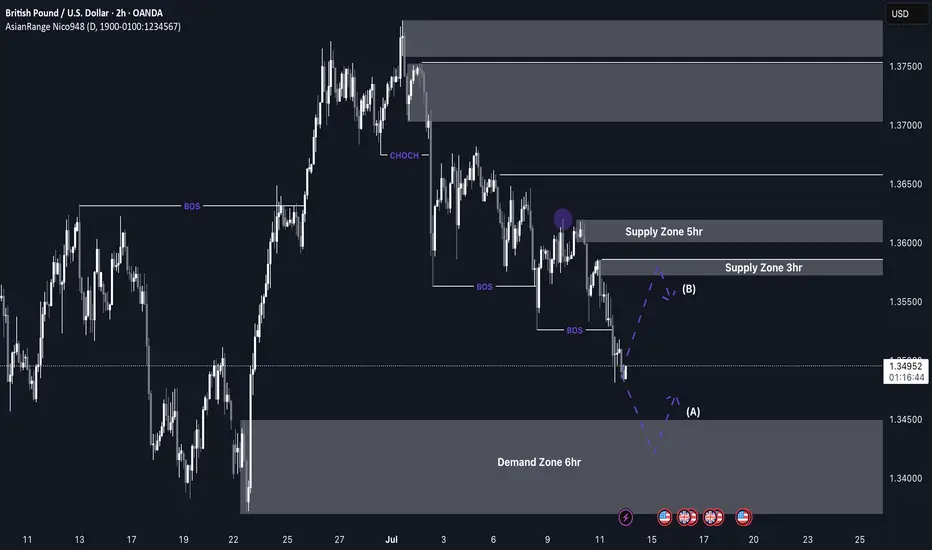

My analysis this week centers around the continuation of the bearish trend we've been observing. Recently, there was a break of structure, and a new supply zone has formed—indicating a potential continuation of the downtrend.

I’ll be waiting for price to retrace back into these Points of Interest (POIs), where I’ll look for lower time frame confirmations to catch potential sell entries and ride the move down.

I believe there’s still some bearish pressure left, and I expect price to continue falling until it reaches the 6-hour demand zone. Once we approach that area, I’ll begin looking for Wyckoff accumulation patterns as a signal for a potential reversal or rally to the upside.

Confluences for GBP/USD Sells:

✅ GBP/USD has been bearish over the past few weeks, and this trend may continue.

✅ Breaks of structure have occurred, forming fresh supply zones ideal for entries.

✅ Liquidity exists below current price, which may get swept before a reversal.

✅ The lower demand zone still needs to be mitigated, suggesting more downside movement first.

📌 If price fails to react properly at the 3-hour supply, I’ll be watching for a move into the 5-hour supply zone, which sits in a more premium area and may offer a cleaner reaction.

Let’s stay patient and focused — wishing everyone a profitable trading week ahead! 📉💼

I’ll be waiting for price to retrace back into these Points of Interest (POIs), where I’ll look for lower time frame confirmations to catch potential sell entries and ride the move down.

I believe there’s still some bearish pressure left, and I expect price to continue falling until it reaches the 6-hour demand zone. Once we approach that area, I’ll begin looking for Wyckoff accumulation patterns as a signal for a potential reversal or rally to the upside.

Confluences for GBP/USD Sells:

✅ GBP/USD has been bearish over the past few weeks, and this trend may continue.

✅ Breaks of structure have occurred, forming fresh supply zones ideal for entries.

✅ Liquidity exists below current price, which may get swept before a reversal.

✅ The lower demand zone still needs to be mitigated, suggesting more downside movement first.

📌 If price fails to react properly at the 3-hour supply, I’ll be watching for a move into the 5-hour supply zone, which sits in a more premium area and may offer a cleaner reaction.

Let’s stay patient and focused — wishing everyone a profitable trading week ahead! 📉💼

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.