Fundamental Analysis

The British Pound (GBP) slipped below the round-figure support of 1.3100 against the US Dollar (USD) in New York trading on Friday. The GBP/USD pair extended its losing streak for a fourth session as market expectations for a 50 basis point (bps) rate cut by the Federal Reserve (Fed) fell again following the release of the upbeat US (US) Non-Farm Payrolls (NFP) report for September.

The CME FedWatch tool showed that the odds of a further 75 basis points (bps) rate cut by the Fed by the end of the year were all but gone after the US NFP data.

Dovish comments from Bank of England (BoE) Governor Andrew Bailey triggered a sell-off in the British Pound early on Thursday. In the second half of the day, the US Dollar (USD) remained strong and did not allow GBP/USD to recover after the September ISM Services PMI Index reached 54.9, surpassing the market expectation of 51.7.

Technical Analysis

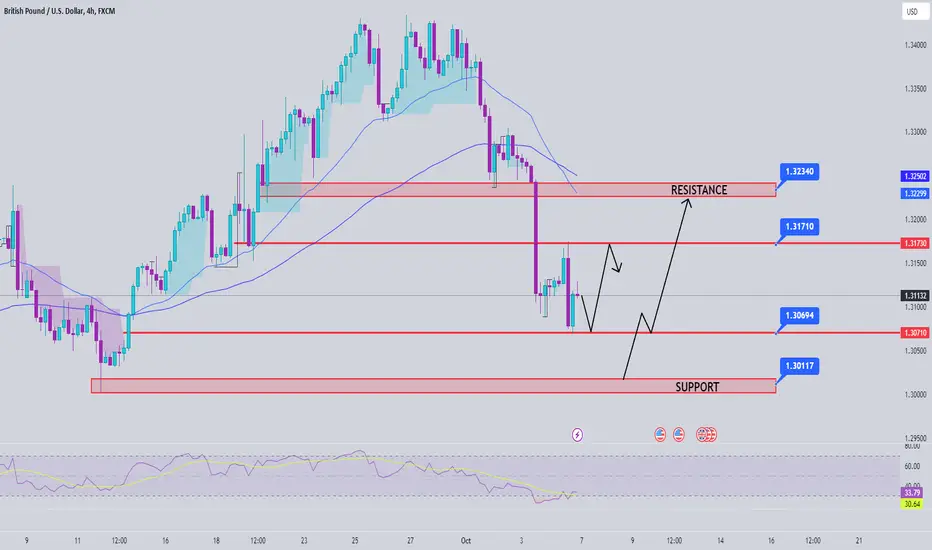

Late Friday, GBPUSD recovered slightly to 1.311 after the NonFarm news release. For now, the trading range will be contained within the range of the H4 candle, also known as the main candle, with a price range of 1.317-1.307. Next week, pay attention to strong support and resistance zones to have the best trading strategy for yourself. The bottom zone of the previous month around 1.301 will be the main BUy zone for next week. The breakout zone of 1.323 coincides with the intersection of the two EMA lines, accumulating a large number of sellers waiting.

Trading Signals

SELL GBPUSD zone 1.323-1.325 Stoploss 1.327

BUY GBPUSD zone 1.301-1.299 Stoploss 1.297

The British Pound (GBP) slipped below the round-figure support of 1.3100 against the US Dollar (USD) in New York trading on Friday. The GBP/USD pair extended its losing streak for a fourth session as market expectations for a 50 basis point (bps) rate cut by the Federal Reserve (Fed) fell again following the release of the upbeat US (US) Non-Farm Payrolls (NFP) report for September.

The CME FedWatch tool showed that the odds of a further 75 basis points (bps) rate cut by the Fed by the end of the year were all but gone after the US NFP data.

Dovish comments from Bank of England (BoE) Governor Andrew Bailey triggered a sell-off in the British Pound early on Thursday. In the second half of the day, the US Dollar (USD) remained strong and did not allow GBP/USD to recover after the September ISM Services PMI Index reached 54.9, surpassing the market expectation of 51.7.

Technical Analysis

Late Friday, GBPUSD recovered slightly to 1.311 after the NonFarm news release. For now, the trading range will be contained within the range of the H4 candle, also known as the main candle, with a price range of 1.317-1.307. Next week, pay attention to strong support and resistance zones to have the best trading strategy for yourself. The bottom zone of the previous month around 1.301 will be the main BUy zone for next week. The breakout zone of 1.323 coincides with the intersection of the two EMA lines, accumulating a large number of sellers waiting.

Trading Signals

SELL GBPUSD zone 1.323-1.325 Stoploss 1.327

BUY GBPUSD zone 1.301-1.299 Stoploss 1.297

JOIN OUR FREE TELEGRAM GROUP t.me/+7rqP7ECMjpUxMzBl

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

JOIN OUR FREE TELEGRAM GROUP t.me/+7rqP7ECMjpUxMzBl

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

MESSAGE US FOR VIP SIGNALS🏆 t.me/Leilani8597

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.