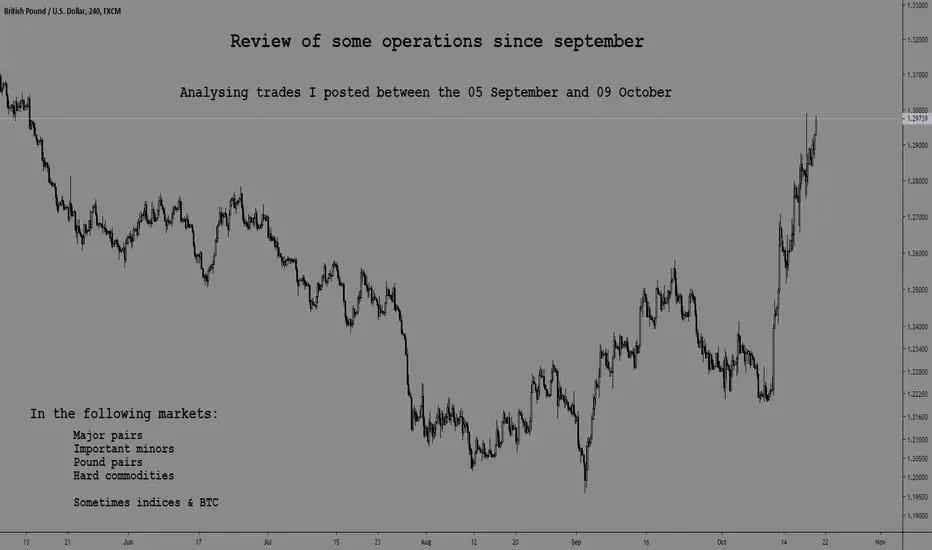

Time to look at some trades I posted, going to focus mostly on the exit. Most important part, that's when you make (or lose) money.

There are a couple of ideas marked "short/long" on 3D & W charts, these are not trades I took or intended on taking, it's a general bias idea.

Maybe I should not tag "long" and "short" so they are more easy to filter...

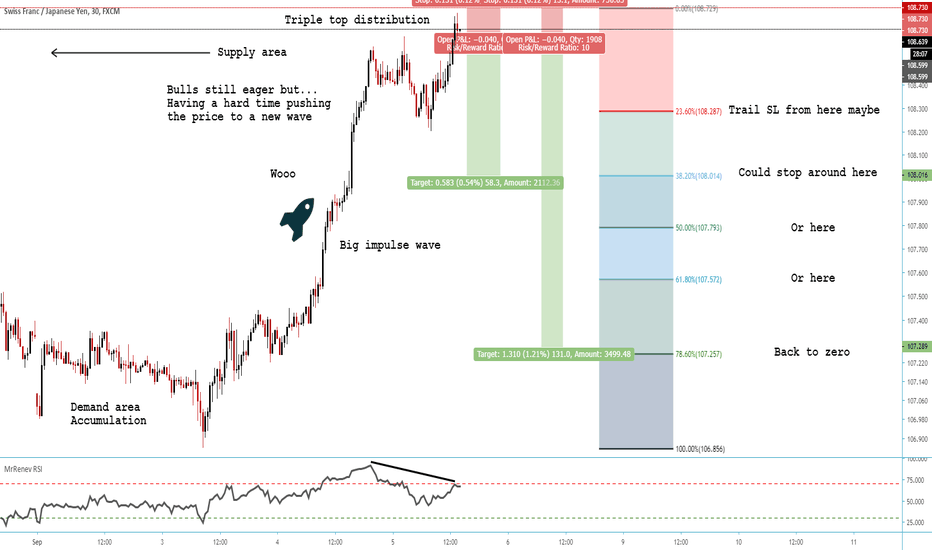

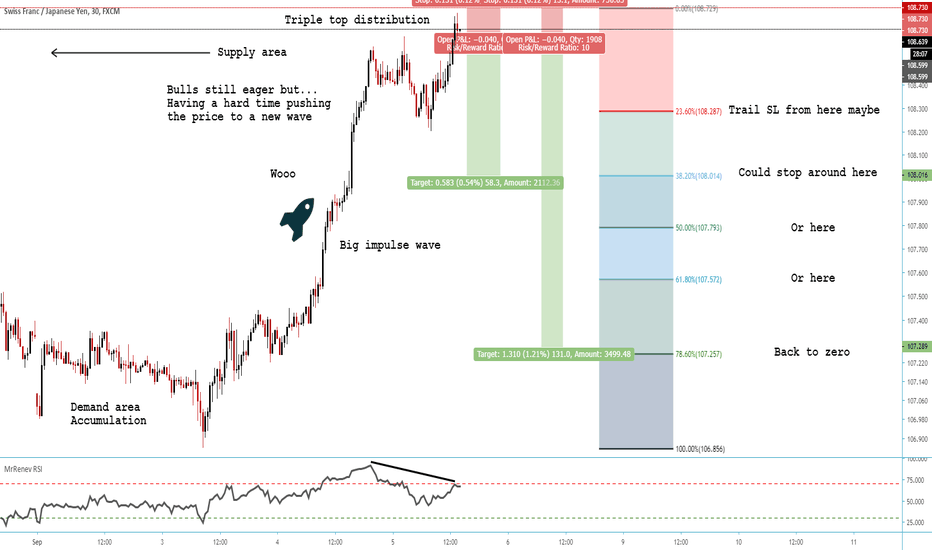

05 September: CHFJPY

Original idea:

Outcome:

A loser, and didn't miss much. Lots of buying pressure. The reversal area was correctly identified thought.

