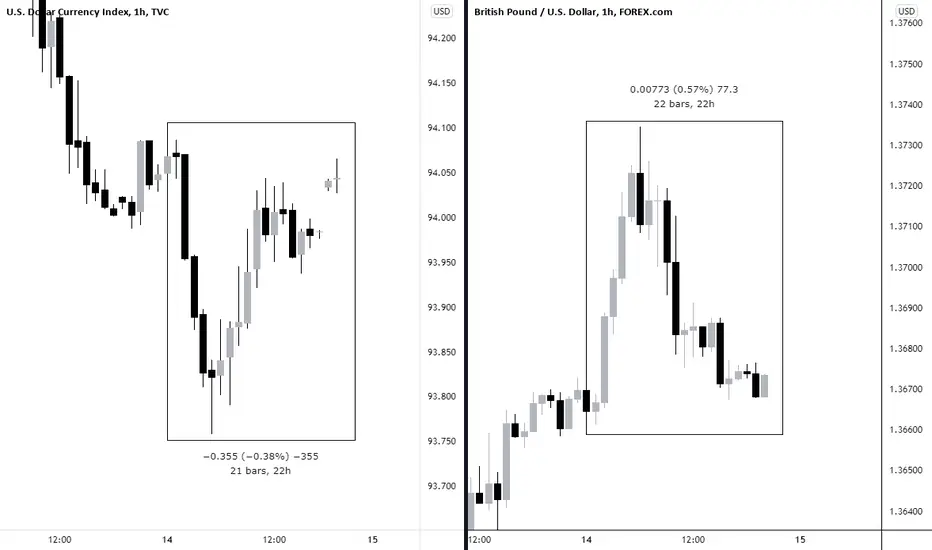

USD – The dollar was slightly lower on Thursday in choppy trading, having erased most of its early session losses, as investors bet the Federal Reserve would begin tapering its asset purchases next month and attention turned to the timing of interest rate hikes.

Indeed, Scotia Capital’s chief FX strategist stated: “I think what we’ve seen over the last day or two is a little bit of profit-taking. I don’t think this is, at the moment, anything close to a significant reversal in the dollar trend, and in fact, I think what we’ve seen today might be a sign that the corrective rebound that we’ve seen over the past day or two has perhaps run its course.”

GBP – Sterling hit a two-week high on Thursday, adding to the previous session’s gains, as trader focused on hopes that a post-Brexit trade war with the European Union will be avoided and on expectations the Bank of England will raise rates this year.

Indeed, Scotia Capital’s chief FX strategist stated: “I think what we’ve seen over the last day or two is a little bit of profit-taking. I don’t think this is, at the moment, anything close to a significant reversal in the dollar trend, and in fact, I think what we’ve seen today might be a sign that the corrective rebound that we’ve seen over the past day or two has perhaps run its course.”

GBP – Sterling hit a two-week high on Thursday, adding to the previous session’s gains, as trader focused on hopes that a post-Brexit trade war with the European Union will be avoided and on expectations the Bank of England will raise rates this year.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.