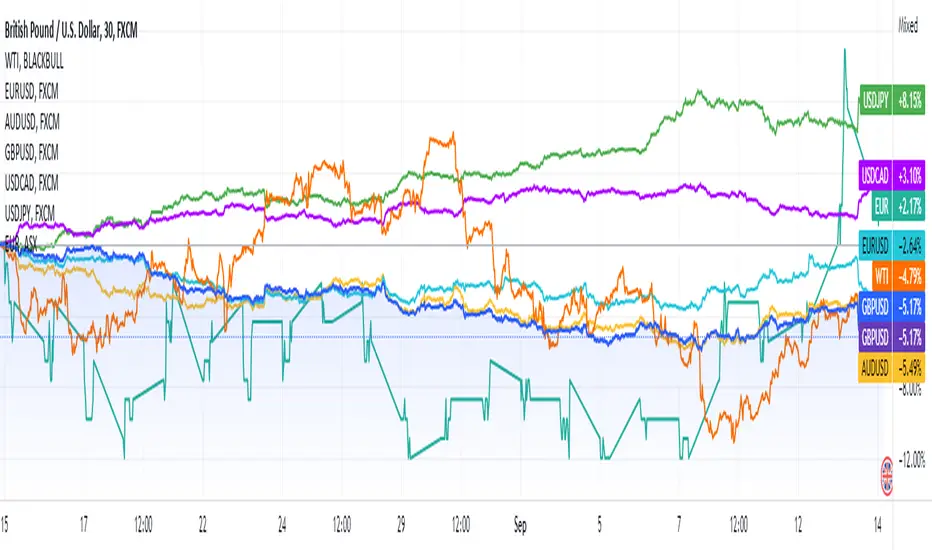

EUR/USD 🔽

GBP/USD 🔽

AUD/USD 🔽

USD/CAD 🔼

USD/JPY 🔼

XAU 🔽

WTI ▶️

Rate hike expectations were heightened once again - as the US CPI readings revealed an 8.3% year-on-year increase in August instead of 8.1%, while month-on-month was up by 0.1% against a -0.1% estimate. The market then feared the Federal Reserve will resort to even more aggressive rate hikes to control inflation, in the range of 75-100 bps.

As a result, the stock market and all three major US stock indices recorded significant losses, and gold futures also followed. After taking a nosedive, Nasdaq 100, Dow Jones, and S&P 500 are currently at 12,033.62, 31,104.97, and 4,037.12 respectively. Gold futures were last traded at $1,708.7 an ounce, suppressed by a greenback with renewed strength.

Meanwhile, other major currencies suffered heavily as well, EUR/USD fell sharply back under parity to 0.997. The interest rate decision from the Bank of England was postponed to next week due to the passing of Queen Elizabeth II, and GBP/USD also dropped to 1.1491. The AUD/USD pair closed at 0.673, losing over 150 pips in the process.

On the flip side, USD/CAD enjoyed a rally to 1.3167, and USD/JPY is edging back to the 24-year high, with a closing price of 144.55. Undecided between increasing demands and inventory projections, WTI crude futures mostly traded flat at $87.57 a barrel.

More information on Mitrade website.

GBP/USD 🔽

AUD/USD 🔽

USD/CAD 🔼

USD/JPY 🔼

XAU 🔽

WTI ▶️

Rate hike expectations were heightened once again - as the US CPI readings revealed an 8.3% year-on-year increase in August instead of 8.1%, while month-on-month was up by 0.1% against a -0.1% estimate. The market then feared the Federal Reserve will resort to even more aggressive rate hikes to control inflation, in the range of 75-100 bps.

As a result, the stock market and all three major US stock indices recorded significant losses, and gold futures also followed. After taking a nosedive, Nasdaq 100, Dow Jones, and S&P 500 are currently at 12,033.62, 31,104.97, and 4,037.12 respectively. Gold futures were last traded at $1,708.7 an ounce, suppressed by a greenback with renewed strength.

Meanwhile, other major currencies suffered heavily as well, EUR/USD fell sharply back under parity to 0.997. The interest rate decision from the Bank of England was postponed to next week due to the passing of Queen Elizabeth II, and GBP/USD also dropped to 1.1491. The AUD/USD pair closed at 0.673, losing over 150 pips in the process.

On the flip side, USD/CAD enjoyed a rally to 1.3167, and USD/JPY is edging back to the 24-year high, with a closing price of 144.55. Undecided between increasing demands and inventory projections, WTI crude futures mostly traded flat at $87.57 a barrel.

More information on Mitrade website.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.