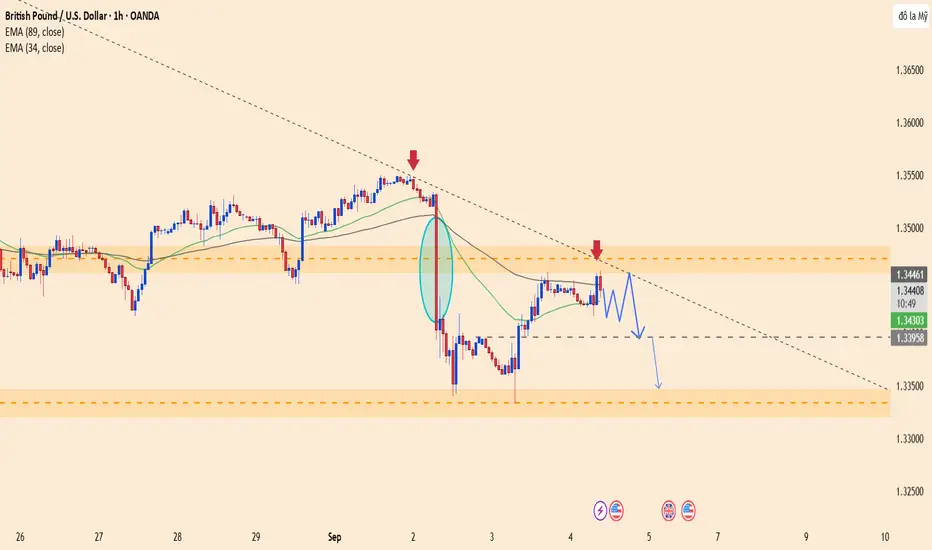

On the 1H chart, GBPUSD failed to break above the 1.3460 resistance and quickly reversed lower. The EMA 34 & 89 are positioned just above price, acting as additional barriers reinforcing the bearish bias. The nearest support sits at 1.3390 – if broken, the market could extend its decline toward lower ranges.

Recent news: The British pound remains under pressure as UK economic data continues to disappoint, while the US dollar gains strength on the back of a stronger-than-expected ISM Services PMI report. This combination makes it difficult for GBPUSD to sustain any rebound.

Trading idea:

Favor shorts below 1.3460

Short-term target: 1.3390

A decisive break below 1.3390 could open the door for deeper downside moves.

Bottom line: GBPUSD is leaning toward a bearish scenario, with both technicals and fundamentals currently favoring the US dollar.

Recent news: The British pound remains under pressure as UK economic data continues to disappoint, while the US dollar gains strength on the back of a stronger-than-expected ISM Services PMI report. This combination makes it difficult for GBPUSD to sustain any rebound.

Trading idea:

Favor shorts below 1.3460

Short-term target: 1.3390

A decisive break below 1.3390 could open the door for deeper downside moves.

Bottom line: GBPUSD is leaning toward a bearish scenario, with both technicals and fundamentals currently favoring the US dollar.

Top trading opportunities are waiting for you! : t.me/+TaRRH29IRysyNGJl

🔥 High-quality signals – Win rate up to 85%

📍 Accurate, verified technical analysis

⚡ Fast updates – Never miss a golden entry

🔥 High-quality signals – Win rate up to 85%

📍 Accurate, verified technical analysis

⚡ Fast updates – Never miss a golden entry

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Top trading opportunities are waiting for you! : t.me/+TaRRH29IRysyNGJl

🔥 High-quality signals – Win rate up to 85%

📍 Accurate, verified technical analysis

⚡ Fast updates – Never miss a golden entry

🔥 High-quality signals – Win rate up to 85%

📍 Accurate, verified technical analysis

⚡ Fast updates – Never miss a golden entry

Related publications

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.