Not much to trail here...

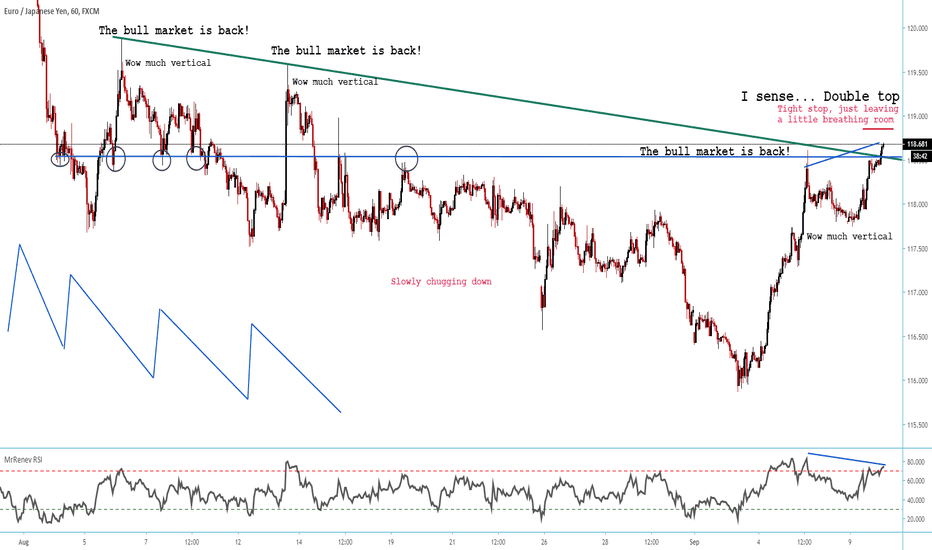

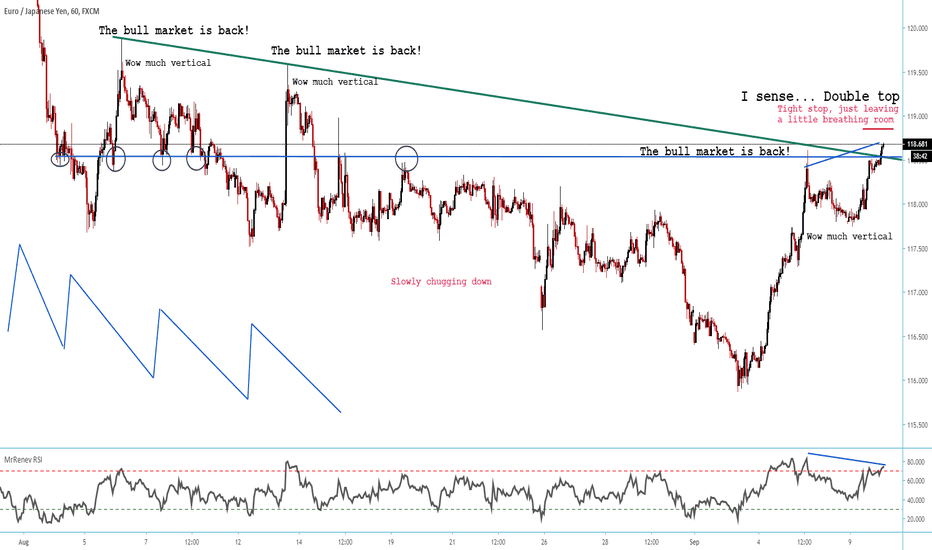

10 September: EURJPY

Original idea:

Outcome:

Kinda repeated what I did on CHFJPY...

