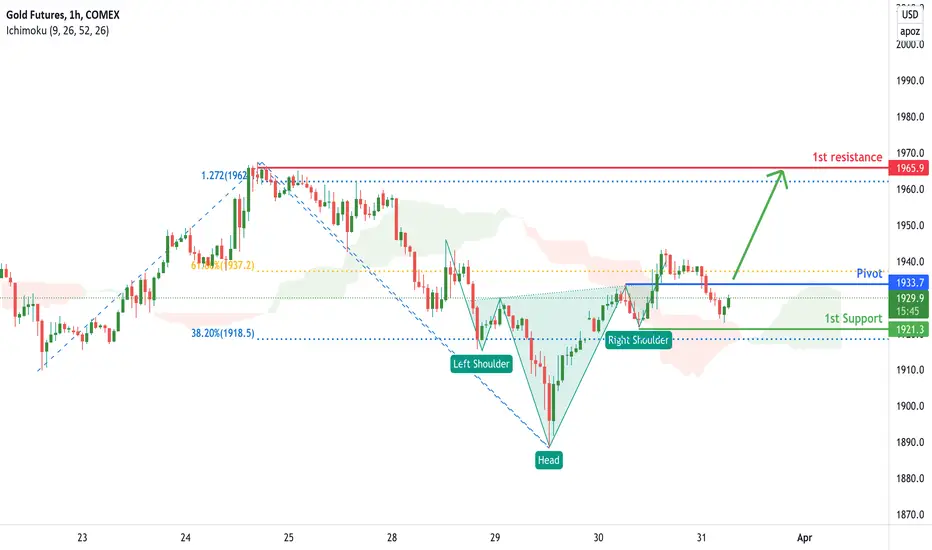

Title: Gold Futures (GC!), H1 Potential for Reversal!

Type: Bullish reversal

Resistance : 1965.9

Pivot: 1933.7

Support : 1921.3

Preferred case: Prices have consolidated in an inverse head and shoulders pattern. We see the potential for a bounce from our Pivot at 1933.7 which is the break of the inverse head and shoulders neckline towards our 1st resistance at 1965.9 in line with 127.2% Fibonacci Projection. Our bullish bias is further supported prices trading above our ichimoku clouds.

Alternative scenario: If prices were to reverse, they can potentially reach our 1st support at 1921.7 in line with 38.2% Fibonacci retracement.

Fundamentals: With gradual settlement of war-negotiations, we might expect a slight bearish turn towards the precious metal.

Type: Bullish reversal

Resistance : 1965.9

Pivot: 1933.7

Support : 1921.3

Preferred case: Prices have consolidated in an inverse head and shoulders pattern. We see the potential for a bounce from our Pivot at 1933.7 which is the break of the inverse head and shoulders neckline towards our 1st resistance at 1965.9 in line with 127.2% Fibonacci Projection. Our bullish bias is further supported prices trading above our ichimoku clouds.

Alternative scenario: If prices were to reverse, they can potentially reach our 1st support at 1921.7 in line with 38.2% Fibonacci retracement.

Fundamentals: With gradual settlement of war-negotiations, we might expect a slight bearish turn towards the precious metal.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.