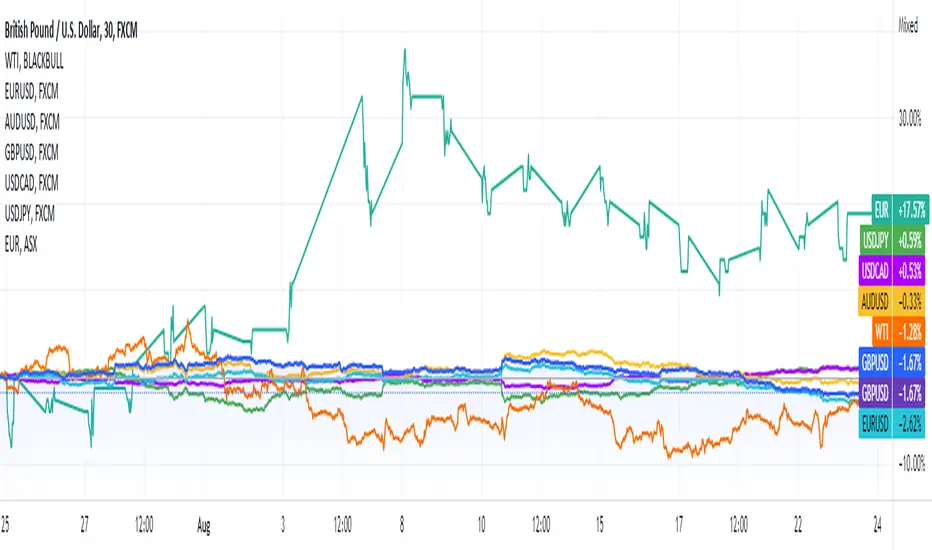

EUR/USD 🔽

GBP/USD 🔽

AUD/USD 🔽

USD/CAD 🔼

USD/CHF 🔼

USD/JPY 🔼

XAU 🔽

WTI 🔽

A surge in dollar values throughout the first half of the day was followed by a decline against most of the dollar's key competitors. This was caused by unfavorable US statistics, such as the US Services S&P Global PMI dropping to 44.1. Manufacturing contracted at a slower pace than expected from 52.2 to 51.3.

S&P Global PMIs for the majority of the main economies, however, showed sluggish economic growth and even recession, demonstrating it is a global problem. Prior to Wall Street's close, the dollar made some gains as risk-off flows persisted. In the midst of extreme overbought circumstances, the dollar's slide appears corrective. Investors were able to record some profits thanks to tepid US data, but a trend reversal is not evident.

Fabio Panetta, a member of the ECB Executive Board, gave a bleak picture. He stated that when the likelihood of a recession rises, the central bank may need to further modify its monetary policies. In the meantime, speculative interest is gradually but steadily rising on a 75 basis point rate hike by the US Federal Reserve in September.

The GBP/USD exchange rate is at 1.1830, while the AUD/USD rate is around 0.6920. The USD/CAD pair dropped significantly throughout the day, closing at 1.2950.

Safe-haven currencies saw gains against the dollar, with the USD/CHF rate circling at 0.9640 and the USD/JPY rate trading at 136.77.

The price of gold is currently up for the day at $1,7477 per troy ounce, while the price of crude oil has continued its recent rise amid market speculation that OPEC+ may reduce production. Currently, WTI is $93.60 per barrel.

Asia's macroeconomic calendar will stay empty, with Wednesday's US Durable Goods Orders report taking center stage.

More information on Mitrade website.

GBP/USD 🔽

AUD/USD 🔽

USD/CAD 🔼

USD/CHF 🔼

USD/JPY 🔼

XAU 🔽

WTI 🔽

A surge in dollar values throughout the first half of the day was followed by a decline against most of the dollar's key competitors. This was caused by unfavorable US statistics, such as the US Services S&P Global PMI dropping to 44.1. Manufacturing contracted at a slower pace than expected from 52.2 to 51.3.

S&P Global PMIs for the majority of the main economies, however, showed sluggish economic growth and even recession, demonstrating it is a global problem. Prior to Wall Street's close, the dollar made some gains as risk-off flows persisted. In the midst of extreme overbought circumstances, the dollar's slide appears corrective. Investors were able to record some profits thanks to tepid US data, but a trend reversal is not evident.

Fabio Panetta, a member of the ECB Executive Board, gave a bleak picture. He stated that when the likelihood of a recession rises, the central bank may need to further modify its monetary policies. In the meantime, speculative interest is gradually but steadily rising on a 75 basis point rate hike by the US Federal Reserve in September.

The GBP/USD exchange rate is at 1.1830, while the AUD/USD rate is around 0.6920. The USD/CAD pair dropped significantly throughout the day, closing at 1.2950.

Safe-haven currencies saw gains against the dollar, with the USD/CHF rate circling at 0.9640 and the USD/JPY rate trading at 136.77.

The price of gold is currently up for the day at $1,7477 per troy ounce, while the price of crude oil has continued its recent rise amid market speculation that OPEC+ may reduce production. Currently, WTI is $93.60 per barrel.

Asia's macroeconomic calendar will stay empty, with Wednesday's US Durable Goods Orders report taking center stage.

More information on Mitrade website.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.