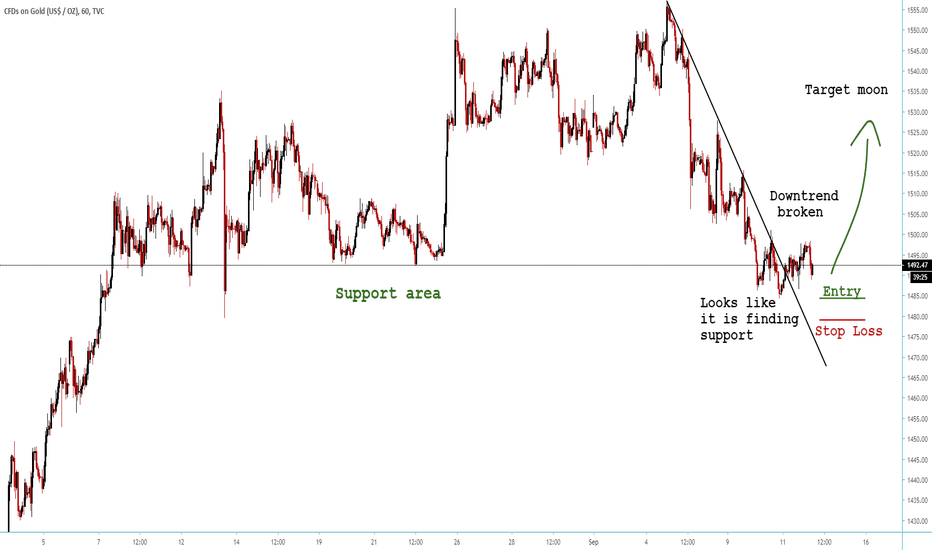

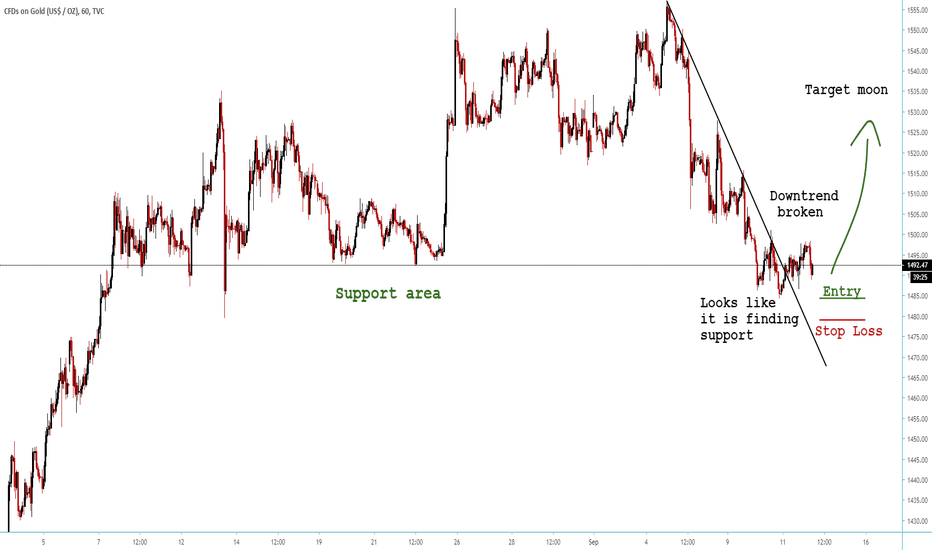

12 September: Gold

Original idea:

Had 11 losers in a row, was aiming for 12. Get ready to get big losing streaks if you go for RR of 5, 10+.

Outcome:

I am keeping it in the back of my head, but I don't think there is much to learn from that specific trade.

More generally there is something to learn, that when the recession is looking close, and there is an uptrend and great news catalysts, and on the weekly/monthly chart we broke out of accumulation and are going up; then buys are a good idea.

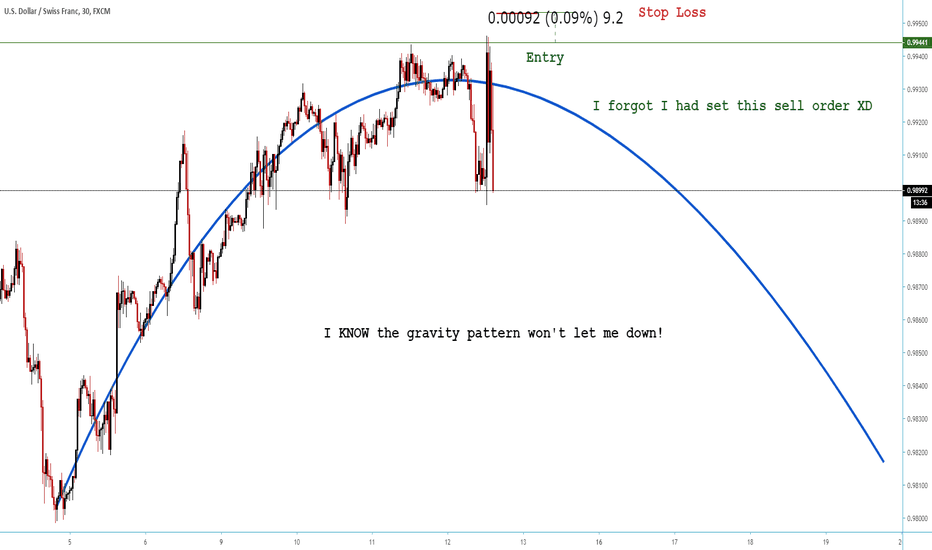

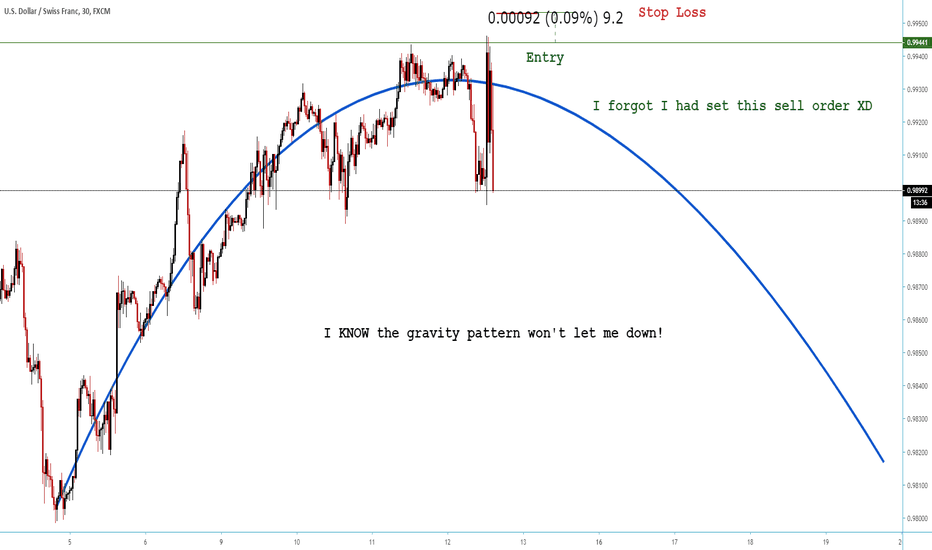

12 September: USDCHF

Original idea:

"Watch me end my losing spree live"

Normally I won't post a trade way after I entered and it went my way, but this was ending my lose spree I wanted to...

Outcome:

Conclusion: Well don't try running winners in choppy markets (if you even can trade them). Nothing much else...

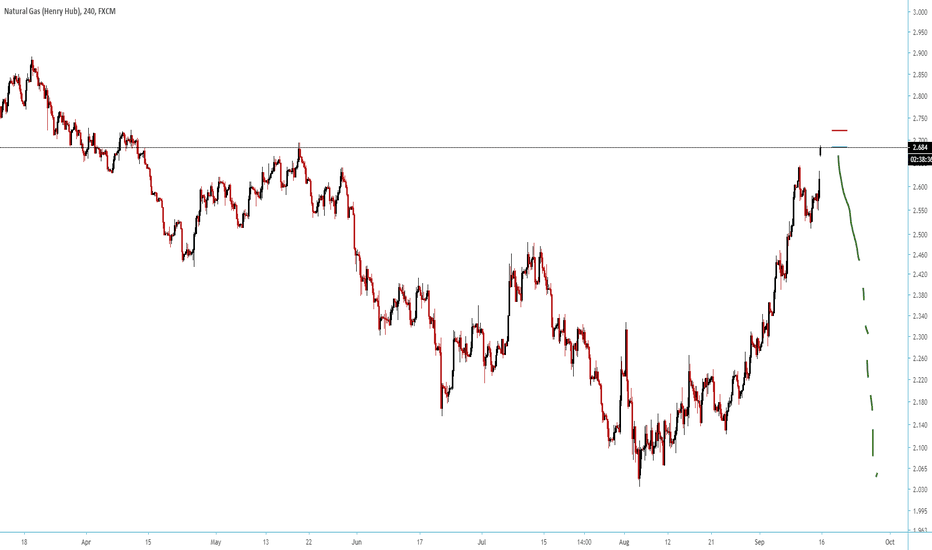

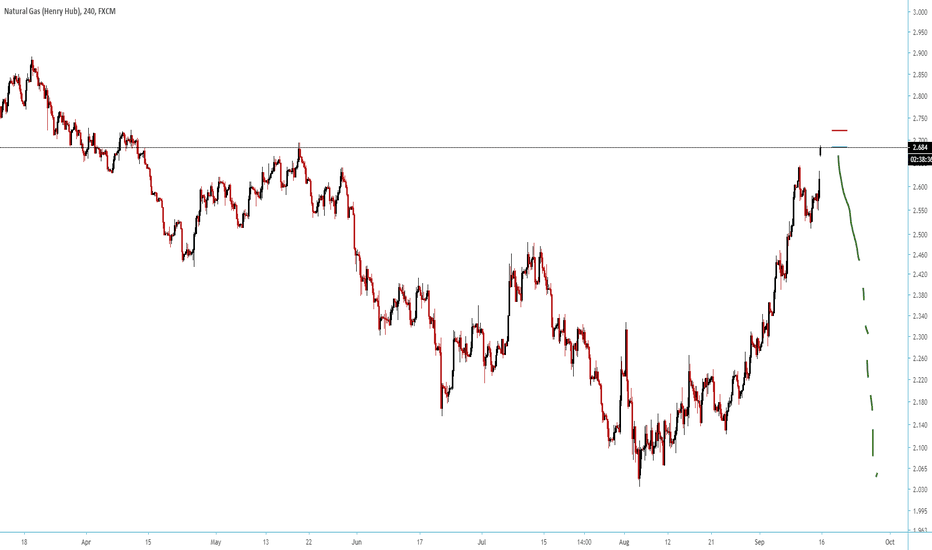

16 September: NatGas

Original idea:

Outcome: Not sure how to explain that one without swearing. I'll use a little monkey emoji instead.

Need to look at Oil:

Of course in this case, EMAs cannot be used to trail... It makes no sense...

It did not go much higher and went way down. I can't see H4 & H1. Probably would end up a 5R to 10R.

There is alot of fear and uncertainty in these events, possible price just has some wild sudden moves in 1 direction.

So ye, no opportunity for a very large winner, but still a great 5R in 5 days with what I think are high odds.

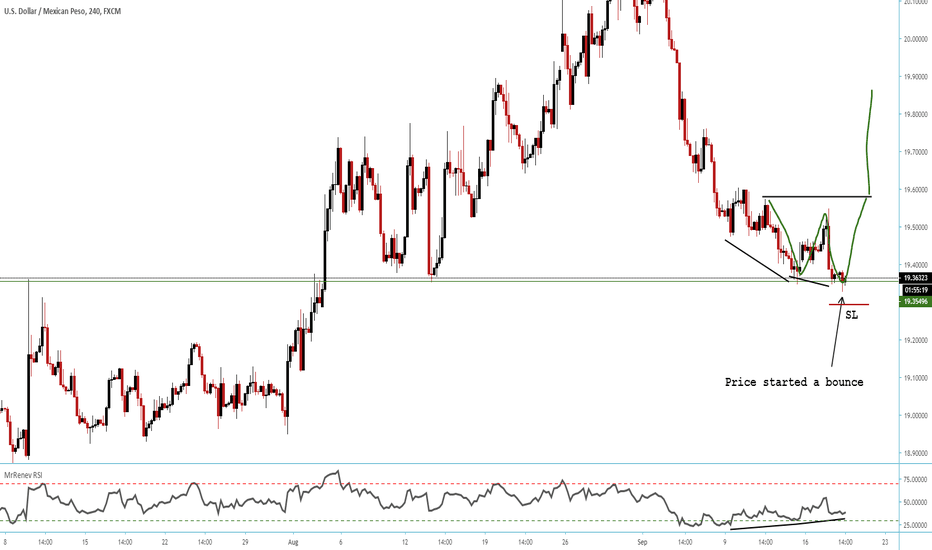

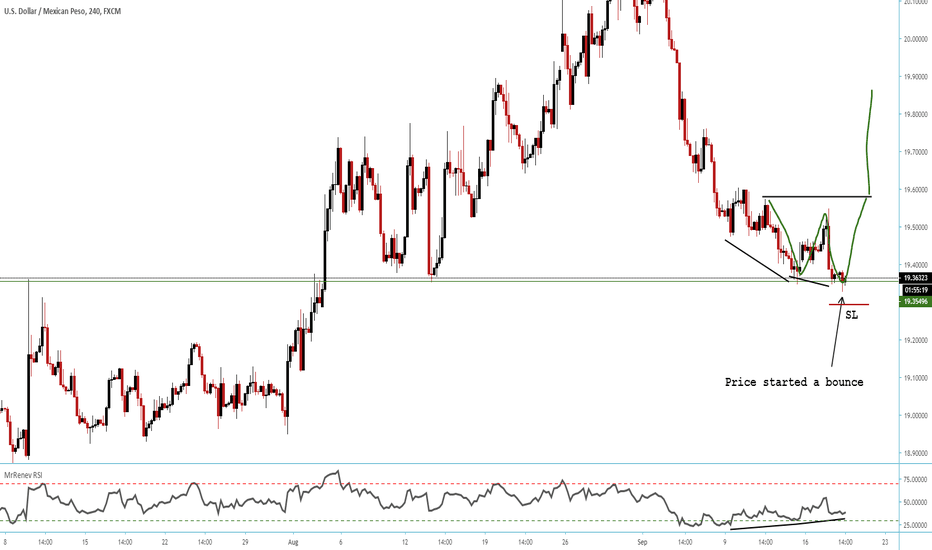

18 September: USDMXN

Original idea:

Outcome:

I got kicked out early, as price was retracing alot several times before the rising wedge broke bullish.

Only got 1R out...

If I waited for 3 or 4 R before trailing my stop I'd catch the move.

Was hard to stay in this one I find, but maybe I should risk it, and wait for at least 3-4 R before trailing my stop.

Usually I do...

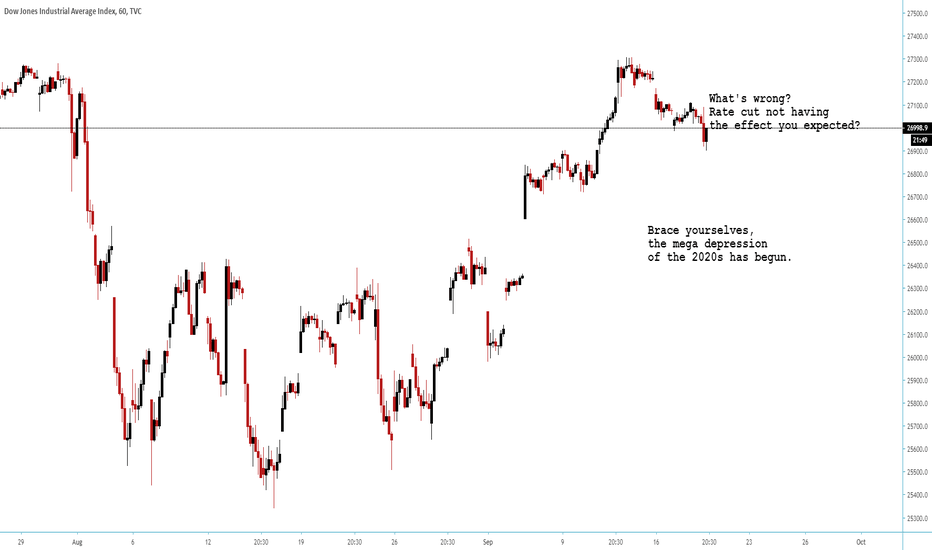

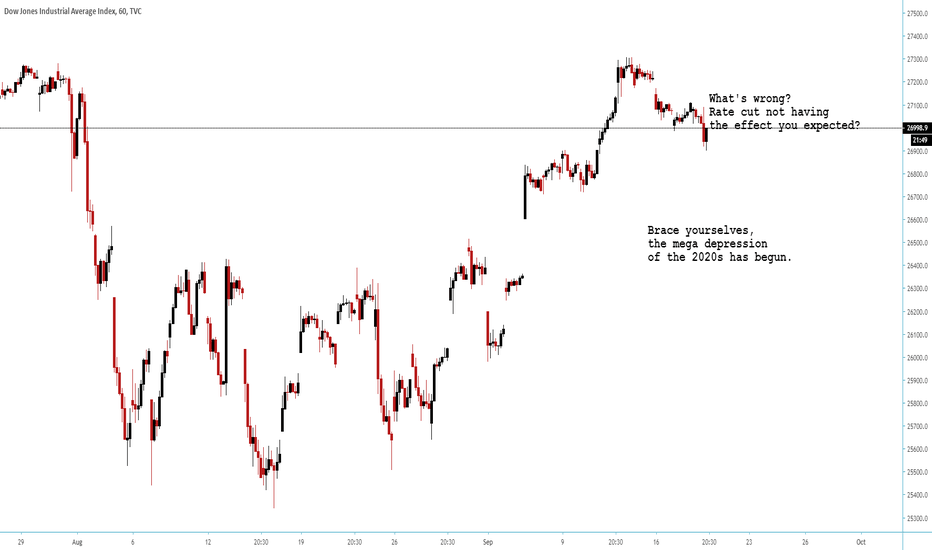

18 September: Dow Jones & Dax

Original idea:

Uh, another winner, I did not take the shot thought.

Hmmm ok great. Had a winner that would have almost entirely paid for my entire losing spree by itself (if I managed it perfectly and also went into the right indice which would not have happened).

Bummer. Had alot of winners at around the same time during that period I remember, then back to lose spree ^^.

---- Checking my log I had 15 trades that were trades I lost, missed, broke even, small winners. But mostly losses ;)

Going to fast forward or this post will never end.

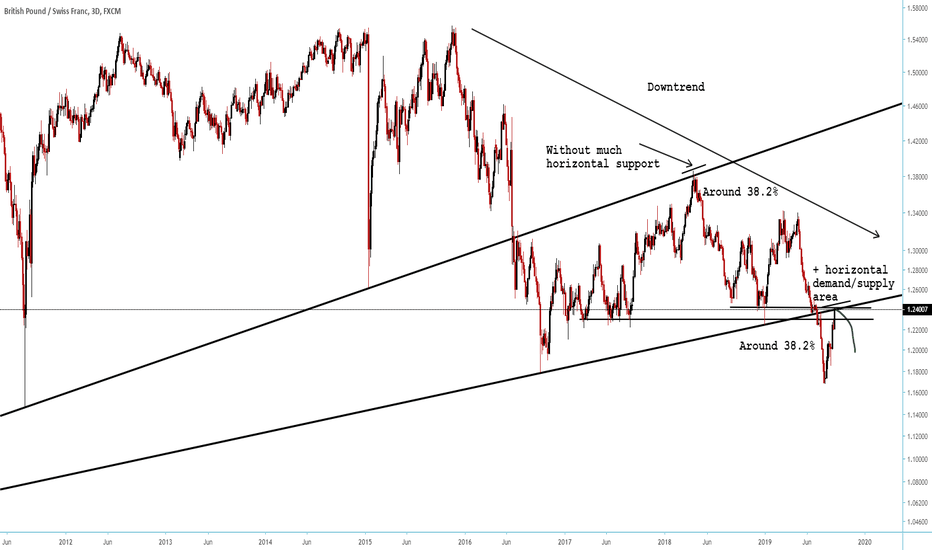

- 1 exception I want to look at thought, from this idea:

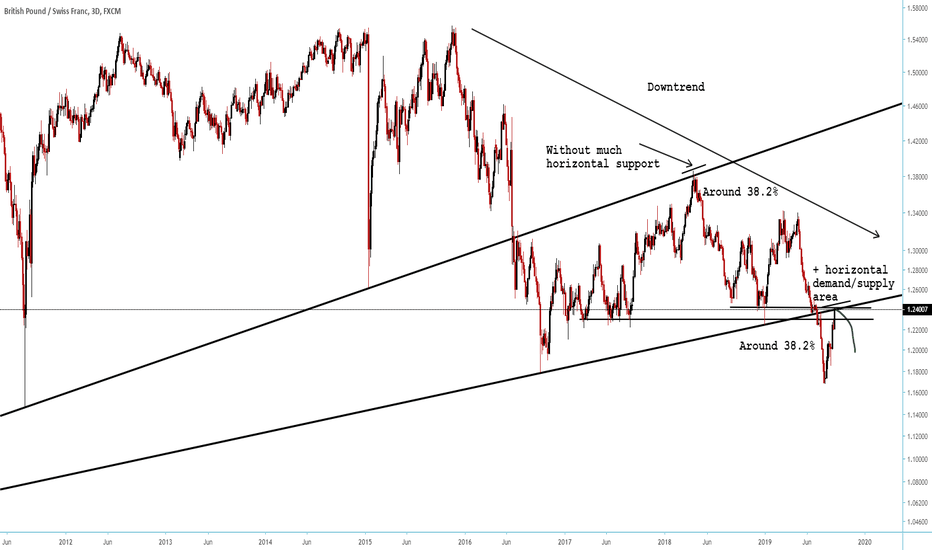

Lost on GBPCHF, went the other way, then in an update Imentionned I went short GBPJPY

Stopped at the top then it went my way, very much. Pretty fun.

Also going to skip those recent yen pairs. USDJPY going down of course ahah.

CHFJPY and EURJPY, same as on the 5 september. I shorted vertical candles.

No waves, just a straight candle. And lost. Again.

I want to look at a complicated BitconnectCoin trade a while ago...

Shorting Bitcoin is not rewarding. Bears should be buyers too.

I don't recommend shorting it honestly, expect when it breaks down vertically, very short term trades.

I keep repeating this lol. For 1 year now.

No one ever listens so I'll keep repeating it.

It moves exponentially... So obvious. Bulls think they have discovered something...

So obvious it hurts.

What to learn here is (apart from that pennants work wonders), just set a buy order on a predetermined price,

and it will get filled by a vertical candle...

Have to short on Bitmex as a hedge or (*0) to be flat... Really sucks. Have to be around the PC. (Because bitmex is all in btc not stable currencies).

OR use Kraken/etc buuut if you use leverage and your stop gets ignored, go enjoy.

Great, by analysing Bitcoin, I have convinced myself once again that it sucked and I didn't like it. Not on my timeframes.

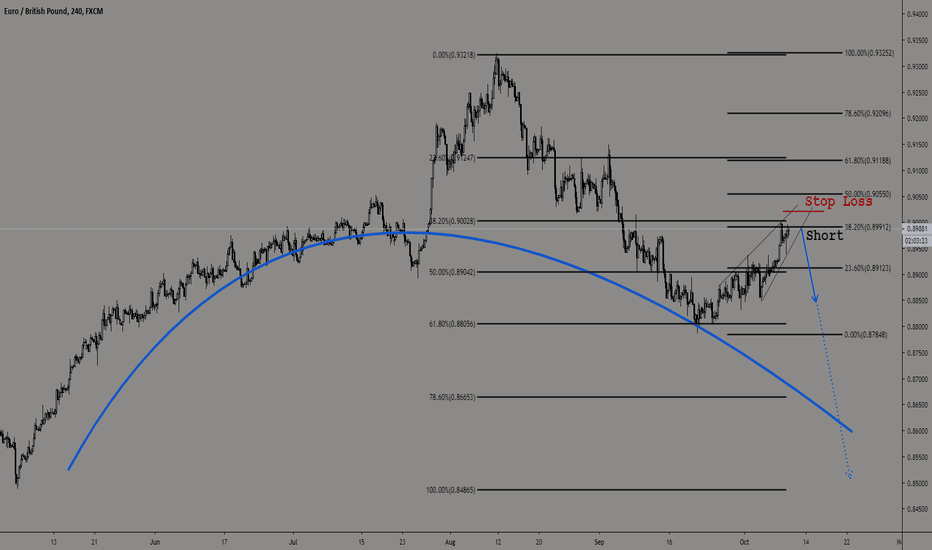

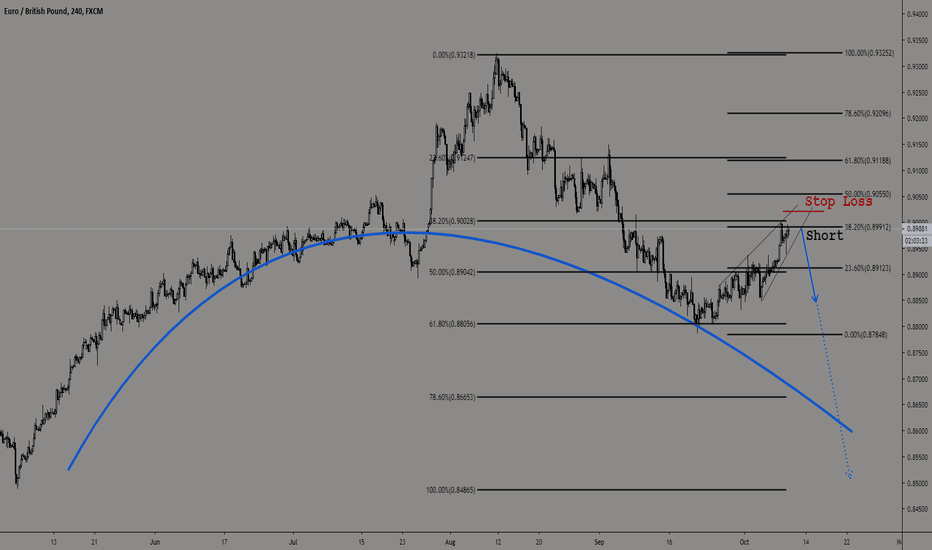

09 October: EURGBP & GBPNZD

Original idea:

Outcome:

No central bank meeting/release all week.

Is giving back 1-2 R on most winners to get 20R once in a while worth it?

YES! Well has to happen at least 10% of the time...

Those 20R are just insane. Arrr I feel like a pirate. Because I found a treasure.

Staying in a winner, nothing feels better. You just need 1 big winner and you are so done.

On higher timeframes think about the people that bought Bitcoin here and stayed in until perfect exit:

Say they're a long term trader. Let's try finding something that makes some sense.

Another example:

Well in general I have a whole lot of small losers, really tons of those, a few small winners (they are pointless, I need to keep trying to have as little of those as possible they really are pointless), a few ~5R, and the 10-20 or even more R is super rare but the rare time it happens my account takes a huge leap. Worth giving up some on 5Rs to get these huge winners once in a while. 5Rs almost feel as "meh" "they're just small winners that cancel themselves out with the losers".

Time to look at some trades I posted, going to focus mostly on the exit. Most important part, that's when you make (or lose) money.

There are a couple of ideas marked "short/long" on 3D & W charts, these are not trades I took or intended on taking, it's a general bias idea.

Maybe I should not tag "long" and "short" so they are more easy to filter...

05 September: CHFJPY

Original idea:

Outcome:

A loser, and didn't miss much. Lots of buying pressure. The reversal area was correctly identified thought.

Not much to trail here...

10 September: EURJPY

Original idea:

Outcome:

Kinda repeated what I did on CHFJPY...

12 September: Gold

Original idea:

Had 11 losers in a row, was aiming for 12. Get ready to get big losing streaks if you go for RR of 5, 10+.

Outcome:

I am keeping it in the back of my head, but I don't think there is much to learn from that specific trade.

More generally there is something to learn, that when the recession is looking close, and there is an uptrend and great news catalysts, and on the weekly/monthly chart we broke out of accumulation and are going up; then buys are a good idea.

12 September: USDCHF

Original idea:

"Watch me end my losing spree live"

Normally I won't post a trade way after I entered and it went my way, but this was ending my lose spree I wanted to...

Outcome:

Conclusion: Well don't try running winners in choppy markets (if you even can trade them). Nothing much else...

16 September: NatGas

Original idea:

Outcome: Not sure how to explain that one without swearing. I'll use a little monkey emoji instead.

Need to look at Oil:

Of course in this case, EMAs cannot be used to trail... It makes no sense...

It did not go much higher and went way down. I can't see H4 & H1. Probably would end up a 5R to 10R.

There is alot of fear and uncertainty in these events, possible price just has some wild sudden moves in 1 direction.

So ye, no opportunity for a very large winner, but still a great 5R in 5 days with what I think are high odds.

18 September: USDMXN

Original idea:

Outcome:

I got kicked out early, as price was retracing alot several times before the rising wedge broke bullish.

Only got 1R out...

If I waited for 3 or 4 R before trailing my stop I'd catch the move.

Was hard to stay in this one I find, but maybe I should risk it, and wait for at least 3-4 R before trailing my stop.

Usually I do...

18 September: Dow Jones & Dax

Original idea:

Uh, another winner, I did not take the shot thought.

Hmmm ok great. Had a winner that would have almost entirely paid for my entire losing spree by itself (if I managed it perfectly and also went into the right indice which would not have happened).

Bummer. Had alot of winners at around the same time during that period I remember, then back to lose spree ^^.

---- Checking my log I had 15 trades that were trades I lost, missed, broke even, small winners. But mostly losses ;)

Going to fast forward or this post will never end.

- 1 exception I want to look at thought, from this idea:

Lost on GBPCHF, went the other way, then in an update Imentionned I went short GBPJPY

Stopped at the top then it went my way, very much. Pretty fun.

Also going to skip those recent yen pairs. USDJPY going down of course ahah.

CHFJPY and EURJPY, same as on the 5 september. I shorted vertical candles.

No waves, just a straight candle. And lost. Again.

I want to look at a complicated BitconnectCoin trade a while ago...

Shorting Bitcoin is not rewarding. Bears should be buyers too.

I don't recommend shorting it honestly, expect when it breaks down vertically, very short term trades.

I keep repeating this lol. For 1 year now.

No one ever listens so I'll keep repeating it.

It moves exponentially... So obvious. Bulls think they have discovered something...

So obvious it hurts.

What to learn here is (apart from that pennants work wonders), just set a buy order on a predetermined price,

and it will get filled by a vertical candle...

Have to short on Bitmex as a hedge or (*0) to be flat... Really sucks. Have to be around the PC. (Because bitmex is all in btc not stable currencies).

OR use Kraken/etc buuut if you use leverage and your stop gets ignored, go enjoy.

Great, by analysing Bitcoin, I have convinced myself once again that it sucked and I didn't like it. Not on my timeframes.

09 October: EURGBP & GBPNZD

Original idea:

Outcome:

No central bank meeting/release all week.

Is giving back 1-2 R on most winners to get 20R once in a while worth it?

YES! Well has to happen at least 10% of the time...

Those 20R are just insane. Arrr I feel like a pirate. Because I found a treasure.

Staying in a winner, nothing feels better. You just need 1 big winner and you are so done.

On higher timeframes think about the people that bought Bitcoin here and stayed in until perfect exit:

Say they're a long term trader. Let's try finding something that makes some sense.

Another example:

Well in general I have a whole lot of small losers, really tons of those, a few small winners (they are pointless, I need to keep trying to have as little of those as possible they really are pointless), a few ~5R, and the 10-20 or even more R is super rare but the rare time it happens my account takes a huge leap. Worth giving up some on 5Rs to get these huge winners once in a while. 5Rs almost feel as "meh" "they're just small winners that cancel themselves out with the losers".

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.